Posts Tagged: "Patent Licensing"

A patent litigator knows the ultimate truth about patents: their real value is only revealed in the gauntlet of litigation. In a bygone era, patents were reputed to have a statutory presumption of validity, the power to exclude by way of injunction, and the capacity to yield treble damages if an accused infringer were so wanton as to disregard a notice letter and fail to obtain an opinion of counsel. It was often unnecessary for a patent holder to flex its muscle by bringing suit to enforce its intellectual property rights. Instead, the arms-length Georgia-Pacific theoretical license negotiation might well have occurred even before the commencement of any infringement. Those days are over.

Patent licensing is becoming increasingly challenging and it requires thorough preparation on the licensor’s part to convince a potential licensee that a license is both required and inevitable and to persuade them into serious negotiations. The steps involved will vary based on whether your patents are already being infringed upon or if they protect a new technology that can extend market value or penetration. In this article, the focus is on the research and preparation for the licensing of patents that may already be in use.

“At the end of the day innovation is important,” Jung explained before he lamented the fact that the United States “seems to be making it harder and harder to be competitive globally…” Jung ended his presentation by pointing out that in 1820 the United States contributed only 1.8% of world GDP, but that thanks to an innovation economy the United States peaked at about 30% of world GDP, “predominantly driven by invention-driven industries like automotive, like aerospace, like pharmaceutical and so on. These were all based on key inventions that the US dominated the landscape on. That’s clearly not going to be the case going forward. It’s going to be much more distributed across many different countries, which is why I think, again, diversity is going to be the key.”

“I don’t think investors care about names,” Croxall said. “I think they care about results. I have the troll conversation, but it is never with investors. Are they getting smarter about the risk of going to trial? I think they have… I think you get punished more for losing than rewarded for winning.” Croxall also acknowledged that the troll issue seems to have penetrated into the jury box. Hartstein would later agree that public IP companies get punished at least twice as much with a litigation loss as compared with a litigation victory.

Abha Divine is the founder and managing director of Techquity Capital Management, which is an IP investment firm that partners with IP owners to help them deploy their assets into untapped markets to broaden their reach and increase liquidity.We discussed the changing IP investment landscape and deals used to focus nearly exclusively on the number of patents transacted. Of course, that changed in the wake of recent substantive patent law changes. The focus of deals, at least those that were being done over the past few years, was quality. But now we are starting to see the marketplace value quantity again, but not at the expense of quality.

EDWARD JUNG: ”At the other end of that value chain you now have some of the most valuable companies in the entire world in places like China. What stops them from taking all of the value they’ve been able to derive from their over one billion population base, which well capitalizes them, and coming in and competing in the US? The US has not seen so many threats to their industry come from outside the US as opposed to within the US so in that sense I think that’s a whole new set of interesting problems to think about. I’ve actually had encounters with Chinese companies asking if there was some kind of, you know, hidden trick in the way we appear to be opening our market for them to freely come in without any IP barriers. For example, in pairing software and IP and so on and so forth.”

One thing is certain in these tumultuous times, the business of patents has changed. The days of bulk buying at $10,000 per patent have ended; public IP companies are under legislative and shareholder pressure; and, IPR’s have significantly impacted the value of weak patents. These are just some of the examples of significant business changes. So what is a patent owner to do when they want to monetize their patents? There are only three options for patent owners: they can license their patents, they can sell their patents or they can do nothing.

Although the job of developing the patent portfolio never ends, once the assets begin to reach a critical mass it becomes equally important to tactically manage the portfolio. Because if not managed properly, a patent portfolio will not only fail to generate revenue, it will also drain the company coffers. With this in mind it is essential to know thy portfolio, prune thy portfolio and monetize thy portfolio. When many think of patent monetization, patent sales and licensing (in and out of court) are what come to mind, but there have been a slew of anti-patent court decisions that patent owners need to consider before monetizing. Crisis is often said to spawn opportunity and the patent world is no different. Uncertainty in the litigation arena has spawned new, non-litigation offerings to innovators desirous of leveraging the value of their patents.

Covenant Not to Challenge clauses are common in patent licenses, including licenses that are part of post-litigation settlements. clause is seen as a benefit bargained for under a license agreement and constitutes part of the consideration obtained by the licensor for the license. The intended effect of such a clause is to allow the licensor to make an estoppel argument in the event that licensee does challenge the patent, in spite of its agreement not to do so. However, the PTAB thus concluded that without an express grant from Congress, it did not have the authority to recognize contractual estoppel as a bar to an inter partes review.

Both Korea and China are major players on the global patent stage, and the leading companies of these countries file and obtain thousands of patents annually. But it seems increasingly clear that the governments of these countries are attempting to support their domestic companies via antitrust enforcement to lower the price of access to patented technologies of foreign competitors.

