Posts Tagged: "Pfizer"

GlaxoSmithKline filed a four-count civil action for patent infringement in the United States District Court for the District of Delaware late last week seeking damages for Pfizer and BioNTech’s infringing manufacture, use, sale and marketing of both the original “monovalent” and “bivalent” Comirnaty COVID-19 vaccines. The COVID-19 vaccine was quickly rolled out compared to other vaccines in the past and many pharmaceutical companies benefited financially. However, GSK contends their competitors, Pfizer Inc. and Pharmacia & Upjohn Co. LLC (collectively Pfizer) and BioNTech SE, BioNTech Manufacturing GMBH and BioNTech US Inc. (collectively BioNTech) developed their vaccines with GSK’s patented inventions created about a decade earlier.

In a recent brief to the Patent Trial and Appeal Board (PTAB), Pfizer and BioNTech (Pfizer) told PTAB judges that Moderna’s dismissal of prior art listed in Pfizer’s August 2023 petition for inter partes review (IPR) of Moderna’s patent on mRNA vaccine technology is inconsistent with its declarations to the Food and Drug Administration (FDA) during the drug approval process. According to the brief, when Moderna was seeking approval for its COVID-19 vaccines, the company “candidly represented to the FDA that prior studies for related vaccines…supported an expectation of safety and efficacy. But now, faced with invalidating vaccine prior art…Moderna wrongly casts the same vaccine prior art as irrelevant.” The brief referred to this as a “litigation-driven one-eighty.”

Pfizer, Inc. and BioNTech SE on Monday hit back at competitor COVID-19 vaccine maker Moderna with inter partes review (IPR) petitions against two Moderna patents on mRNA vaccine technology at the Patent Trial and Appeal Board (PTAB). Pfizer/ BioNTech told the PTAB that Moderna’s patents include “unimaginably broad claims directed to a basic idea” and asked the Board to cancel all of the challenged claims of both patents.

Substantial patent litigation activity occurred in the mRNA space in 2022, involving nearly all of the major mRNA and lipid nanoparticle (LNP) pioneers. Since this is the most significant happening in this space with respect to IP in 2022, this post will provide an overview of that activity as well as a summary exposure analysis.

Moderna has sued Pfizer and BioNTech over the mRNA vaccine patents behind the COVID-19 vaccines. Moderna is not seeking to remove Comirnaty® from the market and is not asking for an injunction to prevent future sale, nor damages related to Pfizer’s sales for any COVID-19 vaccine used in 92 low- and middle-income countries. Moderna is represented by Wilmer Cutler Pickering Hale and Dorr. The patents asserted in the complaint filed in the District of Massachusetts are: U.S. Patent Nos. 10,898,574 (the “’574 patent”), 10,702,600 (the “’600 patent”), and 10,933,127 (the “’127 patent”).

In April of this year, we provided a three-part series relating to the IP and Competitive Landscape for the mRNA market. In this post (Part I), we provide a 2021 year in review update on mRNA pioneers Moderna, BioNTech and CureVac, and in Part II, we profile Sanofi and other companies in the mRNA space and offer additional conclusions and outlook for 2022 and beyond.

Shortly after we posted about Moderna, Inc.’s October 2020 pledge not to enforce its COVID-19-related patents during the pandemic, the United States Food & Drug Administration (FDA) granted emergency regulatory approval for two COVID-19 vaccines produced by Moderna and BioNTech (with Pfizer), making these groups the first to ever enter the commercial market with mRNA-based therapies. This little-known and never-before-approved mRNA technology has since been widely administered and represents a primary weapon being used to defeat the pandemic. While this effort carries on, market players are confident that COVID-19 is but one of many indications that the mRNA technology platform might be utilized for, and that approval of the mRNA vaccines could open the door for the approval of other mRNA-based medicines, creating a wide range of new markets. With the anticipated increase in market activity and competition, we will provide an overview of the mRNA IP and competitive landscape in a series of three posts in the context of certain key players’ patent positions, drug pipelines, strategic relationships, and other attributes. These posts are based on publicly available information, are non-exhaustive, and do not identify all market players or potential market players in this space.

