“The observation that many Wi-Fi 6 core technologies result from 3GPP standardization is supported by the owners of the potentially relevant Wi-Fi 6 patents, as many of them have declared these same patents as being essential to LTE and 5G.”

Wi-Fi 6 shares new technologies with LTE and 5G that are subject to heavy patenting. The firms and institutions that currently monetize their standard essential patents (SEPs) against LTE and 5G will likely be looking to increase their royalty income from Wi-Fi 6 and 6e. This could mean that the recent disputes over LTE and 5G standardization participants’ fair, reasonable, and non-discriminatory (FRAND) SEP licensing commitments will spill over into Wi-Fi. Current Wi-Fi litigation trends suggest that this is already afoot, and the recent licensor-friendly changes in the IEEE IPR rules are feared to only fuel this trend.

Wi-Fi 6 shares new technologies with LTE and 5G that are subject to heavy patenting. The firms and institutions that currently monetize their standard essential patents (SEPs) against LTE and 5G will likely be looking to increase their royalty income from Wi-Fi 6 and 6e. This could mean that the recent disputes over LTE and 5G standardization participants’ fair, reasonable, and non-discriminatory (FRAND) SEP licensing commitments will spill over into Wi-Fi. Current Wi-Fi litigation trends suggest that this is already afoot, and the recent licensor-friendly changes in the IEEE IPR rules are feared to only fuel this trend.

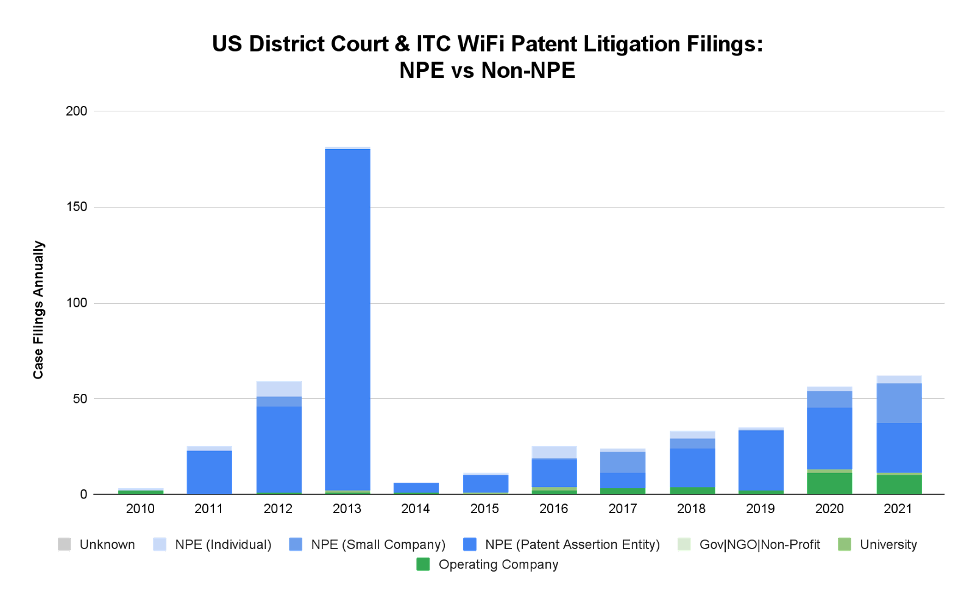

Wi-Fi Litigation Rising

Wi-Fi patent litigation in the United States is experiencing an upward trend and promises to only continue as Wi-Fi 6 adoption accelerates. As can be seen in the graph below, a similar trend was last seen in 2011 – 2013 with the tapering off of Wi-Fi 4 and the adoption of Wi-Fi 5. The ballooning of Wi-Fi SEP portfolios and fundamental changes in the reasonable and non-discriminatory (RAND, the IEEE version of FRAND) licensing regime for these SEPs promises to only fuel the upward trend.

