Posts Tagged: "Antitrust"

Both Korea and China are major players on the global patent stage, and the leading companies of these countries file and obtain thousands of patents annually. But it seems increasingly clear that the governments of these countries are attempting to support their domestic companies via antitrust enforcement to lower the price of access to patented technologies of foreign competitors.

On June 26, the Third Circuit held that payment includes more than just cash transfers. Judge Scirica, in a unanimous decision, wrote that Glaxo’s promise to Teva not to introduce an authorized generic version of epilepsy-and-bipolar-disorder-treating Lamictal was an “unusual, unexplained reverse transfer of considerable value.” And the court held that this transfer could “give rise to the inference that it is a payment to eliminate the risk of competition.”

Starting before World War II and continuing throughout the 1950s, 60s and 70s, short sighted and now discredited government antitrust policies, coupled with judicial hostility toward patent enforcement and patent licensing, converged to reduce the enforceability of patents and to restrict the ability of patent owners to license their inventions. The result: foreign competitors began to capture entire industries that should have been dominated by U.S. companies that had pioneered the relevant technologies.

First, the Actavis decision is not limited to cash. The case itself involved not cash payments, but brand overpayments for generic services. In addition, the Supreme Court’s assertions on payments encompassed value from a generic’s reprieve from competition during its 180-day exclusivity period, as this period “can prove valuable, possibly ‘worth several hundred million dollars.’” Antitrust law makes clear that economic substance—not form—matters. And it does not make economic sense to apply Actavis to preclude antitrust scrutiny where, instead of overpaying for services, the brand pays the generic with real estate, gives the generic a lucrative business deal for free, or agrees not to launch its own generic version (known as an “authorized generic”).

The FTC brief explains that the no-authorized-generic (no-AG) commitment at issue raises the same antitrust concern that the Supreme Court identified in Actavis. A no-authorized-generic commitment means that the brand-name drug firm, as part of a patent settlement, agrees that it will not launch its own authorized-generic alternative when the first generic company begins to compete. An FTC empirical study of the competitive effects of authorized generics found that when a brand company does not launch an authorized generic during the exclusivity period reserved for the first-filing generic under the Hatch-Waxman Act, it substantially increases the first generic company’s revenues, and consumers pay higher prices for the generic product.

The testimony further discusses the Commission’s interest in the problem of “patent hold-up” that can arise during an industry standard-setting process. Patent hold-up occurs when the holder of a standard essential patent (SEP), which has previously committed to license that SEP on reasonable and non-discriminatory (RAND) terms, violates its RAND commitment and uses the leverage of the standard setting process to negotiate higher royalties than it could have before the patent was incorporated into the standard. The FTC recently pursued several enforcement actions related to patent holders who seek injunctive relief or exclusion orders for alleged infringement of their RAND-encumbered SEPs.

According to the FTC’s complaint, the elimination of future competition between Nielsen and Arbitron would likely cause advertisers, ad agencies, and programmers to pay more for national syndicated cross-platform audience measurement services. Thus, Nielsen agreed that it will divest and license assets and intellectual property needed to develop national syndicated cross-platform audience measurement services.

The Federal Trade Commission has asked the U.S. District Court for the District of New Jersey to accept an amicus brief that addresses the application of the U.S. Supreme Court’s recent ruling in FTC v. Actavis to a patent settlement containing a “no-authorized-generic” commitment. The FTC’s amicus brief states that the Effexor XR case presents “an issue with significant implications for American consumers”: whether pharmaceutical patent settlements are “immune from antitrust scrutiny so long as the brand-name drug manufacturer pays for delayed entry with something other than cash.” The brief explains why “[t]he allegations here raise the same type of antitrust concern that the Supreme Court identified in Actavis,” and thus should be treated in the same fashion.

1. Reed Tech takes over USPTO Contract from Google. 2. Pharma Patent Settlements Saved $25.5 Billion for US Health System. 3. Coffee Analysis Smart Phone App for that Perfect Brew. 4.FDA Approves Brain Wave Test to Assess ADHD in Children. 5. CAFC Copaxone® Patent Ruling Allows May 2014 Generic Launch. 6. A Permanent Injunction in a Patent Infringement Case! 7. Post-Grant Proceedings Treatise Publishes.

In this case, the Supreme Court considered an arrangement by which brand firm Solvay paid generics Watson (now Actavis) and Paddock roughly $30 to $40 million to delay entering the market with generic versions of testosterone gel. The Eleventh Circuit upheld the activity, concluding that “absent sham litigation or fraud in obtaining the patent, a reverse payment settlement is immune from antitrust attack so long as its anticompetitive effects fall within the scope of the exclusionary potential of the patent.” The court explained that “[p]atent holders have a ‘lawful right to exclude others from the market’” and that a patent “conveys the right to cripple competition.”

