“Overall, the number of filed eTROs has increased 70% from 2019 to 2021, representing a 72.8% increase in filings in a short period.”

Protecting brands and going after counterfeiters is like herding cats. There are hundreds, if not thousands, of ways that online counterfeiters illegally monetize brands. Companies have many ways to combat them, but it can traditionally take lots of time, cost, and resources to do it. Now there is a less publicized option in the United States which can deter counterfeiters, takes little time, and often even pays for itself. This ultimately can result in true deterrence of counterfeiters for a brand in online marketplaces.

Protecting brands and going after counterfeiters is like herding cats. There are hundreds, if not thousands, of ways that online counterfeiters illegally monetize brands. Companies have many ways to combat them, but it can traditionally take lots of time, cost, and resources to do it. Now there is a less publicized option in the United States which can deter counterfeiters, takes little time, and often even pays for itself. This ultimately can result in true deterrence of counterfeiters for a brand in online marketplaces.

With online sales exploding, there has been a marked increase in sales of counterfeit products, despite various solutions available to combat it. Indeed, the industry as a whole will see over $1.7 trillion of sold counterfeit products on various online platforms each year—and that estimate, by the International Anti-Counterfeiting Coalition, was in 2015. Counterfeit sales result in the loss of millions of U.S. jobs and lost profits, and is by far the world’s largest criminal enterprise, with eCommerce counterfeit sales expected to grow to $6 trillion by 2024 in the United States alone. Many online marketplaces, such as eBay, Amazon, Walmart and others, have taken steps to combat it through takedowns of counterfeit listings. This has resulted in a seemingly endless stream of millions of fake listings being taken down every year; nonetheless, most sellers haven’t seen a substantial decrease in counterfeits being sold since the cost to repost is relatively low. So, even though the millions of listings are regularly taken down, more replace them with little or no disruption to sales, resulting in little or no net change. Other ways of combating counterfeit sales, such as lengthier investigations and full-blown lawsuits, raids or border seizure, are of limited effectiveness, very expensive, and time-consuming. Sellers are often left with the realization that making a significant dent in their counterfeit problem is often either very expensive or largely ineffective.

Often, online counterfeiters have nothing but an email address, a U.S. bank account, and a loose connection with an online marketplace. Brands have responded to the dramatic increase in usage of marketplaces by foreign counterfeiters by increasingly employing emergency Temporary Restraining Orders (“eTRO”) coupled with preliminary injunctions for clear fake listings. This allows them to freeze bank accounts associated with online sales while the court works out the details of the case. Defendant sellers may be listed by the hundreds based on alleged counterfeit products sold on sites such as Amazon, eBay, Walmart, and Wish. Freezing bank accounts associated with platforms offers leverage against otherwise hard-to-track counterfeiters. It can also be a cost-effective and fast way to deter counterfeiters and often pays for itself.