Source: Unified Patents Litigation Portal

Wi-Fi has attracted the attention of SEP holders over the past few years due to the California Institute of Technology’s (“CalTech”) case filed in 2016 against Broadcom and Apple. Damages of $1.1 billion were awarded against Apple and Broadcom for their implementation of low-density parity check error correction codes, optional features in Wi-Fi 4 and Wi-Fi 5 but mandatory in Wi-Fi 6. The case was largely upheld on appeal in February 2022 but the damages amount was vacated and a retrial ordered as the two-tiered licensing of chips was found in the record to be legally unsupported. No decision is expected before the summer of 2023. Meanwhile, CalTech has expanded its monetization campaign and filed litigation against Dell, HP, Microsoft, and Samsung. As of December 2022, only one of the CalTech patents is still in force, but is expected to expire in May of 2023.

W-Fi litigation has been a bellwether for determining the contours of the F/RAND licensing commitments required of participants in standards setting organizations. The 2012 decision in Motorola v. Microsoft, the 2013 decision In re Innovatio IP Ventures, LLC, and the 2014 decision in Ericsson v. D-Link all covered patents claimed to be essential to the then-current Wi-Fi standards.

The Innovatio decision eschewed a bottom-up approach to calculating royalties in favor of a top-down model. This was precipitated in part by Innovatio’s failure to provide compelling arguments for using a top-down model and in part by the immensity of the task of weighing the advantages and costs of alternative technologies and sifting through subjective claims of essentiality and its various degrees.

Failures in the Innovatio case also arguably led to the entrenchment in the IEEE’s 2015 IPR rule changes of the smallest saleable patent-practicing unit (“SSPPU”) established in the 2009 Cornell University v. Hewlett Packard case and the 2012 LaserDynamics v. Quanta Computer case. Since Innovatio failed to provide the court with a “… legally sound and factually credible method to apportion the price of the accused end-products to the value of only Innovatio’s patented features,” the court used the Wi-Fi chip price as a basis for determining the royalty. The court in Innovatio settled on the unweighted average sales price of a Wi-Fi chip of $14.85 over the period 1997 – 2013 when the average price went from $37 to $3.05. During this period the price of chips declined due to a number of factors, including the decline in silicon used in modern chips and the dramatic increase in volumes. It is natural with each introduction of a new Wi-Fi generation that the price of chips implementing the new generation comes initially with a premium and declines over time. With Wi-Fi 6, this pricing cycle seems to have started out at a lower premium as the average sales price for Wi-Fi 6 chipsets is already estimated to be $6.57 in 2022 after the technology has been in the market for only 3 years.

The court in the Innovatio case settled on a royalty of $0.0956 for a collection of what was regarded then as a collection of 19 US SEP families (apparently using the PCT simple family definition) of moderate to high importance to the Wi-Fi standard. The court arrived at this rate first by using the industry’s average profit margin of 12.1% on the $14.85 average sales price of a Wi-Fi chipset sales and multiplying that by 84% since Innovatio’s SEPs were considered to be of moderate to high importance and thus numbered among the top 10% of the SEPs relevant for Wi-Fi. With this the court calculated Innovatio’s share using the landscape figure of 3,000 families with a granted US patent, rounded down from 3,106, predicted by PA Consulting to be potentially essential to Wi-Fi in 2013. According to the court in Innovatio the equation for the royalty on a single moderately to highly important SEP in 2013 is as follows:

Per SEP Royalty Rate $0.00503 = ($14.85 x 12.1% x 84%) / (3,000 x 10%)

Wi-Fi 6 Core Technologies

Wi-Fi 6 now shares a number of core technologies with 3GPP LTE and 5G, such as the following:

- Beamforming (BF) enables transmissions to be formed and directed to specific users. BF traces its beginnings to the work on phased arrays and directional antennas in the early 1900s. BF has been part of LTE since 2009.

- Orthogonal Frequency Division Multiple Access (OFDMA) enables simultaneous communication between an access point (AP) and multiple clients using subsets of subcarriers called resource units. OFDMA is a multi-user access method using Orthogonal Frequency Division Multiplexing (OFDM), which was introduced in 1966. OFDM and OFDMA have been implemented in LTE and 5G from their inception.

- Multiple User – Multiple Input Multiple Output (MU-MIMO) enables high speed connectivity among multiple users over multiple pathways. Multiple Input Multiple Output (MIMO) was the subject of research already in the 1970s and the 1990s. MU-MIMO is a part of LTE and was adopted for the downlink in Wi-Fi 5 and for both downlink and uplink in Wi-Fi 6.

