Posts Tagged: "Patent Licensing"

To maximize the return on investment from a patent portfolio, patent owners must determine which is more lucrative: sales or licensing. In general, patent licensing promises the highest total return on monetizing an IP portfolio because the IP owner can license the same asset or (a single patent or portfolio) to a number of different licensees. On the other hand, it may take three to five years to realize significant revenue from licensing. Additionally, licensing comes with a host of potential risks including litigation, invalidity arguments, and more. More and more frequently patent sales/transfers are part of licensing settlements to ensure there is more of a ‘win/win’ result for negotiating parties.

NASA released 56 formerly-patented technologies to the public domain so that they can be used by commercial enterprises prior to their expiration. Patents released by NASA into the public domain were selected based on the low likelihood that the patents would be licensed by private enterprise because of low demand for resulting products. Other patents cover technologies that require further development before products are market-ready.

Patents are a big capital investment for a startup company, but so is an office building. However, no startup company owns their office building outright. Even if they did own the building, they would take a mortgage on the building to free up capital. Exclusive licenses are the same thing as a lease agreement: the startup has full control of the assets, but does not have to spend capital to build or maintain the asset.

Though much of today’s proposed patent legislation is controversial, removal of the Brulotte rule remains largely uncontested by analysts and has historically garnered support on both sides of the political divide. Replacing the Brulotte rule with the rule of reason from antitrust law would improve market efficiency and spur innovation by increasing the dissemination of intellectual property in the marketplace. To unlock those benefits, Congress must modernize how Federal Courts evaluate post-expiration patent royalty cases.

Unlike other technologies (e.g. User interface) where the manufacturers have a choice to design around the technology of the patent, in case of SEPs, there is no possible way to avoid infringement and still comply with the standard. On the other hand, non-compliance with standard is a commercially non-viable option. This situation gives the SEPs holders a great leverage to assert their licensing terms. While there have been several cases and rulings in favor of SEP licensees that put some restrictions on the SEP holders regarding their FRAND licensing commitments as well as their abilities to exercise an injunction for infringement of SEPs, lack of clarity on FRAND terms still make the negotiations tough for a potential SEP licensee.

This post provides a practical approach for companies to handle the licensing of Intellectual Venture’s (IV’s) smaller in-house funds (ISF & IDF) during a negotiation with IV. These two smaller, in-house funds together represent approximately 20% of IV’s total portfolio. In a typical negotiation with IV, all of the patents in the IIFs (described below) are available for license without exclusions. But, the ISF and IDF patents are more restrictively licensed. Additionally, IV may have presented evidence of use (EOU) materials for assets in these funds, or otherwise highlighted, some of these assets during negotiations, further heightening the risks. For the two smaller funds, IV will provide a list of excluded assets. How can you cost-effectively assess these funds and the associated risks from these smaller funds?

How can a patent that is deemed essential for a standard not be infringed in a product that implements that standard? One possible explanation could be that the claim of essentiality is incorrect. That’s why it is important to document essentiality with a claim chart and ask an independent expert to verify that infringement of the patent claim is prescribed by the standard. But an independent verification is still no guarantee that court will agree that such a patent is really infringed by a product. Another explanation is that the patent is essential for an option in the standard and that the product does not implement this particular option. Most technical specifications of interface standards have options, describing alternative methods to implement the standard. Manufacturers can choose one of the options and will not infringe patents that are essential for implementing another option.

Industry self-regulation is the most efficient and least disruptive means for realizing the benefits of our patent system. It will bring greater certainty to IP-related transactions, and support collaboration to enhance the creation, development, and commercialization of new products and services. It will advance the Constitutional imperative of promoting the progress of the useful arts. By drawing upon the skills, insights, and resources of the diverse community of IP and business development experts, LES will ensure a fair and equitable system of standards that will benefit both society as a whole and the innovators who depend on that system.

The best patents are those that multiply an investment and actually generate money on their own… Standards essential patents are the holy grail of patents in today’s business landscape. Most startups are focused on getting a product to market quickly, getting validation, and starting a revenue stream. Once there, the startups begin to scale. If there is any chance that a startup’s technology – even a piece of it – could be incorporated into an industry standard, the patent needs to be investment-grade. In these situations, multiple patents would also be a good investment.