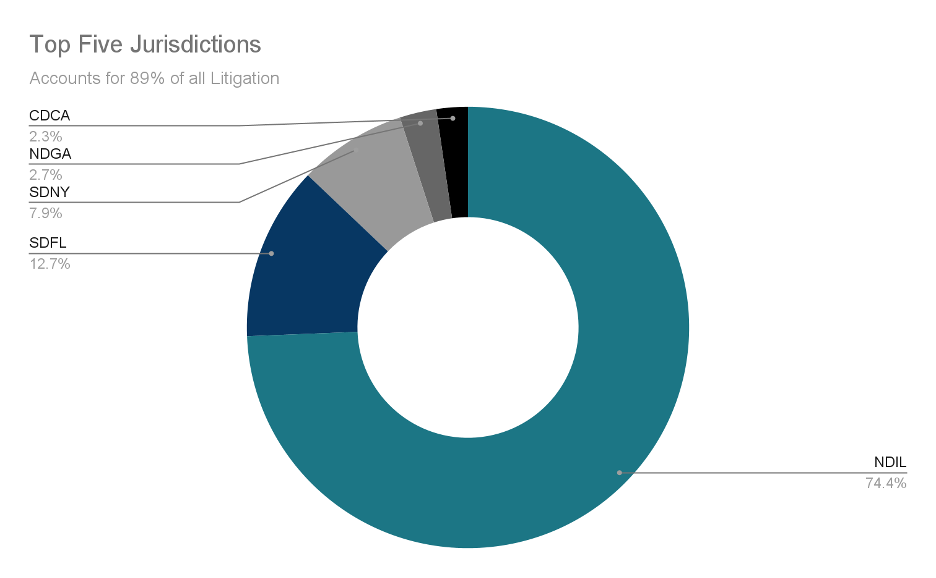

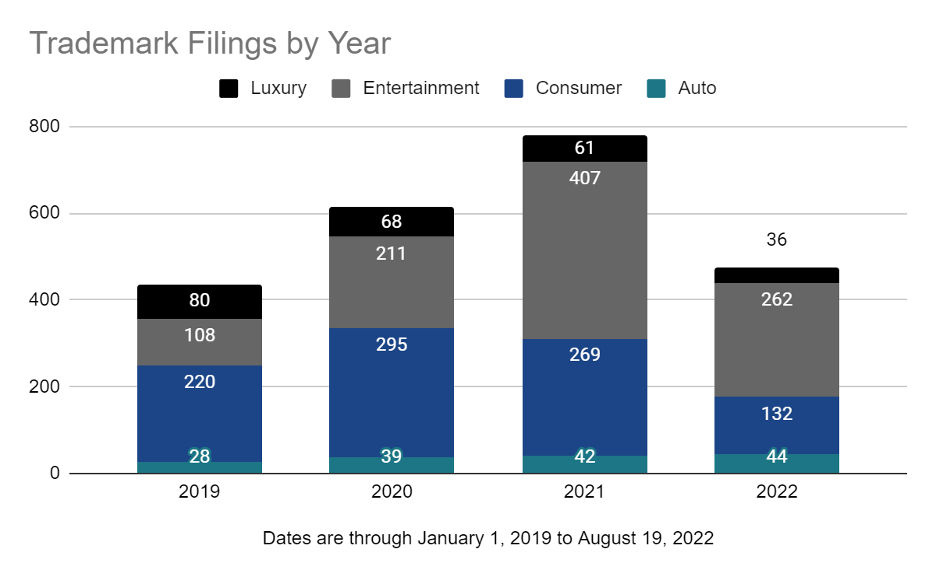

Overall, the number of filed eTROs has increased 70% from 2019 to 2021, representing a 72.8% increase in filings in a short period. To begin understanding the current trends in brand counterfeiting, filing data was collected, with the time frame being January 1, 2019, through August 19, 2022. In particular, five venues accounted for the bulk of the filings. The Northern District of Illinois (NDIL) made up over 75% of the cases, with the Southern District of Florida (SDFL), the Southern District of New York (SDNY), the Northern District of Georgia (NDGA) and the Central District of California (CDGA) rounding out the top five.

These five districts alone handled almost 90% of all eTRO filings. In 2019, the Northern District of Illinois handled 241 eTRO cases. In 2021, there were 539 cases filed there, an increase of 120% in two years. The Northern District of Illinois has historically seen the most of these types of cases because of the large consumer base in the area. Many litigators see this court as friendly to cases using anonymous plaintiffs and case combining. The Southern District of Florida has recently seen a surge in counterfeit products, primarily due to its port access. For instance, in September of 2022, Adidas filed suit over counterfeit products.

Brand protection is becoming more of a focus for many brand owners and is a trend that we believe will continue. In 2022, there have already been 483 eTRO cases filed in all venues by early August – a pace similar to 2021.

Brands were divided into industries to help identify the activity and allow for comparisons between brand types. Our major industry groupings were settled on: Entertainment, Consumer Products, Luxury, and Automotive. Some brands did not fit cleanly into these categories, but none of them had more than two cases on file in any of the venues. The categories were defined as:

Brands were divided into industries to help identify the activity and allow for comparisons between brand types. Our major industry groupings were settled on: Entertainment, Consumer Products, Luxury, and Automotive. Some brands did not fit cleanly into these categories, but none of them had more than two cases on file in any of the venues. The categories were defined as:

- Entertainment includes brands representing musical artists, video games, television and movie properties, toys, and book publishers.

- Consumer products include brands related to beauty, home products, clothing, electronics, health, and food.

- Luxury products include brands that put a high value on the recognition of their brands and their quality.

- Finally, Automotive products include any brands related to automobiles, motorcycles, racing (including BMX racing) and related products.

