Posts Tagged: "patent troll"

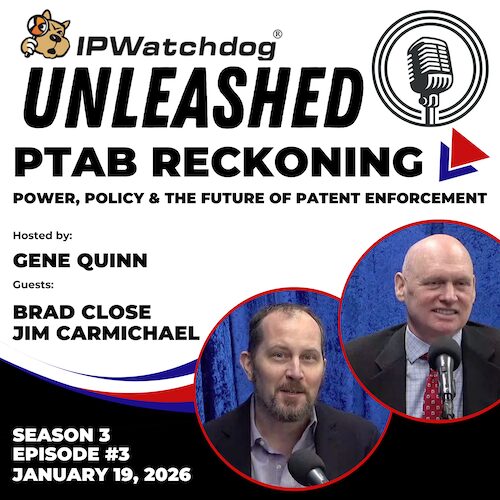

In the latest episode of IPWatchdog Unleashed, I sat down with my good friends Brad Close, who is the Executive Vice President of Transpacific IP, and Jim Carmichael, a former judge on the Board of Patent Appeals and Interferences and founder of Carmichael IP. Brad, Jim and I engaged in a candid conversation that provides our unvarnished assessment of the Patent Trial and Appeal Board (PTAB), where it started historically, where it is today, and where it may finally be headed. Bottom line: the PTAB is no longer the automatic execution squad it once was, but durable patent rights will require reform well beyond the agency level.

This week on IPWatchdog Unleashed, we enter the patent litigation world for a conversation about gaming patent litigation. For too long, popular sentiment has been that patent owners are bad actors simply because they are patent owners. A more nuanced but still grossly overbroad view is that patent owners are not per se bad actors, but if you are a patent owner who has the audacity to enforce a patent against an alleged infringer then you are most definitely a bad actor. Obviously, just being a patent owner does not make one a bad actor, and neither does enforcing a patent against an alleged infringer. But this patent troll narrative has been quite successful

The term “patent troll” has become ubiquitous in the IP world since it was first coined at Intel in the late 1990s. There is no single definition of what it means but it is always used pejoratively and is most frequently deployed against non-practicing entities (NPEs). NPEs do not manufacture patented products. Instead, they derive economic value from IP sales, licensing or other monetization activities. In recent years, there has been a deliberate and partially successful effort to conflate NPEs with patent trolls. However, to do this is disingenuous at best, dishonest at worst.

My conversation this week with John White was much like any number of conversations we have had over the years over dinner or drinks. What prompted me to ask John to speak with us this week was an article he recently wrote, which we published on IPWatchdog. It was styled as an open letter to Elon Musk and Vivek Ramaswamy, the incoming co-leaders of the soon-to-be Department of Government Efficiency. In that article John explains that “the patent system is currently foundered”, but that it can be fixed with “focus and ongoing commitment to see the fixes through to results.” So, that is where we start our conversation, like so many we have had over the last 26 years—what is wrong with the patent system and how should it be fixed.

There is absolutely no doubt that at least some bad-acting patent owners continue to engage in a systematic game of extortion that leverages judicial inefficiencies and the often-outrageous costs of fighting and winning even when there is absolutely no merit to the patent infringement allegations. And these patent owners who do engage in this type of bad action do the industry a tremendous disservice, because these nefarious actors behave so egregiously that it causes a stain on the entire industry, and sadly it allows for all patent owners to be swept up together. That means that those patent owners with a real grievance—and there are many—get unfairly labeled as patent trolls and treated as if they are engaging in the same low-rent bad action as the truly nefarious actors.

Efforts by high-tech companies to undermine both the Patent Eligibility Restoration Act of 2023 and the Promoting and Respecting Economically Vital American Innovation Leadership (PREVAIL) Act ramped up this week, with a joint letter sent to the Senate Judiciary Committee by a number of tech industry organizations on Monday and a campaign launched by the Electronic Frontier Foundation (EFF) yesterday.

