“It’s been proposed today by the proponents of the bill that this is about keeping foreign influence out of our courts…and generally protecting America from foreign influence. So my amendment offered in good faith would limit this bill to exactly that.”- Rep. Thomas Massie

The House Judiciary Committee on Tuesday considered the Protecting Third Party Litigation Funding (TPLF) From Abuse Act as part of a lengthy markup hearing that chiefly focused on escalating immigration enforcement operations in the United States. The bill did not reach a vote after committee members recessed for votes on the House floor and never reconvened. Sources tell IPWatchdog the bill has now been pulled.

The House Judiciary Committee on Tuesday considered the Protecting Third Party Litigation Funding (TPLF) From Abuse Act as part of a lengthy markup hearing that chiefly focused on escalating immigration enforcement operations in the United States. The bill did not reach a vote after committee members recessed for votes on the House floor and never reconvened. Sources tell IPWatchdog the bill has now been pulled.

The TPLF bill closely tracks a bill last considered in November 2025, the “Litigation Transparency Act of 2025,” meant to curb the use of third-party litigation funding in U.S. lawsuits, which failed to get to a vote at the time and was later pulled. Both the Protecting TPLF From Abuse Act and the Litigation Transparency Act were introduced by Representative Darrell Issa (R-CA) and would require any party in a civil action to disclose third-party sources of funding in most cases.

According to a press release about the bill issued last year, Issa said the legislation “targets serious and continuing abuses in our litigation system that distort our system of justice by obscuring public detection and exploiting loopholes in the law for financial gain… We fundamentally believe that if a third-party investor is financing a lawsuit in federal court, it should be disclosed rather than hidden from the world and left absent from the facts of a case.”

Concerns about the language of the Litigation Transparency Act led to negotiations, however, particularly with respect to the types of entities that would be required to disclose. According to Issa, the latest bill includes language that would require an in camera review by a judge to first determine whether or not the defendant has “a reasonable need to know”, and that would ensure funding sources are not discoverable unless they “are effectively the plaintiff, meaning you share in the profits and likely share in the ability to settle or not settle.”

Representative Thomas Massie (R-KY) introduced an amendment yesterday that would narrow the bill’s focus to national security concerns, specifying an exception to disclosure for any entity that is “a citizen or lawful permanent resident of the United States or any entity organized and principally operated under the laws of the United States or any state thereof and not controlled directly or indirectly by a foreign person.” Massie explained:

“This is a very simple amendment. It’s been proposed today by the proponents of the bill that this is about keeping foreign influence out of our courts… and generally protecting America from foreign influence. So my amendment offered in good faith would limit this bill to exactly that.”

Many of the committee members were open to this amendment, and Issa also seemed amenable to considering language that would further narrow the bill, but it was unclear if his proposed fix with respect to in camera review would satisfy Massie. Another bill that was also considered last year, the “Protecting Our Courts from Foreign Manipulation Act,” introduced by Representative Ben Cline (R-VA), would have amended chapter 111 of title 28, USC, “to increase transparency and oversight of third-party funding by foreign persons, to prohibit third-party funding by foreign states and sovereign wealth funds.” That bill was reported out of the Committee in November by a vote of 15-11.

Many of the committee members were open to this amendment, and Issa also seemed amenable to considering language that would further narrow the bill, but it was unclear if his proposed fix with respect to in camera review would satisfy Massie. Another bill that was also considered last year, the “Protecting Our Courts from Foreign Manipulation Act,” introduced by Representative Ben Cline (R-VA), would have amended chapter 111 of title 28, USC, “to increase transparency and oversight of third-party funding by foreign persons, to prohibit third-party funding by foreign states and sovereign wealth funds.” That bill was reported out of the Committee in November by a vote of 15-11.

A majority of committee members were concerned about ensuring TPLF remains broadly available to smaller plaintiffs. Representative Becca Balint (D-VT), for instance, said that TPLF “levels the playing field for ordinary Americans who face powerful corporations, which is exactly why major business interests are now working to discredit it.”

Balint also claimed that the compromise Issa touted in his opening remarks regarding excluding disclosure for certain entities was actually already required under Supreme Court precedent in Bates v. Little Rock, which held that “requiring the NAACP to disclose its contributors unjustly interfered with the member’s freedom of association, which is protected by the due process clause of the 14th Amendment from invasion by the states.”

“So this new text [that] suggests that member and donor lists of TPLF funders don’t have to be disclosed in some situations is simply a restatement of governing law,” she added.

