Posts Tagged: "pharmaceuticals"

The Federal Trade Commission will require Watson Pharmaceuticals, Inc. and Actavis Inc. to sell the rights and assets to 18 drugs to Sandoz International GmbH and Par Pharmaceuticals, Inc, and relinquish the manufacturing and marketing rights to three others, to settle charges that Watson’s proposed $5.9 billion acquisition of Actavis would otherwise be anticompetitive.

Last week the Federal Circuit decided the case of Santarus, Inc. v. Par Pharmaceutical, Inc., which dealt with whether a drug covered by an Abbreviated New Drug Application (ANDA) infringed the patents owned by that patent owner relative to the proton pump inhibitors (PPI) product omeprazole. The big issue in the case is what might at first glance seem to be a rather innocuous statement relative to the support necessary in a patent specification for a negative claim limitation. But after reading the Newman dissent (which joins in the other aspects of the Court’s decision) it starts to become clear that this could be a much larger issue of significant consequence.

While the Supreme Court may have expanded the reach of the Hatch-Waxman “safe harbor,” the Medtronic and Merck cases only involved pre-marketing FDA approval activity. But the recent split Federal Circuit panel decision in Momenta Pharmaceuticals, Inc. v. Amphastar Pharmaceuticals, Inc. has now (alarmingly in my view) further widened the applicability of this “safe harbor” beyond such pre-marketing FDA approval activity. In Momenta Pharmaceuticals, Judge Moore (writing for the majority joined by Judge Dyk) ruled that this “safe harbor” could also apply to post-FDA approval activity, even if that activity was at least arguably commercial in nature.

The mantra of the anti-patent community is nearly in unison on the issue of patented drugs. Of course, everyone wants drugs to be developed, but no one wants to pay the exorbitant prices charged for blockbuster, patented drugs. You can add me to that list of individuals who doesn’t like the prices, but at least there is a benefit. Without appropriate financial incentives in place drugs would not be patented, but then again they wouldn’t be developed either. But what is the justification for scarcity and exorbitant prices of old drugs that are off patent?

In Duramed, the invention claimed in U.S. Pat. No. 5,908,638 (the “’638 patent”) involved a conjugated estrogen pharmaceutical compositions for use in hormone replacement therapies. The critical aspect of the claimed invention was the moisture barrier coating (MBC) which surrounded the composition. Claim 7 (which depended from independent Claim 1) specified that this MBC “comprises ethylcellulose.” During patent prosecution, the examiner rejected both Claims 1 and 7 for obviousness under 35 U.S.C. § 103. As a result of an interview with the examiner, Claim 1 was amended to include the recitation in Claim 7, and in due course, the ‘638 patent issued. Sounds to me like a classical instance of prosecution history estoppel coming into play and barring any application of the doctrine of equivalents.

As a prelude to his presentation at BIO Mr. Iverson agreed to go on the record with me. Part 1 of my interview with Mr. Iverson was published last week, and what appears below is the final segment of our discussion. We pick up with discussion of crowd sourcing techniques to enhance innovation and the humanitarian work of the Gates Foundation, as well as the humanitarian work of all those engaged in the life sciences, which Iverson says is “all about helping people and saving lives.”

While success in Phase I is critical, there are substantial hurdles to overcome yet before this vaccine could reach the market. Nevertheless, such a promising cancer vaccine ought to be heralded by everyone, right? Think again! Inovio actually has the audacity to have patents on its ground breaking innovation, which will lead the anti-patent non-thinkers to be more concerned with blowing up the patent system than rooting on Inovio and others as they attempt to eradicate cancer. Absolutely ridiculous if you ask me!

I am skeptical about the prospects for invalidating patents on drugs, particularly important or blockbuster drugs. I also question whether anti-patent do-gooders in the biotech and pharma space are really causing more harm than good through attempts to bust patents on blockbuster drugs. According to their own press release, PUBPAT acknowledges that the tablet is heat stable and does not need to be refrigerated like prior versions of the drug. They seemingly make the argument, although not directly, that because this makes it much more convenient for patients it is unfair to charge prices sufficient to recoup R&D and a premium to make the speculative R&D reasonably profitable for investors. Of course, the fact that the drug in question is extremely convenient for patients is not a reason to invalid the claims, and in fact is likely a compelling reason why in this instance the patent claims cover a truly novel and nonobvious innovation.