Words can have profound impact. The term “patent troll,” coined by an Intel litigator, has done incalculable damage. First use is attributed to Peter Detkin, who is said to have deployed it in 2001 to belittle plaintiffs in a patent case involving the chipmaker. Shortly after its appearance, Detkin emerged as what some in the tech world would consider a bad actor. He co-founded Intellectual Ventures, a company that raised $5.5 billion to acquire more than 40,000 patents and applications for sale, license or enforcement. The IP community needs to be more vigilant about preventing parties of interest and the media from controlling the IP narrative.

January 17 marks the first day in the tenure of the U.S. Patent and Trademark Office’s (USPTO’s) new Commissioner for Patents, Vaishali Udupa. Udupa, whose appointment was announced in December, comes to the USPTO after serving the last seven years as the head of litigation for Hewlett Packard Enterprise, where she was responsible for heading HPE’s intellectual property litigation and formulating case strategies. She replaces Acting Commissioner for Patents Andrew Faile, who served in that role since January 2021 and who will be retiring from the agency after 33 years upon Udupa’s installation as commissioner. Well-known within the patent community as an advocate for diversity and representation issues, Udupa joins the USPTO as a relative outsider. She comes in as the first full Commissioner for Patents since the retirement of Drew Hirshfeld, who served with the agency for two decades before he was first appointed to Commissioner in 2015. Those familiar with recent Patent Office history will recall that Commissioners immediately preceding Hirshfeld included Bob Stoll, Peggy Focarino, John Doll and Nick Godici. Stoll, Focarino, Doll and Godici each served in various capacities at the Office, including in high-level policy and regulatory positions, for more than a generation prior to becoming Commissioner.

The chaotic state of the world today makes it increasingly difficult for American companies to compete. Russian hostility has the democratic world on edge, U.S. inflation is at a 40-year high and hitting consumers hard, and China continues its aggressive push for economic and technological dominance. To stay on top, the United States must out-innovate our competitors. America needs to lead the world in cutting-edge products and new technologies, and those are made possible by policies that support the innovation economy. The Ukraine crisis makes it clear that energy and cyber policy is crucial. Recently, the U.S. Trade Representative told Congress that supporting and protecting the full range of our innovators from China’s distortive practices is critical to our nation’s future.

On March 4, the U.S. Court of Appeals for the Eighth Circuit issued a ruling in Tumey v. Mycroft AI, Inc. in which the appellate court overturned the Western District of Missouri’s grant of injunctive relief to Tumey, a patent attorney representing a plaintiff asserting patent claims against Mycroft. The Eighth Circuit found that Tumey had not met the requisite standard of proof to show that Mycroft had engaged in cyber attacks and harassing phone calls targeting Tumey and his family to support injunctive relief. The appellate court also remanded the case with instructions to reassign the case to a different district court judge.

Big Tech’s patent troll narrative is really just the great Big Tech smash and grab. Jean Ann Booth explains in the Waco Tribune what patent trolls are by taking Big Tech’s cartoonish characterization as her own: Patent trolls are rich investors who buy up patents from failed startups just so they can sue companies commercializing the invention in order to extort their money. Extortion – that’s what patent trolls do. And they are wrecking U.S. innovation to boot. They sure sound scary. Patent trolls are indeed frightening. Flush with big bucks, Big Tech lobbyists pushed the patent troll narrative on Congress, the administration, and the courts, demanding that we gut U.S. patent law (the same U.S. patent law that drove over 200 years of American innovation) if we are to save American innovation. Government bureaucrats and politicians complied by smashing the U.S patent system. Now Big Tech can grab whatever technology they want.

Meanwhile, all patents— good, bad, revolutionary, and stupid— have eroded to the point where continued use of the U.S. patent system must be questioned. Despite the statute saying that patents are to be treated as property rights, the Supreme Court has ruled that patents are merely government franchises that can be stripped at any point in time during the life of the patent regardless of how much time or money has been invested by the patent owner. It simply cannot make any sense for all patents to become increasingly worthless simply because of the victimization of large multinational corporations who are incapable of crafting a strategy that solves the nuisance litigation problem that does not destroy the entire system.