Pfizer and BioNTech have hit back at Allele Biotechnology and Pharmaceuticals, Inc.’s October 2020 complaint accusing the COVID-19 vaccine manufacturers of infringing Allele’s U.S. patent covering a particular “tag” used to track vaccine in a patient’s blood…. U.S. regulatory approval requires Pfizer and BioNTech to show that their vaccine is safe and effective against SARS-CoV-2 infection. To meet the Food and Drug Administration’s (FDA’s) requirements, Pfizer and BioNTech have been and “continue to be engaged in large scale clinical trials to evaluate, among other things, whether individuals who receive the vaccine are less susceptible to COVID-19 infection.” As part of these trials, the results of laboratory tests on blood samples drawn from patients in the clinical trials who received the vaccine are evaluated. One of these tests is a “neutralization assay,” which is a laboratory procedure to detect the presence of antibodies in the blood of a patient after receiving a vaccination capable of neutralizing the SARS-CoV-2 virus. As part of the assay mentioned above, a fluorescent “tag” is used to track the vaccine in a patient’s blood. Allele alleged in its complaint filed in October 2020 that Pfizer and BioNTech infringed their patent for their particularly engineered tag.

The biggest vaccination effort in the history of medicine is underway to eradicate the global pandemic, with several strong prospects appearing poised for regulatory approval. As of December 2020, data from the World Health Organization showed over 50 vaccine candidates in clinical research, and 163 more in the preclinical stage. The wait could soon be over. Two separate vaccines – one from Pfizer and BioNTech and one from Moderna – are pending emergency use authorization from the U.S. Food and Drug Administration. The former is already being administered for the first time outside of clinical trials following its approval by the UK government. That’s why recent calls to strip away intellectual property protections are so dangerous. Specifically, some nations have asked the World Trade Organization (WTO) to waive intellectual property protections related to COVID-19 – including not only vaccines, treatments, diagnostics, and medical technologies, but all forms of IP – until the majority of the world’s population has developed immunity. They argue that the current global intellectual property system is a barrier to accessing said COVID-19 vaccines, treatments, diagnostics, and medical technologies.

As Pfizer and BioNTech announced this week that results of their COVID-19 vaccine have exceeded expectations, the technology behind the vaccine (messenger RNA, or mRNA) has taken center stage. Last month, Moderna Therapeutics, one of the global leaders in the race to produce a COVID-19 vaccine using mRNA, made the following statement regarding enforcement of its patents: “We feel a special obligation under the current circumstances to use our resources to bring this pandemic to an end as quickly as possible. Accordingly, while the pandemic continues, Moderna will not enforce our COVID-19 related patents against those making vaccines intended to combat the pandemic. Further, to eliminate any perceived IP barriers to vaccine development during the pandemic period, upon request we are also willing to license our intellectual property for COVID-19 vaccines to others for the post pandemic period.” This post examines why Moderna made this patent pledge by examining its mRNA technology, go-to-market status, patent landscape, and market position.

Allele Biotechnology and Pharmaceuticals, Inc. (Allele) has accused Regeneron Pharmaceuticals, Inc. (Regeneron); Pfizer, Inc. (Pfizer); and BioNTech SE and BioNTech US, Inc. (collectively BioNTech) for allegedly infringing U.S. Patent No. 10,221,221 (the ’221 patent), which is directed to an artificial flourescent, i.e. mNeonGreen, used for testing COVID-19 assays against vaccine candidates. Allele argues that Regeneron, Pfizer and BioNTech have been infringing the ‘221 patent by taking mNeonGreen “for their own unauthorized commercial testing and development.” Regeneron has been in the news lately for famously providing the “antibody cocktail” given to President Donald Trump shortly after he tested positive for COVID-19 last week. The cocktail is name in the complaint as one of the allegedly infringing technologies.

IPWatchdog’s most recent webinar focused on the role of IP in the development of the most promising vaccines to combat COVID-19 and included speakers from the medical community, the U.S. Food and Drug Administration (FDA) and the biopharmaceutical industry. The upshot was: wear masks, get the vaccine when it’s available to you, trust the FDA, and stop targeting IP rights, since there’s no evidence they have hindered the process and, in fact, IP has so far played a crucial role in collaboration efforts.

