“Though these patent issuance numbers are seemingly robust given the state of the world economy and many research & development activities during the COVID-19 pandemic… [t]he true impacts of COVID-19 on patent filing applications might become clearer in late 2021 or perhaps even beyond.”

On January 12, patent database provider IFI Claims published its Top 50 U.S. patent grant recipient list for 2020, as well as its Global 250 list of top owners of active patent assets worldwide. The Top 50 list includes many of the usual suspects among top patent filing organizations, including IBM, which takes the top spot among all firms receiving U.S. patents for the 28th year in a row. Perhaps the most surprising finding from the study is that patent application filing activity increased slightly during 2020 despite the massive disruptions to daily life caused by the COVID-19 pandemic.

IBM Claims Most Issued Patents Crown for 28th Straight Year

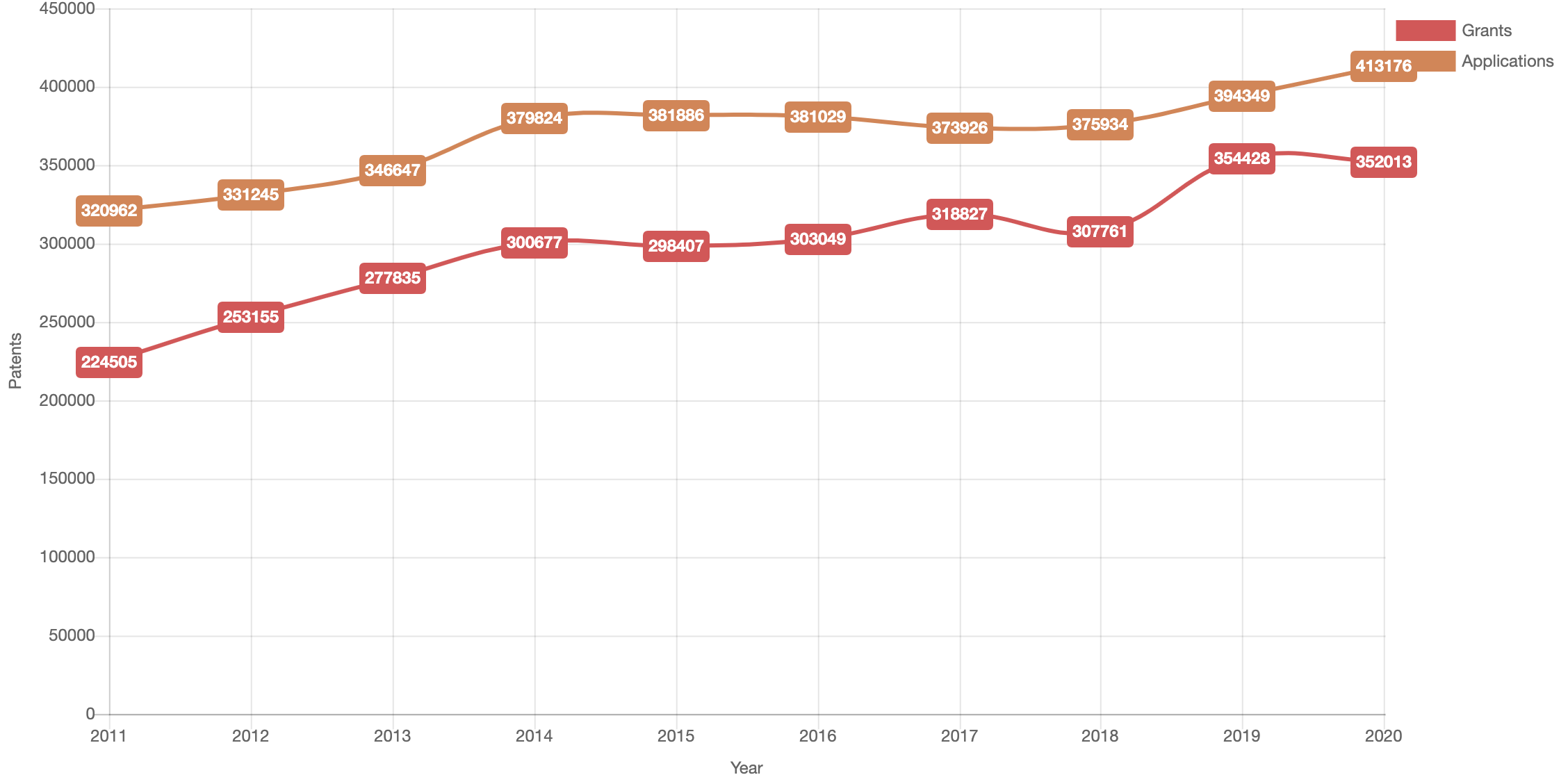

An IFI Claims trends and insights page shows that the U.S. Patent and Trademark Office received a total of 413,176 patent applications during 2020, a 5% increase over the 394,349 patent applications filed at the USPTO during 2019. Despite the increase to the number of U.S. patent applications filed, patent grants by the USPTO decreased by less than 1% down to 352,013 issued patents during 2020. However, that’s only a slight reduction from the record number of patents issued in 2019 (354,428 issued patents) and the largest total for any single year except for 2019.