For 2010 the US Trade Representative reviewed 77 trading partners for this year’s Special 301 Report, and placed 41 countries on either the Priority Watch List, Watch List, or the Section 306 monitoring list. The Priority Watch List for 2010 names the following countries:China, Russia, Algeria, Argentina, Canada, Chile, India, Indonesia, Pakistan, Thailand and Venezuela.

The plaintiffs had argued that defendants had in fact violated Section 1 of the Sherman Act when they settled their dispute concerning the validity of Bayer’s Cipro patent by agreeing to a reverse exclusionary payment settlement. Bayer agreed to pay the generic challengers, and in exchange the generic firms conceded the validity of the Cipro patent. The Second Circuit panel affirmed the granting of summary judgment, finding themselves confined by the previous Second Circuit ruling in Tamoxifen. The panel did, however, make the extraordinary invitation to petition the Second Circuit for rehearing in banc, citing the exceptional importance of the antitrust implications, the fact that the primary authors of the Hatch-Waxman Act have stated reverse payments were never intended under the legislation and the fact that the Second Circuit in Tamoxifen simply got it wrong when they said that subsequent generic entrants could potentially obtain a 180 exclusive period even after the first would-be generic entrant had settled.

Now here is what really caught my attention about PARD, on November 13, 2009 the stock was trading at $7.58, and on Monday, November 16, 2009 it dropped like a rock to $1.83, where it has largely stayed in a trading range plus or minus since. So what happened? On November 16, 2009, PARD announced what they called a positive Phase 3 study of picoplatin for use to treat small cell lung cancer patients. Those treated with picoplatin had an 11% reduction in the risk of death compared to patients treated with current best practices, which was not a positive enough result to be statistically significant. As is often the case with companies like this in the biotech sector, bad news is devastating to a stock. It is also true that stocks in the biotech sector also do quite well on good news. Back in March 2009, PARD was trading at about $1.70 to $1.80 before running up to a high of $9.14. So could this positive Phase 2 news of picoplatin and colorectal cancer be the precursor to another run up?

Some may recall my “dissertation” on the case of Amgen Inc. v. F. Hoffman-La Roche Ltd. See CAFC: A Divisional By Any Other Name Is Not a Divisional . In Amgen, the Federal Circuit made it clear that you had better characterize an application as a “divisional” if you wanted the benefit of the “safe harbor” provided by 35 U.S.C…

Latest IPW Posts

USPTO Proposes National Strategy to Incentivize Inclusive Innovation

May 1, 2024 @ 02:15 pmThe SEP Couch: Shogo Matsunaga on SEPs and the Law in Japan

May 1, 2024 @ 07:15 amWitnesses Tell Senate IP Subcommittee They Must Get NO FAKES Act Right

April 30, 2024 @ 05:15 pmCAFC Affirms TTAB’s Refusal to Register Hair Products Mark Due to Opposer’s Prior Use

April 30, 2024 @ 01:15 pm

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

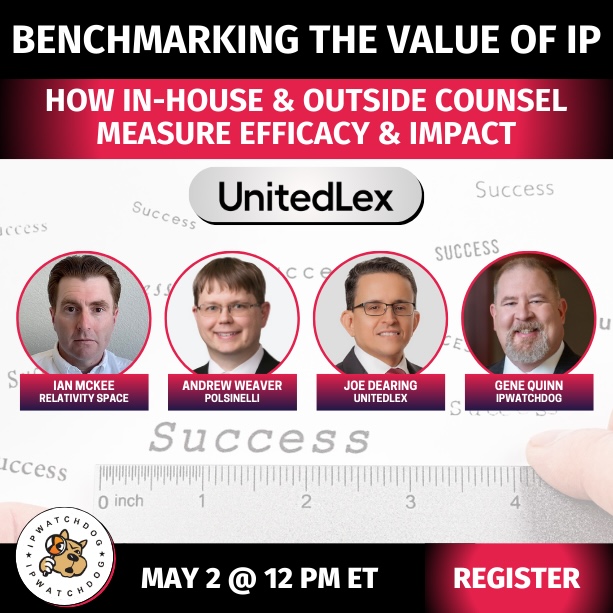

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/05/Quartz-IP-May-9-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)