Brands were limited to a single industry. For example, many brands have marks registered for International Classification 025 for clothing, footwear and headgear. However, if the brand was an automotive company, the brand was classified as Automotive.

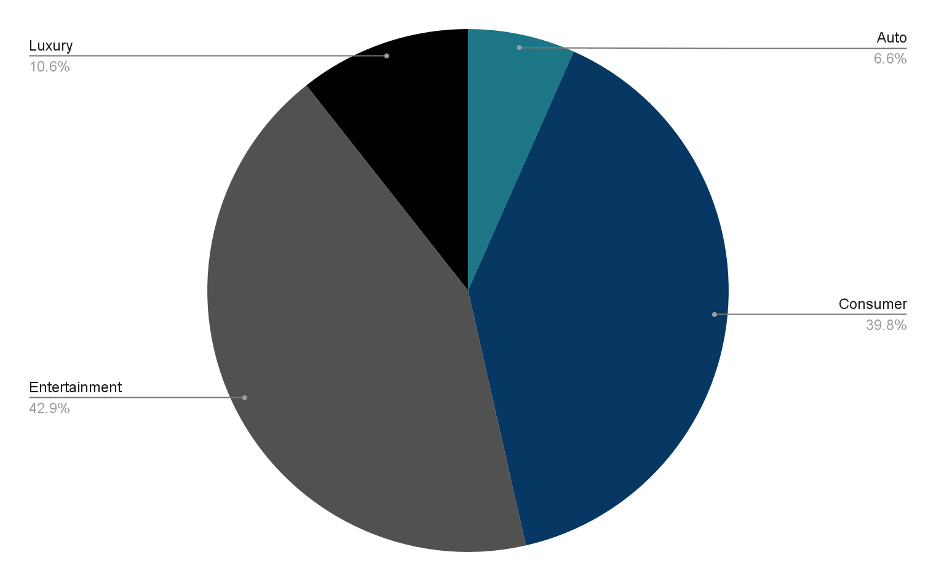

Entertainment brands comprise the most filed eTRO cases. Of the 2,364 total cases from the past three years, Entertainment brands were responsible for 42.9% (988 cases). Consumer brands accounted for 39.8% (916 cases), Luxury filed 10.36% (245) and Automotive filed 6.6% (153).

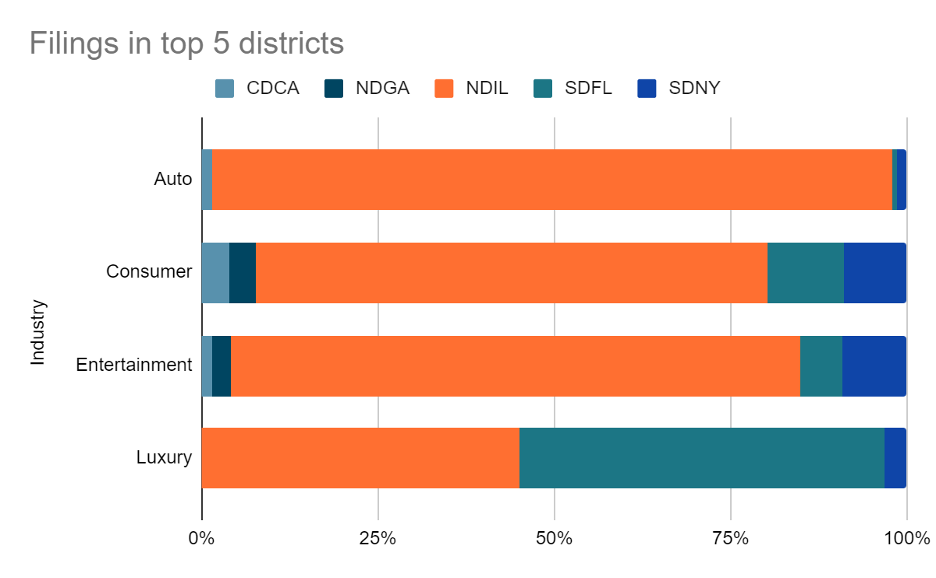

Within each district, there are some notable trends. Every industry files most of their cases in the NDIL, except for Luxury. Over the past three years, Luxury brands filed 109 cases in this court but filed 125 in the SDFL. Interestingly, SDNY (home to many luxury brands) only had eight cases by luxury brands.