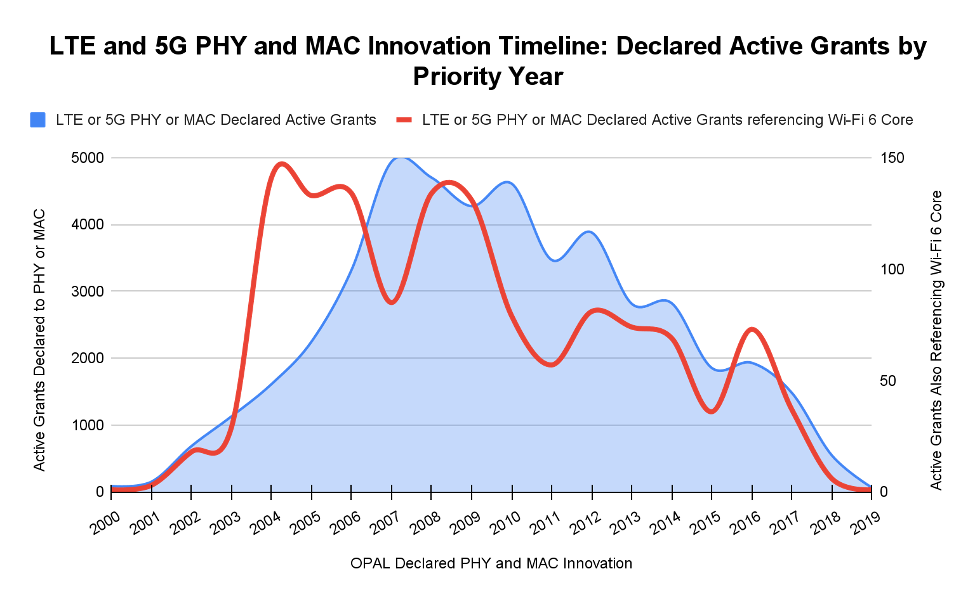

These shared technologies expose Wi-Fi 6 to assertions from a large collection of patents that were innovated in connection with LTE and 5G well before the development of Wi-Fi 6. As of January 2023, over 66,000 patent grants have been self-declared to ETSI as being essential to the LTE or 5G radio access network (RAN) and 70% of those have been declared to the physical (PHY) and medium access control (MAC) layers. About 3% of those active grants use in their claims, abstract, or title the keywords “beamform”, MU-MIMO, or OFDMA but this likely only covers a portion of the LTE and 5G declared patents that may be relevant for the Wi-Fi 6 core technologies. The timeline below shows the priority dates for this innovation from a 3GPP perspective. As can be seen from the chart below, the major push for PHY and MAC innovation as measured by the priority dates of the relevant patents occurred during LTE’s development and standardization years 2004 – 2009.