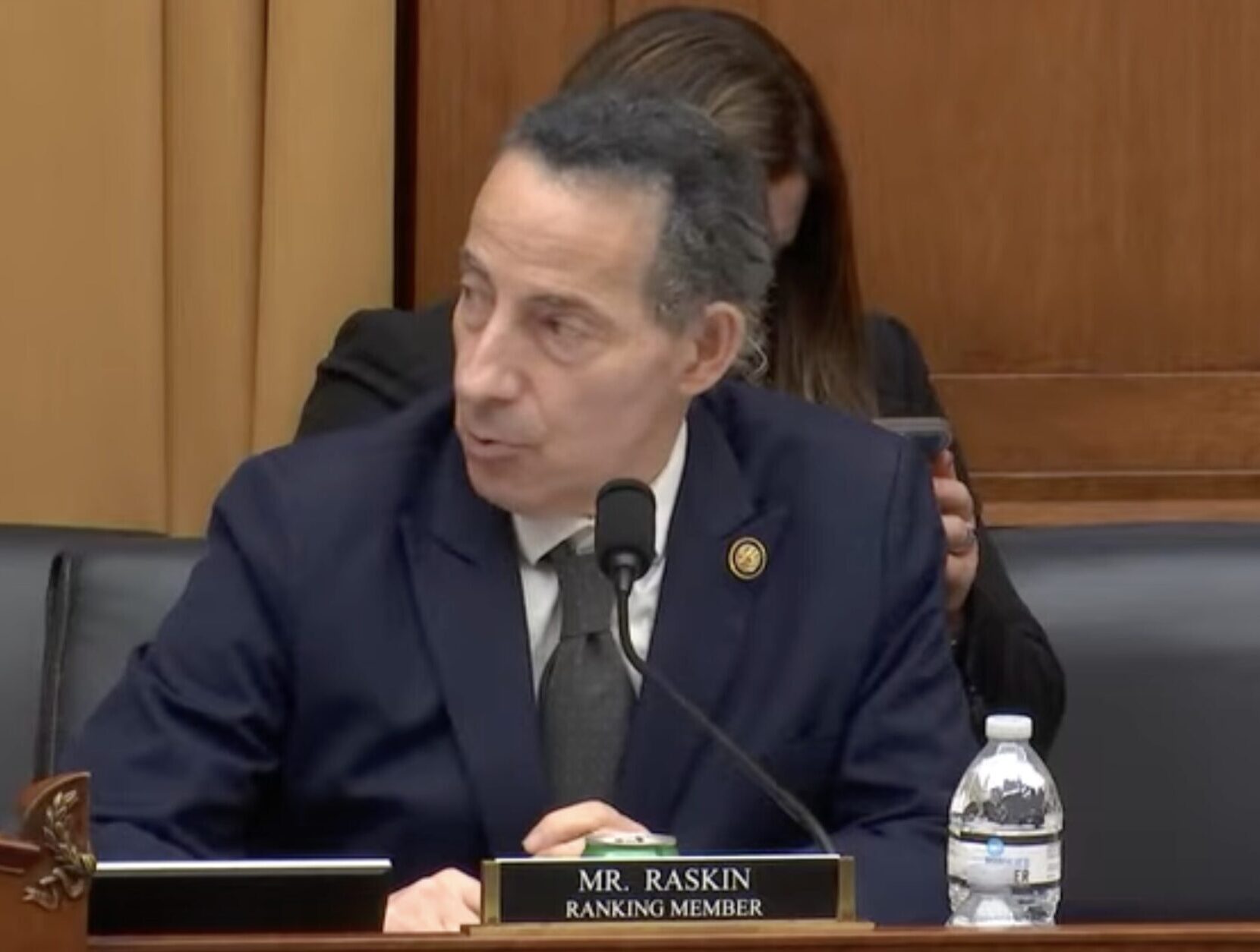

Representative Jamie Raskin (D-MD) called the legislation “the giant corporation bill of the year” and dismissed assertions that it’s needed for reasons of national security. “Look, if we don’t want China or Russia or an autocratic regime funding something in America, we’ll then take that on directly and say, ‘Let’s go ahead and ban that,’” Raskin said. “We don’t need legislation that is going to, in a vastly over broad way, intervene on the sides of the big defendants in these cases.”

Representative Jamie Raskin (D-MD) called the legislation “the giant corporation bill of the year” and dismissed assertions that it’s needed for reasons of national security. “Look, if we don’t want China or Russia or an autocratic regime funding something in America, we’ll then take that on directly and say, ‘Let’s go ahead and ban that,’” Raskin said. “We don’t need legislation that is going to, in a vastly over broad way, intervene on the sides of the big defendants in these cases.”

But Issa rejected the repeated characterizations of TPLF as being a David vs. Goliath dynamic. “Many of the statements so far have said little guy, little guy, little guy,” Issa said. “What’s amazing is that it’s in fact the big guy that’s funding this against little guys.”

Some industry groups also weighed in to oppose the bill. The Inventors Defense Alliance (IDA) “strongly opposes” the proposed legislation and said in a statement “it would harm America’s small businesses, deter investment, and weaken the innovation ecosystem.”

IDA’s chief policy counselor, Kristen Osenga, explained that, “for many innovators, third-party litigation funding is not optional—it is the only way to stand up to large corporations that rely on delay and intimidation to avoid accountability. The Act’s disclosure requirements would expose sensitive legal strategies and financial relationships, giving powerful defendants an unfair advantage and opening the door to harassment of investors.”

Osenga added that the bill would require disclosure beyond litigation funding and would force disclosure of “all investors in any non-public company, including individual investors, venture capital backers and other sources of equity financing that have nothing to do with a specific lawsuit.” She called it a “sweeping approach would chill investment across the innovation ecosystem, not just in litigation finance.”

The American Civil Accountability Alliance (ACAA) was launched specifically “in response to growing efforts to restrict access to the courts” and said that “litigation finance is an important tool that enables individuals and small businesses to fund the expensive, years-long legal battles that are often necessary to secure justice.”

ACAA board member and partner at Cherry Johnson Siegmund James, Erick Robinson, said, “too often, the litigation finance debate has ignored the people most affected — plaintiffs who need access to capital to seek justice. ACAA exists to elevate those voices and ensure they have a seat at the policymaking table.”

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2026/01/IP-Author-Jan-22-2026-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2025/11/PTAB-Masters-2026-sidebar-regular-price-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2025/12/LIVE-2026-sidebar-early-bird-new-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet. Add my comment.

Add Comment