Within each district, there are some notable trends. Every industry files most of their cases in the NDIL, except for Luxury. Over the past three years, Luxury brands filed 109 cases in this court but filed 125 in the SDFL. Interestingly, SDNY (home to many luxury brands) only had eight cases by luxury brands.

Consumer brands used a number of different venues as well, with 16% of their cases filed outside of the top five courts. The Automotive industry filed almost exclusively in Illinois, with 135 of their 153 total cases raised in that court. Entertainment brands, like Consumer brands, filed in a number of districts, with Illinois at the top of the list.

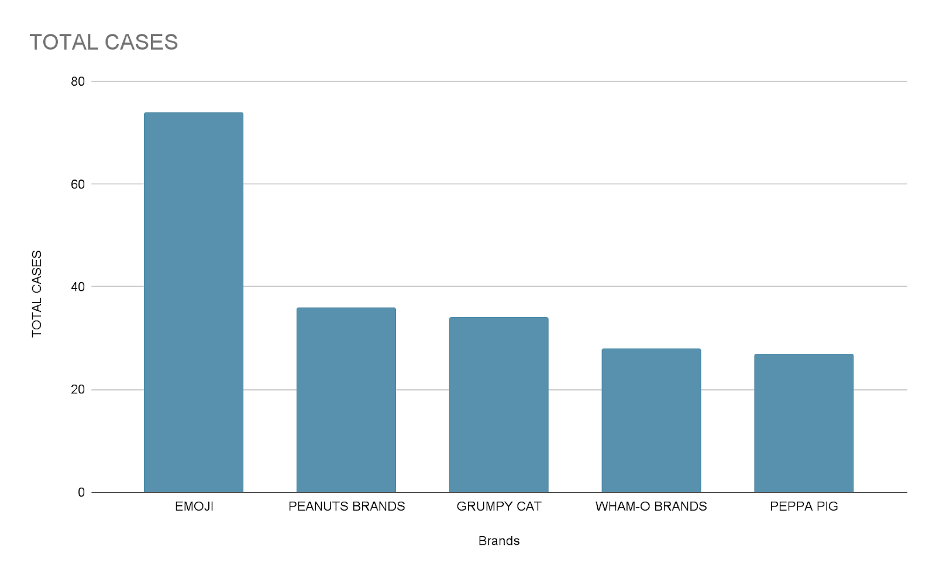

The largest industry group, Entertainment, has the EMOJI company at the top of its list with 74 filings, followed by Peanuts, with 36 filings. Grumpy Cat Limited, the company created to manage and protect the Grumpy Cat brand, is in third place with 34 filings, only two less than Charlie Brown and gang. After Grumpy Cat is WHAM-O’s various brands, including Frisbee and Hula Hoop with 28 filings followed by British children’s television show, Peppa Pig with 27 eTROs during these three years. Entertainment companies actively protect their assets with 21 brands in this industry with at least 10 or more filings. Within these double-digit filers are toy brands like Care Bears and the Mattel properties, musical artists Pink Floyd and The Beatles, as well as the National Basketball Association.

The largest industry group, Entertainment, has the EMOJI company at the top of its list with 74 filings, followed by Peanuts, with 36 filings. Grumpy Cat Limited, the company created to manage and protect the Grumpy Cat brand, is in third place with 34 filings, only two less than Charlie Brown and gang. After Grumpy Cat is WHAM-O’s various brands, including Frisbee and Hula Hoop with 28 filings followed by British children’s television show, Peppa Pig with 27 eTROs during these three years. Entertainment companies actively protect their assets with 21 brands in this industry with at least 10 or more filings. Within these double-digit filers are toy brands like Care Bears and the Mattel properties, musical artists Pink Floyd and The Beatles, as well as the National Basketball Association.

But enforcement is spotty and rare. Many major brands are missing from this list, although they may be resolving their complaints through different channels.