Source: Unified Patents OPAL

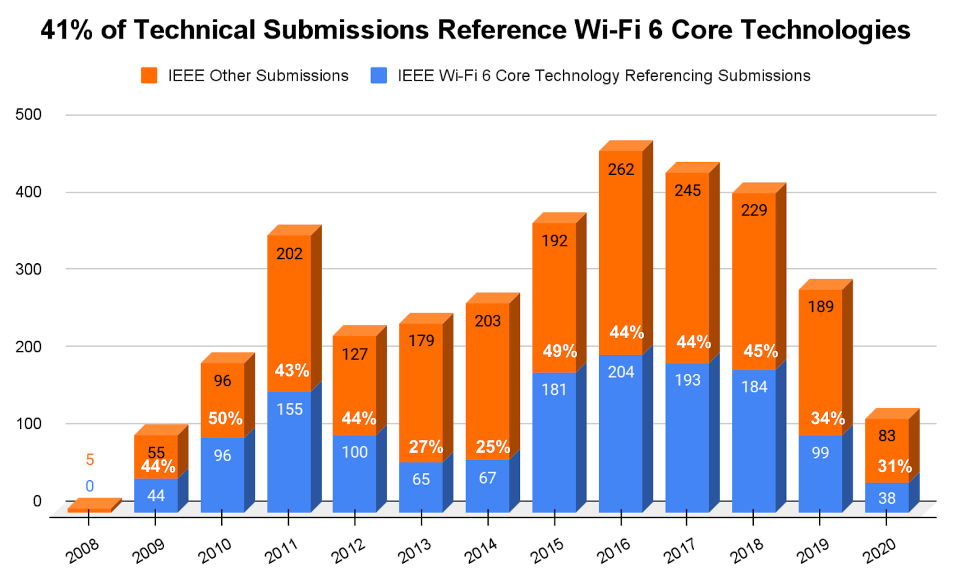

BF, MU-MIMO, and OFDMA also attracted a lot of attention in the technical submissions made to IEEE’s 802.11 Task Groups ac and ax (TGac and TGax) and High Efficiency WLAN Study Group (HEW SG) during the development of the Wi-Fi 5 and 6 standards. The chart below shows that 41% of the technical submissions referenced these core technologies.

Source: Unified Patents OPEN

BF, MU-MIMO, and OFDMA were first a heavy focus in 2009 – 2011 when Wi-Fi 5 was being standardized. BF was a part of Wi-Fi 5 when wave 1 was released in 2013 and MU-MIMO for the AP downlink became part of Wi-Fi 5 with the release of wave 2 in 2016. The increase in attention to these core technologies during 2015 – 2018 coincides directly with the efforts to increase Wi-Fi 6’s capacity and decrease potential signal interference amongst the exploding numbers of IoT devices forecasted.