An Administrative Law Judge (ALJ) at the International Trade Commission (ITC) recently determined that Samsung Phones violate key patents on magnetic emulator technology for contactless payment systems from Pittsburgh’s Dynamics, Inc. We have been collaborating for years in the academic and public sectors on issues raised in that case, and are consulting consult with Dynamics because we think these issues are vital to our innovation ecosystem, our national economy, and our commitments to international partners. It is especially illustrative of the serious risks facing these vital public interests that far too frequently when there has been a full and fair adjudication determining that there has been infringement of multiple patents and that those patents are neither invalid nor unenforceable, the headline more than suggests that the infringer has been cleared of responsibility.

The movements of IP-centric business have never been easy to appreciate. With technology patent and licensing values slowly returning to higher levels, it is a good time to revisit a business model which has been a lightning rod for criticism: the public intellectual property company or PIPCO. PIPCO is a term coined by this Intangible Investor columnist in 2013, when there were 30 or more publicly held patent licensing companies with a collective market capitalization of about $9 billion. That may sound like a lot to some, but when you look at the largest patent licensing company, Qualcomm, whose market cap is currently $136 billion, you realize almost everyone else in this group is or was relatively small, typically a micro-cap, with a market value under $1 billion. These companies’ lack of size, unpredictable quarterly revenue and attractive but unpredictable assets positioned them below the radar of most institutional investors. When it comes to weathering financial storms, like ocean-going vessels, sizes matters.

In early October, social networking firm KinectUs LLC filed a lawsuit in the Western District of Texas alleging claims of patent infringement by Bumble Trading, LLC, the operator of the popular Bumble dating app. In the suit, KinectUs accused Bumble of infringing upon claims of six patents that protect systems and methods for connecting mobile device users via a collaboration system that enables users to connect with other users based on search parameters like common interests or location data. KinectUs’ infringement allegations focus on Bumble’s platform, which allows mobile device users to connect with others based on similar parameters. While the actual analysis of whether Bumble’s user matching system infringes claims of the ‘428 patent would normally require at least a Markman hearing and some discovery, certain members of the U.S. patent community would prefer to harness the power of crowdsourcing to make this determination. IP litigation risk management firm Unified Patents is hosting a Patroll contest seeking prior art to invalidate the ‘428 patent owned by KinectUs. U

Latest IPW Posts

Netflix Scores Win at CAFC in Reversal of 101 Decision for Patent Owner

February 9, 2026 @ 04:36 pmFederal Circuit Finds In-Store Product Locator Patents Ineligible as Abstract

February 9, 2026 @ 09:15 amHow Temu Works With Brands to Protect Intellectual Property Rights

February 9, 2026 @ 08:15 amPatent Portfolio Economics: Balancing Quality, Cost and Market Coverage

February 8, 2026 @ 01:00 pm

Latest Podcasts

IPWatchdog Events

CLE Webinar: How to Prompt AI – A Hands-On Workshop for Patent Prep and Pros

February 10 @ 12:00 pm - 1:00 pm ESTWebinar: IP at Risk – Avoiding Costly Compliance Mistakes in Export Controls

February 12 @ 12:00 pm - 1:00 pm ESTWebinar: Optimizing the Chemistry Drafting Process – Where AI Actually Helps

February 17 @ 12:00 pm - 1:00 pm ESTWebinar: Resurrecting Antibody Genus Protection – Allowed Claims Through CDR-Scanning

March 5 @ 12:00 pm - 1:00 pm ESTIPWatchdog LIVE 2026 at the Renaissance Arlington Capital View

March 22 @ 1:00 pm - March 24 @ 7:00 pm EDT

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2026/02/Junior-AI-Feb-10-2026-sidebar-CLE-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2026/02/Anaqua-Feb-12-2026-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2025/12/LIVE-2026-sidebar-regular-price-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)