https://www.ificlaims.com/rankings-trends-2020.htm

Once again, International Business Machines (IBM) holds the #1 spot among all entities obtaining U.S. patent grants during 2020 with 9,130 patents issued by the USPTO, nearly 3,000 patents more than were obtained by second-place Samsung during 2020 (6,415 issued patents). A press release issued by IBM on the news indicated that the Armonk, NY-based R&D giant’s 2020 patents mainly covered cloud and hybrid cloud tech (3,000 issued patents), artificial intelligence tech (2,300 issued patents) and data security tech (1,400 issued patents).

Following IBM on IFI Claims’ annual ranking of top U.S. patent recipients is a familiar cast of supporting characters including Samsung Electronics (6,415 issued patents), Canon (3,225 issued patents), Microsoft (2,905 issued patents) and Intel (2,867 issued patents). Interestingly, each of the top five patent recipients actually saw their patent grants drop year-over-year; Canon suffered the largest decline, a 9% reduction from the company’s 3,548 issued patents during 2019. By contrast, each of the companies ranked 6th through 9th saw greater numbers of issued patents during 2020: Taiwan Semiconductor Manufacturing Company (TMSC), up 22% to 2,833 issued patents; LG Electronics, up 1% to 2,831 issued patents; Apple, up 12% to 2,791 issued patents; and Huawei, up 14% to 2,761 issued patents. The companies with the greatest percentage increases in 2020 were 24th-ranked Kia Motors, up 44% to 1,323 issued patents, and 32nd-ranked Sharp Corporation, up 27% to 1,042 issued patents.

Though these patent issuance numbers are seemingly robust given the state of the world economy and many research & development activities during the COVID-19 pandemic, IFI Claims CEO Mike Baycroft said that it would take some time before the true impact of COVID-19 on global R&D activities could be measured in terms of impacts to patent filings. “U.S. applications are published 18 months after they’re originally filed,” Baycroft said, “and most of the recent patent application growth predates the pandemic.” The true impacts of COVID-19 on patent filing applications might therefore become clearer in late 2021 or perhaps even beyond.

Could Patent Eligibility Concerns Impact Fastest Growing Tech Sector?