During the week of August 12 – 16, the Patent Trial and Appeal Board (PTAB), issued 26 institution-phase decisions in inter partes review (IPR) proceedings. Nine IPR petitions were denied institution while 17 were instituted; nine of the instituted IPRs were joined to other proceedings that are already ongoing at the agency. Pfizer saw a lot of success last week in having seven IPRs instituted against Sanofi-Aventis, challenging four injectable insulin treatment patents that are at the center of district court infringement litigation between the two parties. The PTAB also instituted IPRs on a series of three LifeNet patents covering tissue graft technologies, which have been asserted against RTI Surgical, including one patent which helped LifeNet earn a multimillion-dollar award for patent infringement in district court.

Last month, business news outlets were reporting that stock prices for pharmaceutical firms Pfizer and Merck took a tumble after financial analysts downgraded the performance of both firms over concerns about impending patent cliffs or exclusivity issues – although more recent reports paint a mostly promising picture for the companies, thanks to upcoming acquisitions. A pharmaceutical analyst for UBS downgraded Pfizer from buy to neutral, citing the loss of patent protection in the 2025 to 2029 timeframe for several drugs which contributed 30 percent of Pfizer’s total revenue in 2015. For Merck, although patent expiry wasn’t cited in a note from a pharmaceutical analyst from BMO, that analyst dropped Merck’s rating from outperform to market perform based on the expectation that the company’s blockbuster cancer drug Keytruda would face increased competition in the immuno-oncology field during 2019. As of January 30, stock prices for both firms were down by at least a dollar per share from their closing price on January 23. The downgrades for both firms are further proof of the importance of maintaining exclusivity through patent protection to pharmaceutical firms.

Drug manufactures spend billions of dollars in R&D and it takes years to get FDA approvals and patent protection. It is vital that these companies keep a vibrant and thriving product pipeline to offset costs of failed drugs, which do not work as intended or do not get FDA approval. Yet, all the money spent can yield tremendous dividends when a drug reaches “blockbuster” status. To attain this label, a drug must be so popular that it generates at least $1 billion in annual sales. Often treating the most common chronic and long-term ailments such as diabetes, high cholesterol and blood pressure, for example… In 2015, Pfizer spent $7.7 billion on R&D costs and Eli Lilly spent $4.5 billion. The forecast for Pfizer and Lilly in 2022 is expected to grow to $7.8 billion and $5 billion respectively. This is on trend with the worldwide pharmaceutical numbers at an expected growth of 2.8% to $182 billion in 2022. Both companies are targeting the largest therapy areas with sales which include oncology leading the group followed by anti-diabetics and anti-rheumatics.

Latest IPW Posts

USPTO Proposes National Strategy to Incentivize Inclusive Innovation

May 1, 2024 @ 02:15 pmThe SEP Couch: Shogo Matsunaga on SEPs and the Law in Japan

May 1, 2024 @ 07:15 amWitnesses Tell Senate IP Subcommittee They Must Get NO FAKES Act Right

April 30, 2024 @ 05:15 pmCAFC Affirms TTAB’s Refusal to Register Hair Products Mark Due to Opposer’s Prior Use

April 30, 2024 @ 01:15 pm

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

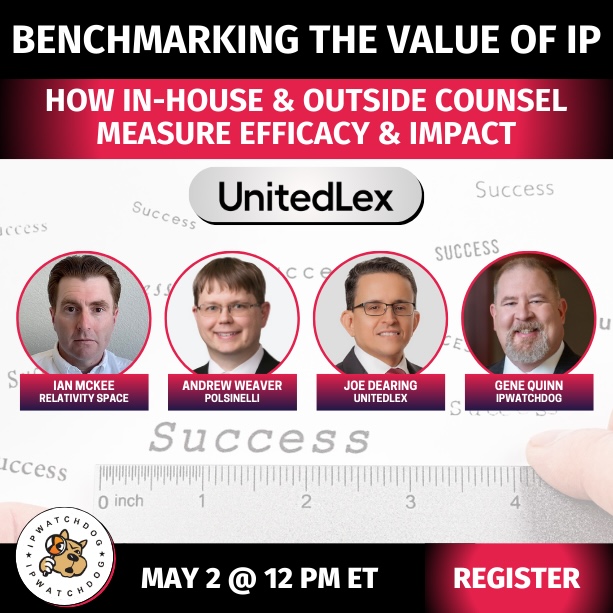

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/05/Quartz-IP-May-9-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)