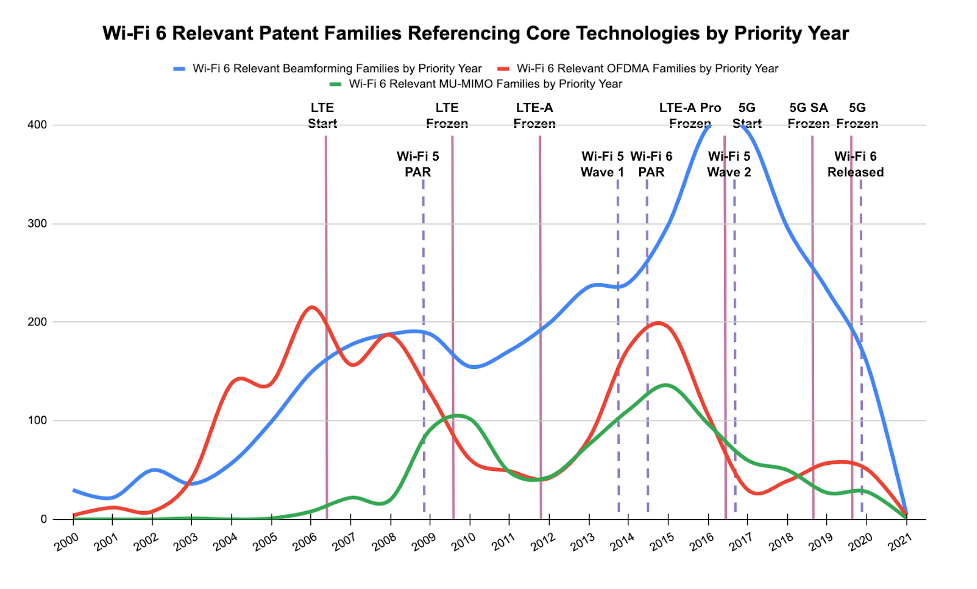

Source: Unified Patents OPAL

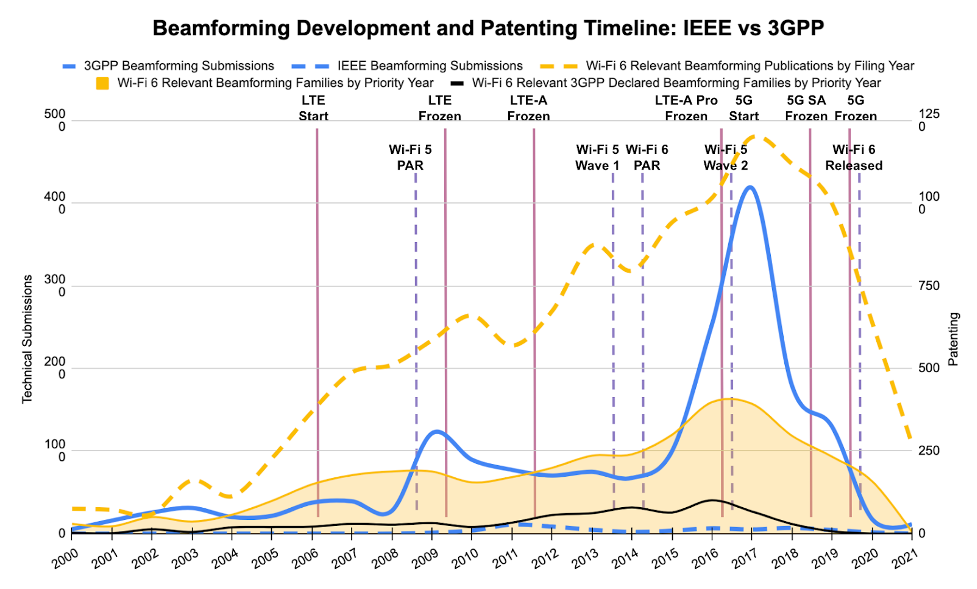

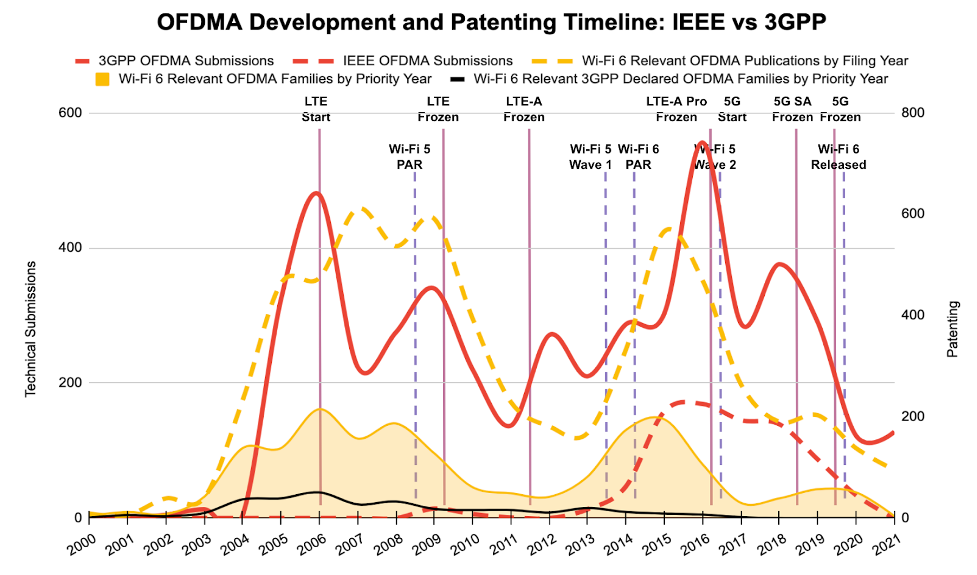

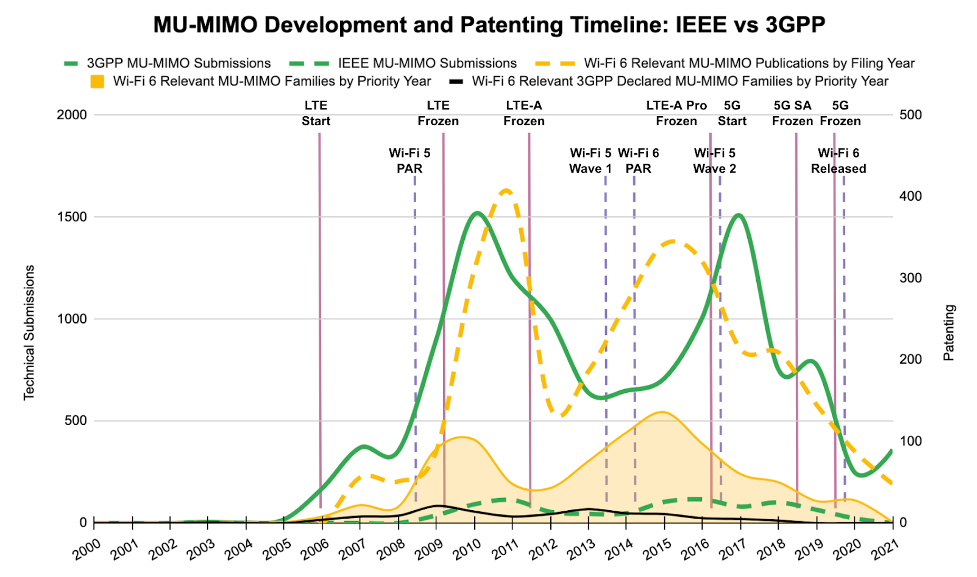

The charts below compare the timelines for standardization work and patenting involving each of the Wi-Fi 6 core technologies. The patents covered in these charts comprise the patents identified to be potentially relevant to BF, MU-MIMO, and OFDMA in Wi-Fi based on relevant keyword searches of patents that (i) list as an inventor a participant in Wi-Fi 6 standardization work, (ii) cite CPC code H0W4, or (iii) cite IEEE and IEEE 802 in their listed non-patent literature.

Source: Unified Patents’ OPEN and OPAL

Source: Unified Patents’ OPEN and OPAL

Source: Unified Patents’ OPEN and OPAL

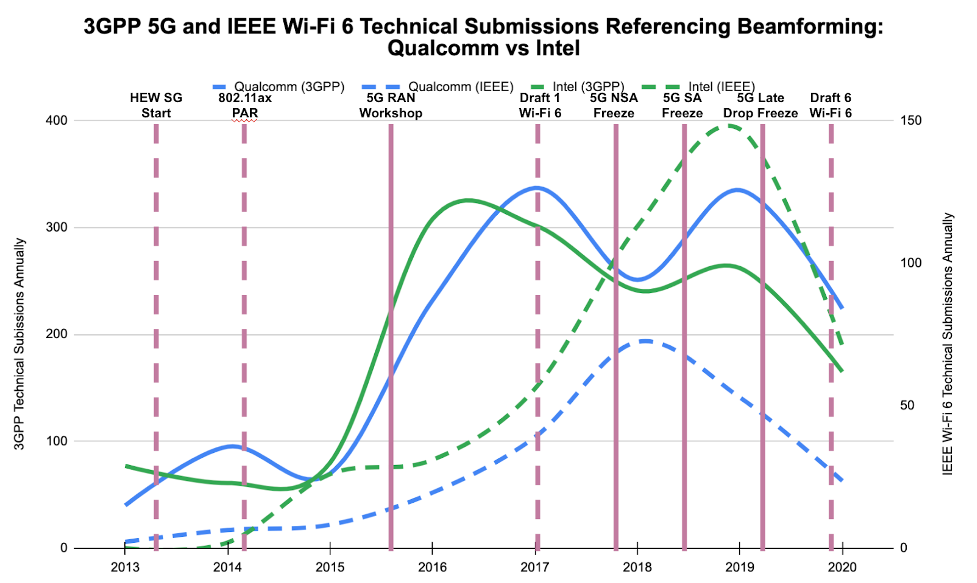

In each of the core technology cases, a lag of 1-2 years and a significantly lower level of input can be observed when comparing the 3GPP technical submission timeline with the IEEE technical submission timeline. Further, the charts show that a large portion of the patents potentially relevant to Wi-Fi 6 arose from innovation during the standardization of LTE. That is not to say that patents did not arise from innovation during the standardization of Wi-Fi 5 or 6. The peak in 2015 – 2018 in innovation and in both IEEE and 3GPP technical submissions results arguably from a combination of 3GPP and IEEE standardization work. The graph below shows in more detail the timelines of BF referencing technical submissions by Intel and Qualcomm, both entities heavily invested in Wi-Fi 6 and 5G technologies during the period 2014 – 2019.