The debate on RAND terms and conditions is mostly about the reasonability of the royalty rate, less about non-discriminatory part. So, what is a “reasonable rate”? Companies that manufacture products based on a standard will demand lower rates or royalty-free licenses, claim harm from patent hold-ups and from royalty stacking. These companies will argue that it is unfair when companies that contribute technology to the standard benefit from the lock-in of the standard because it is now unavoidable to use the essential patents in their products. On the other hand, companies that participated in standards development, and own essential patents because of that investment, claim that lower royalty rates will remove the incentives for future investments in standard setting and will stifle innovation. In the confusion generated by these lobbying interest groups, it makes sense to go back to the one thing everyone seems to agree on: Standards are good.

Having an attorney draft a licensing agreement, or a licensing expert negotiate a licensing agreement, from start to finish is obviously the best way to proceed. But there will always be some who will choose to proceed on their own to negotiate a licensing and/or draft an agreement. This can certainly be dangerous, but sometimes there is no alternative given financial constraints. Whether you are going to represent yourself or work with an attorney or licensing professional, it is a worthwhile endeavor to engage in some strategic thinking, which absolutely must be the precursor to any memorialized deal.

Lenders and investors like Gerchen Keller and Fortress, among others, have provided capital to or are partnering with private and public NPEs. These business are well suited to assessing market conditions, especially value, and calculating risk for given rights in a specific industry. That they are still willing to fund activities and co-invest in this climate is a testament to the durability of good patents. Also, there is some expectation that we are at or near bottom, and that there are more opportunities now.

Alice certainly has dealt a huge blow to patent market, reversing the growth momentum of most market players, big or small. However, the decline in patent sales revenue has significantly decelerated to 5% in 2015, based on the estimated data. Not all segments of IP industry have weathered the Alice storm equally well. Most NPEs have seen their share prices plunging half to nearly 100%. There will be more restructuring and further consolidation in NPE business in 2016.

Open licenses are private arrangements that work within the current legal regime to encourage innovation, discourage trolls, and help attract top engineering talent. It is a win-win solution for different patenting companies and user’s society. There are several different types of most common open licenses. A License of Transfer Agreement (or shortly, a LOT agreement), that helps to prevent legal suits from non-practicing entities that purchase patents for the sole purpose of enforcing them (called Patent Assertion Entities, or PAEs). Under the LOT Agreement, every company that participates, grants a license to the other participants where the license becomes effective only when patents are transferred to non-participants.

So it now looks like this: if you are a patent owner and feel that your rights have been encroached upon, you now have to assume there will be a challenge to their validity by a potential licensee through an Inter Partes Review (IPR). If you are one of the lucky few (~25%) who survive such a challenge with at least one valid patent claim, you then have to expect an appeal. Assuming you win that appeal, then the real court battle starts in earnest and you’ll have to face what has now become a $3-5M ordeal in legal fees to get through a full trial on the merits and the routinely filed appeal should you beat all odds and win. Treble damages for willful infringement have been rarer than a dodo bird sighting and even winning does not mean you will collect your money any time soon, as the Apple-Samsung saga has recently shown.

Latest IPW Posts

Tips for Using AI Tools After the USPTO’s Recent Guidance for Practitioners

May 2, 2024 @ 08:15 amUSPTO Proposes National Strategy to Incentivize Inclusive Innovation

May 1, 2024 @ 02:15 pmThe SEP Couch: Shogo Matsunaga on SEPs and the Law in Japan

May 1, 2024 @ 07:15 amWitnesses Tell Senate IP Subcommittee They Must Get NO FAKES Act Right

April 30, 2024 @ 05:15 pm

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

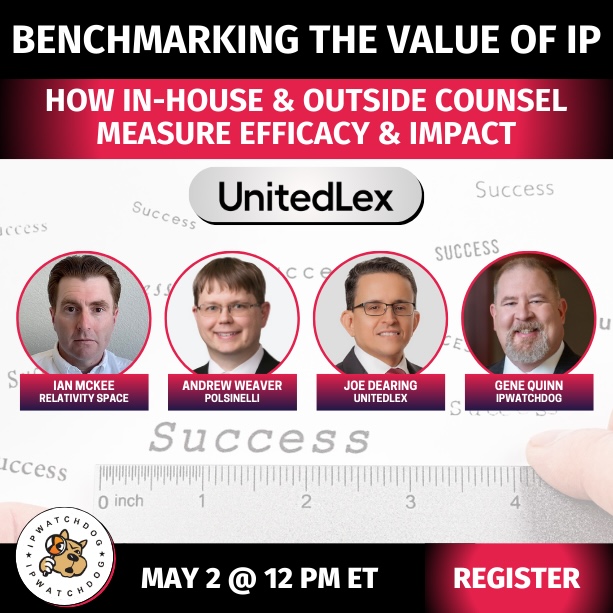

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/05/Quartz-IP-May-9-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)