The U.S. Supreme Court’s recent decision in Kimble v. Marvel Entertainment, LLC (2015) rejuvenates a 50-year-old rule that limits collecting patent royalties after a patent expires. On June 22, 2015, the Court upheld its per se Brulotte rule that bars a patent licensor’s collection of royalties for the use of a claimed invention beyond the expiration date of the underlying patent. The Court directly addressed criticisms of this rule, which originated in its Brulotte v. Thys Co. (1964) decision, and foreclosed any speculation about the continued viability of Brulotte’s bright-line rule in current practice.

While some companies continue to wait and see, we saw a dramatic shift in late 2014. The most sophisticated companies on IP matters used the uncertainty to their advantage. They hypothesized the market couldn’t get much worse, and since they would eventually need to engage in licensing discussions, they used the negotiation leverage they had during a slow market to get the best deal. Similar to a “buyer’s market” in real estate, the IP market was (and continues to be for some) a licensee’s market as many companies sit back and wait to see how the uncertainty will shake out.

In the automotive industry, it seems as though companies cannot give their patents away fast enough. The firesale began in earnest last June when Tesla Motors CEO Elon Musk announced to the world that neither he nor his company would enforce their patent rights on innovations made using their lithium-ion battery technologies. This decision to open source about 200 U.S. patents was bested in January of this year when Japanese auto manufacturer Toyota released a portfolio of more than 5,500 patents in the area of hydrogen fuel cell vehicles through a cost-free licensing program. Most recently, Ford Motor Company (NYSE:F) has joined this collaborative jamboree, announcing that it would facilitate licensing of more than 650 patents and about 1,000 patent applications in the field of electric vehicles (EVs).

Now more than ever succeeding is all about making better products and offering new and improved services quicker and more reliably than your competitors. Surprisingly, at a time when many major technology corporations are struggling to innovate, we see utter disdain for patent owners. Void from the discussion is any perspective on the real problems facing American companies – namely innovating to obtain a competitive advantage and set themselves apart from the competitors they have today and the competitors they will surely have tomorrow. Increased patent licensing, or outright acquisition of patents, will not only help, but will likely become essential for those companies who understand the importance of continually squeezing out innovation as fast and efficiently as possible.

Gulbrandsen’s chief complaint with the U.S. system centers around the fact that it has become enormously easy to challenge issued patents once they have been granted. In fact, organizations in pursuit of acquired technology are leveraging the kill-rate at the Patent Trial and Appeal Board (PTAB) at the United States Patent and Trademark Office (USPTO), to negotiate lower licensing payments. Threats are made that patents will be challenged in Inter Partes review, “so that you amend the license and reduce the fees,” Gulbrandsen explained. “So, immediately you know that devalues the patent and devalues the license agreement that you’ve got.”

Latest IPW Posts

USPTO Proposes National Strategy to Incentivize Inclusive Innovation

May 1, 2024 @ 02:15 pmThe SEP Couch: Shogo Matsunaga on SEPs and the Law in Japan

May 1, 2024 @ 07:15 amWitnesses Tell Senate IP Subcommittee They Must Get NO FAKES Act Right

April 30, 2024 @ 05:15 pmCAFC Affirms TTAB’s Refusal to Register Hair Products Mark Due to Opposer’s Prior Use

April 30, 2024 @ 01:15 pm

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

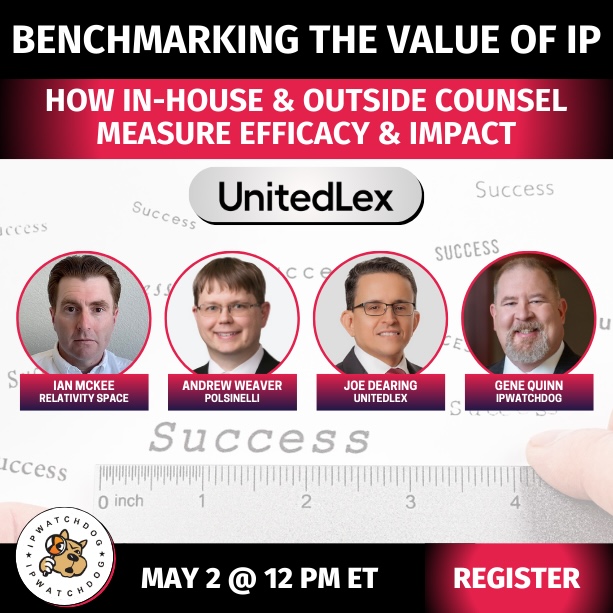

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/05/Quartz-IP-May-9-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)