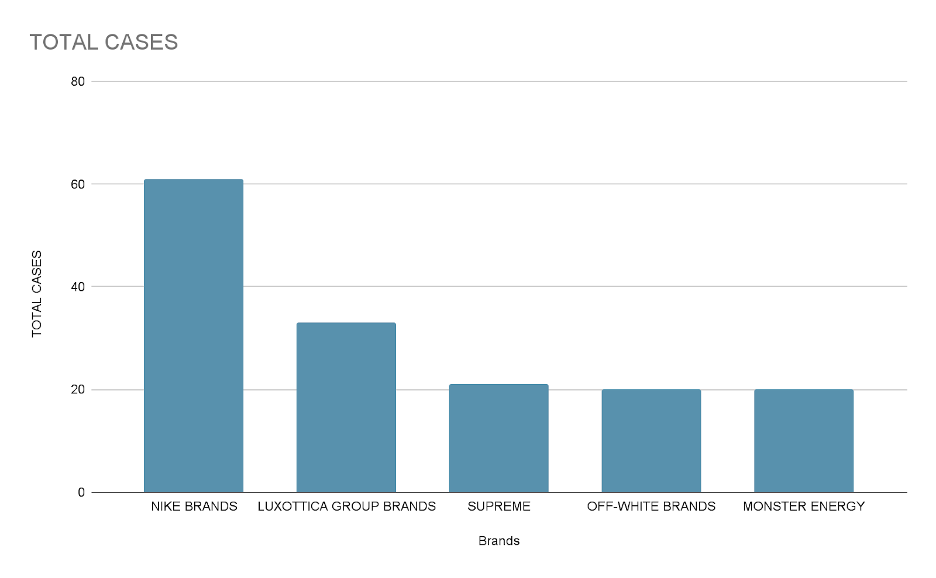

The Consumer industry filers are primarily clothing brands. Nike is the top filer, with 61 cases during this span, over three times the second-most-active filer, Luxottica (owner of eyewear brands like Ray-Ban and Costa) with 33 cases. Supreme clothing brand comes in third with 21 filings and there is a tie for fourth with Monster energy drink brands, by far and away the most active food brand, and Off-White clothing brand with 20 filings each.

The Consumer industry filers are primarily clothing brands. Nike is the top filer, with 61 cases during this span, over three times the second-most-active filer, Luxottica (owner of eyewear brands like Ray-Ban and Costa) with 33 cases. Supreme clothing brand comes in third with 21 filings and there is a tie for fourth with Monster energy drink brands, by far and away the most active food brand, and Off-White clothing brand with 20 filings each.

16 brands in this industry had double-digit filings. They include 3M, Tommy Hilfiger, Converse, Lululemon and Patagonia.

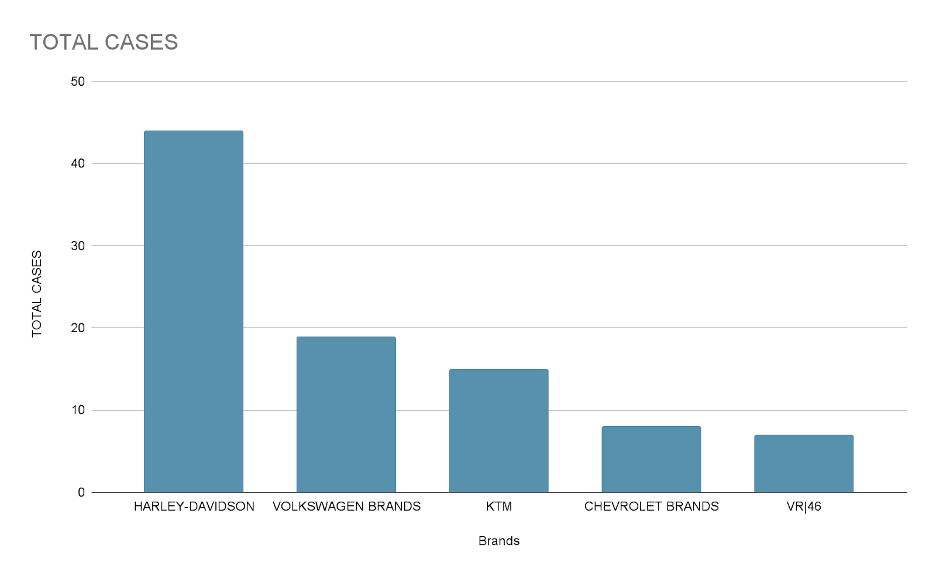

In the Automotive Industry, the top filer is Harley-Davidson, with 44 eTRO cases, more than both the second and third brands combined. In the second position, Volkswagen filed 19 eTRO cases that encompassed all of their brands including the Volkswagen and Audi marks. The third filer in this industry is KTM with 15 based out of Austria, KTM is primarily known for its off-road motorcycles. The fourth most filings in Automotive is for General Motors, more specifically the Chevrolet brands. Corvette, Chevy, and related brands filed eight eTRO complaints. Right behind Chevrolet is Valentino Rossi’s VR|46 motorcycle racing brand, with seven filings. Most of the largest automobile manufacturer brands are on this list, including Toyota, General Motors and Lamborghini.