Source: Unified Patents OPEN for IEEE and 3GPP

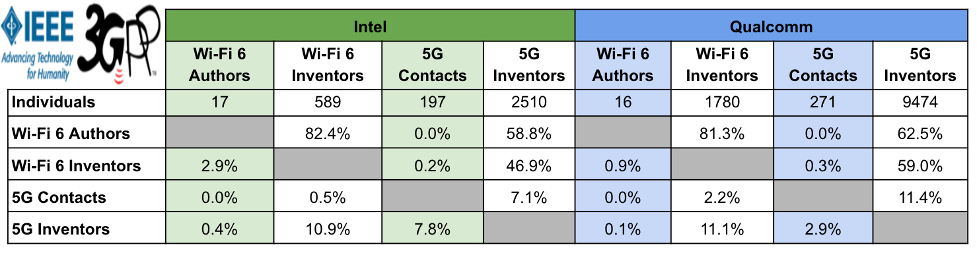

One could speculate that the delay in focus on beamforming between Wi-Fi 6 and 5G standardization work is due to resource prioritization. However, it should be pointed out that both Intel and Qualcomm support IEEE and 3GPP standardization work with large separate representation teams with very little overlap. There is, however, noticeable overlap between the inventors listed on the potentially relevant patents.

Source: Unified Patents OPEN

Of even more interest is that the beamforming references made by these two firms in their Wi-Fi 6 technical submissions increased dramatically after the first draft of the Wi-Fi 6 standard was voted on in January 2017. Since the vote on the first draft in January 2017 reached only a 58% consensus, far below the 75% required, it is possible that beamforming was one of the issues in the first draft that required more development. It was not until the vote on the 3rd Wi-Fi 6 draft in July of 2018 that a consensus of over 75% was reached and this seems to have coincided with Intel’s and Qualcomm’s interest in beamforming in their technical submissions.

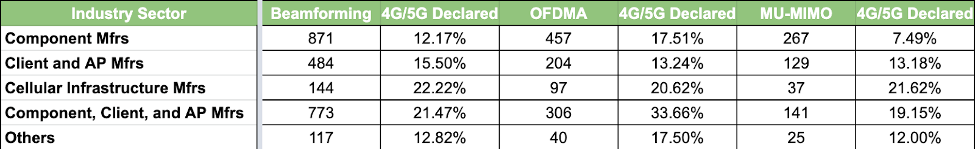

The observation that many Wi-Fi 6 core technologies result from 3GPP standardization is supported by the owners of the potentially relevant Wi-Fi 6 patents, as many of them have declared these same patents as being essential to LTE and 5G. The table below shows the percentages of potential Wi-Fi 6 relevant patents referencing the core technology keywords that have been self-declared by various industry sectors to be LTE and 5G SEPs.

Source: Unified Patents OPAL for Wi-Fi 6, LTE, and 5G

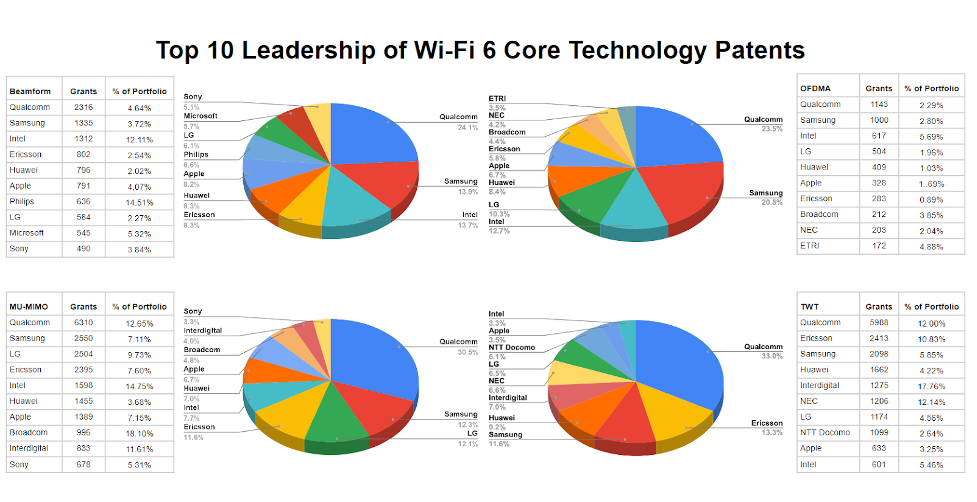

The charts below show the patenting focus of the top 10 patent holders for each of the Wi-Fi 6 core technologies and target wake time (TWT). The patent grant counts below result from the core technology keyword searches described earlier. Notable from the graphs below is that many of the prominent self-declared LTE and 5G SEP holders populate the top 10 lists for these core technologies.

In Part II, we will look at how the IEEE’s recent IPR rule changes will affect the trends and technologies we’ve detailed here.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.