The Supreme Court reversed the Eleventh Circuit, concluding that, while a valid patent allows a patentee to charge “higher-than-competitive” prices, “an invalidated patent carries with it no such right.” The Court recognized the policy encouraging settlements. But for five reasons, it found that that policy did not dictate immunity for pay-for-delay settlements.

IPXI is the first financial exchange that facilitates non-exclusive licensing and trading of intellectual property rights with market-based pricing and standardized terms. Earlier this week word came from the Intellectual Property Exchange International Inc. (IPXI) that the U.S. Department of Justice Antitrust Division issued its Business Review Letter (BRL) upon the culmination of its eight-month review. The DOJ believes that the IP Exchange business model proposed by IPXI is capable of producing market efficiencies in the patent licensing arena and is likely to be pro-innovation. Although no permission is required of the DOJ before IPXI opens its exchange, having this review of the DOJ Antitrust Division complete has to make IPXI and Exchange participants much more at ease as the move closer toward their attempt to revolutionize IP licensing.

Under a settlement reached with the FTC, Google will meet its prior commitments to allow competitors access – on fair, reasonable, and non-discriminatory terms – to patents on critical standardized technologies needed to make popular devices such as smart phones, laptop and tablet computers, and gaming consoles. In a separate letter of commitment to the Commission, Google has agreed to give online advertisers more flexibility to simultaneously manage ad campaigns on Google’s AdWords platform and on rival ad platforms; and to refrain from misappropriating online content from so-called “vertical” websites that focus on specific categories such as shopping or travel for use in its own vertical offerings.

In the past several years, the Second, Eleventh, and Federal Circuits have upheld these settlements (known as “reverse payment” agreements since the money flows from the patentee to the alleged infringer rather than the other way around). These courts have focused on the benefits of settling cases and the presumption of patent validity, and they have explained that payments fall within the “scope of the patent.” In contrast, the Third Circuit recently applied more aggressive scrutiny, rejecting the scope test and finding that payments for delay were “prima facie evidence of an unreasonable restraint of trade.”

Not only is the FTC arguing that product changes to patented drugs violate U.S. antitrust laws, but the FTC and Department of Justice (DOJ) are going to look into whether patent enforcement activities that seek redress for infringement violate U.S. antitrust laws. See FTC, DOJ to Hold Workshop on Patent Assertion Entities. This does not bode well for a second Obama term, and I have to wonder whether those in the patent community that decided to vote for President Obama due to his perceived friendliness to patents and smooth running of the Patent Office are going to start to have regrets, particularly now that David Kappos is leaving the USPTO.

In a “no-AG” agreement, the branded firm, as part of the patent litigation settlement, agrees that it will not launch its own generic alternative when the first generic begins to compete. Since the introduction of the branded AG would cut into the revenues of a competing generic product, a no-AG commitment can induce the generic firm to delay entry of its product to the market. Thus, the Commission concludes, a no-AG commitment is legally sufficient to trigger a rebuttable presumption of illegality under the law of the Third Circuit.

Latest IPW Posts

Tips for Using AI Tools After the USPTO’s Recent Guidance for Practitioners

May 2, 2024 @ 08:15 amUSPTO Proposes National Strategy to Incentivize Inclusive Innovation

May 1, 2024 @ 02:15 pmThe SEP Couch: Shogo Matsunaga on SEPs and the Law in Japan

May 1, 2024 @ 07:15 amWitnesses Tell Senate IP Subcommittee They Must Get NO FAKES Act Right

April 30, 2024 @ 05:15 pm

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

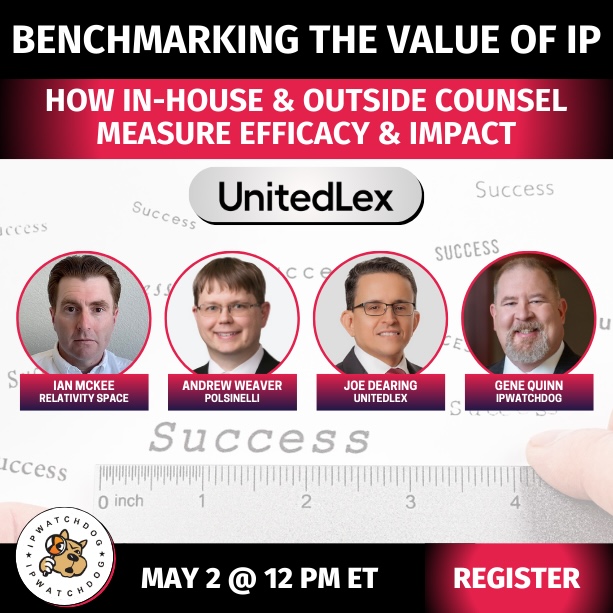

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/05/Quartz-IP-May-9-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)