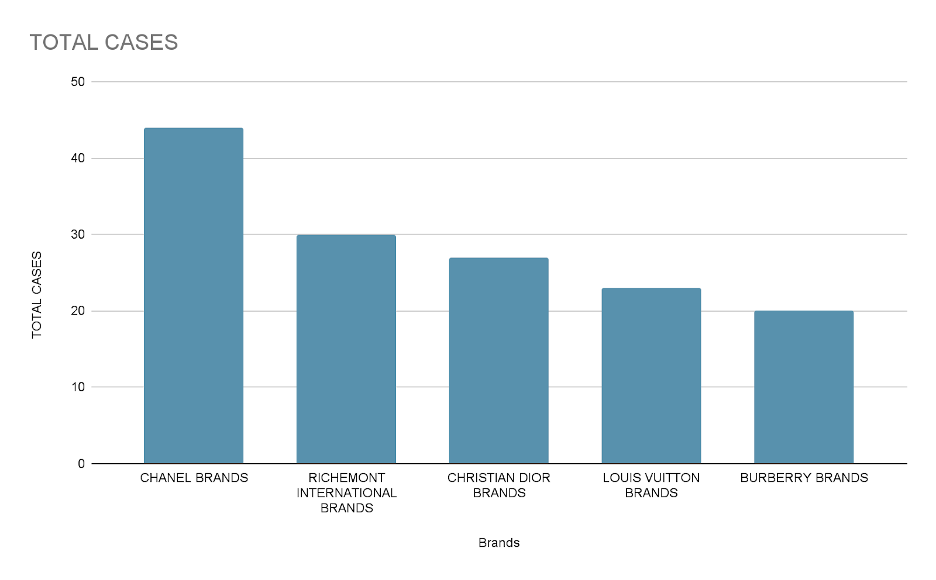

Luxury brands spend a lot of effort keeping counterfeit products off the shelf. Many of the top luxury brands are represented by filings in this industry. Chanel is the top filer, with 44 eTRO cases almost exclusively in the SDFL. Richemont International, owner of jewelry and watch brands like Cartier, Buccellati, and Montblanc filed 30 cases. Christian Dior brands filed 27 cases, all in the SDIL. Some of Dior’s other brands, like Louis Vuitton, filed cases separately. Louis Vuitton specifically came in fourth with 23 filings followed by Burberry filed 20 eTRO cases during this period. Other brands that filed eTRO cases include Swarovski, Tiffany, Gucci and Fendi.

Luxury brands spend a lot of effort keeping counterfeit products off the shelf. Many of the top luxury brands are represented by filings in this industry. Chanel is the top filer, with 44 eTRO cases almost exclusively in the SDFL. Richemont International, owner of jewelry and watch brands like Cartier, Buccellati, and Montblanc filed 30 cases. Christian Dior brands filed 27 cases, all in the SDIL. Some of Dior’s other brands, like Louis Vuitton, filed cases separately. Louis Vuitton specifically came in fourth with 23 filings followed by Burberry filed 20 eTRO cases during this period. Other brands that filed eTRO cases include Swarovski, Tiffany, Gucci and Fendi.

With billions of dollars at stake and multiple platforms with thousands of sellers, fighting counterfeiting will continue to be an important part of brand management. Using tools like eTROs can be an effective way to protect brands, while allowing for some recovery in instances. In a global fight to protect a brand against numerous counterfeit products, these are proven, valuable alternatives to brand owners.

With billions of dollars at stake and multiple platforms with thousands of sellers, fighting counterfeiting will continue to be an important part of brand management. Using tools like eTROs can be an effective way to protect brands, while allowing for some recovery in instances. In a global fight to protect a brand against numerous counterfeit products, these are proven, valuable alternatives to brand owners.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.