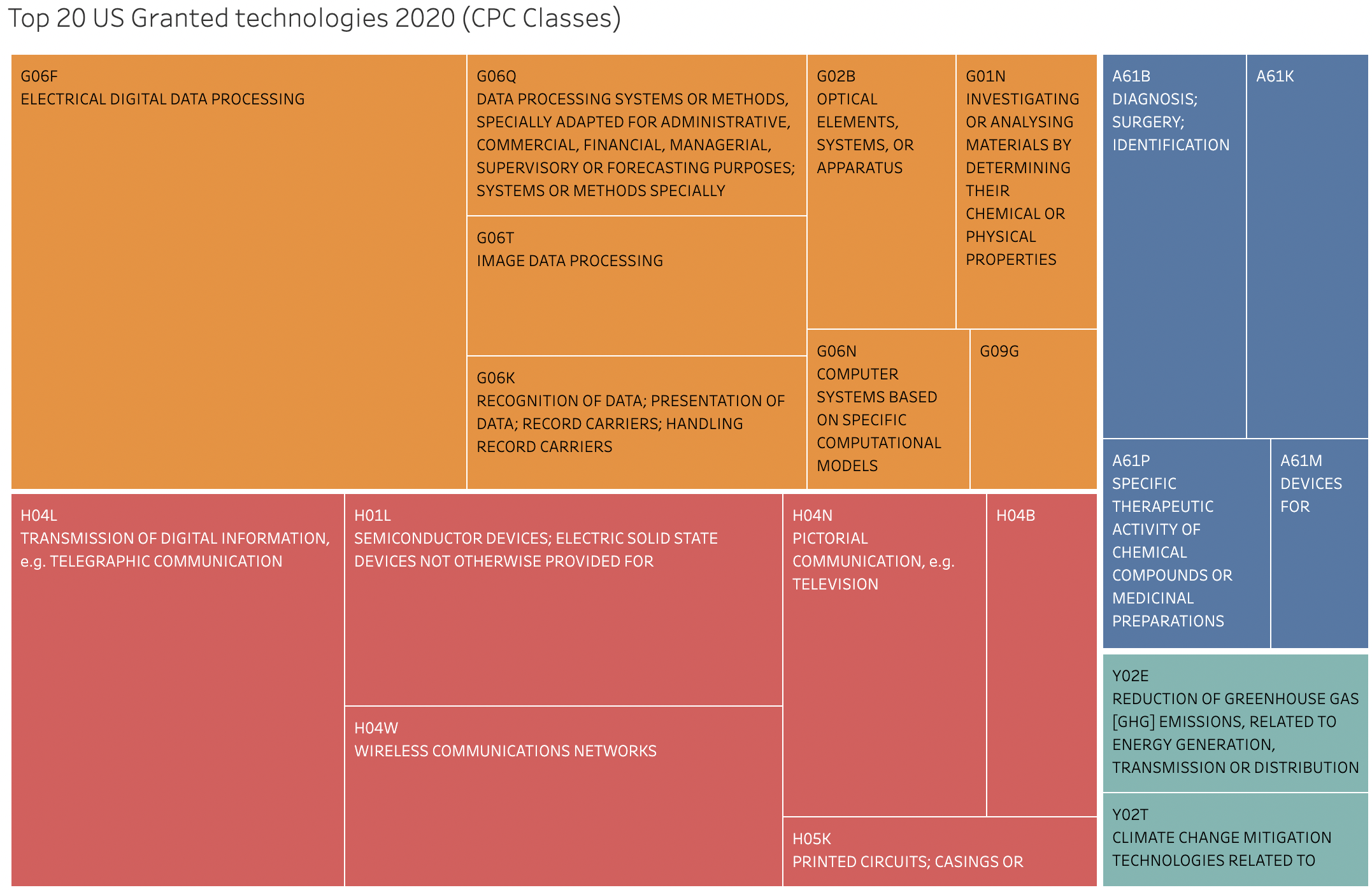

IFI Claims’ data also offers a survey of the top ten fastest growing areas of technology, which is led by computer systems based on biological models, which saw a compound annual growth rate (CAGR) of 67.28% between 2016 and 2020. This area, which covers an array of artificial intelligence (AI) and neural network technologies, was led by IBM, with 2,789 patent applications during the five-year period, followed by Google (1,451 patent applications), Samsung Electronics (1,253 patent applications), Intel (1,102 patent applications) and Microsoft (1,044 patent applications). Of course, the Alice/Mayo patent eligibility framework in the United States has posed a threat to patent applications in the AI and bioinformatics sectors. While these technologies can unlock incredible advances for our society, the application of the preemption test in patent eligibility doctrine can eliminate patent eligibility for many of these inventions because they achieve results for which there are no alternatives.

https://www.ificlaims.com/rankings-trends-2020.htm

Patent eligibility issues are likely much less of a threat to the second-fastest growing technology sector, electrical smoking devices (55.08 % CAGR from 2016 to 2020). Philip Morris maintained a sizable lead during the five-year study period, filing 1,688 patent applications in this sector, more than twice the amount filed by second-place Altria (701 patent applications). Following those firms were RAI Strategic Holdings (658 patent applications), Nicoventures Holding (483 patent applications) and British American Tobacco (474 patent applications). After electrical smoking devices, the third-fastest growing tech sector in terms of patent application growth was angiosperms, or new flowering plants, a sector which Baycroft said was a fascinating area. “It always surprises me to see sectors which may be covered by much smaller patent portfolios, but there’s clearly a lot of activity going on,” Baycroft said. Leaders in the angiosperm space include Monsanto (1,359 patent applications), Pioneer Hi Bred Industries (905 patent applications), Seminis Vegetable Seeds (485 patent applications), Syngenta (392 patent applications) and Duemmen Group (298 patent applications).

Although two of the fastest-growing tech sectors related directly to autonomous vehicles, both Baycroft and Ron Kratz, Chief Commercial Officer for IFI Claims, noted that patent application filings in these sectors have been dominated mainly by traditional automakers and tech firms and not Tesla, which most consumers probably associate most strongly with self-driving car technology. Tesla also doesn’t appear in the Global 250 list, although Kratz cautioned against reading too strongly into Tesla’s lack of a patent portfolio. “Younger companies on the global list have fewer assets than companies that have been around for a while,” Kratz noted. “Tesla’s developing some amazing technologies, but comparatively speaking they’re the young kids.” Of course, Tesla CEO Elon Musk has long had a tenuous grasp on the importance of patent rights, undertaking business activities that are duplicitous in light of his public stance on patents and clearly preferring trade secrets to society’s detriment by refusing to disclose innovation through patents.

IFI’s Global 250 List Shows Samsung’s Dominance in Worldwide Patent Ownership

While IBM is far and away the leader when it comes to numbers of patent application filings and issued patents, Samsung Electronics has a massive lead in terms of ownership of current active patent assets worldwide, according to IFI Claims’ Top 250 Global list, which is in its second year. Unlike the Top 50 list, which looks at the name of the assignee at the time of a patent’s issuance, the Global 250 list both looks at which company actually owns the patent and also aggregates subsidiary patent holdings within the parent company. That’s why Samsung is a perennial runner-up to IBM in the Top 50 listings and yet tops the Global 250 list with twice as many active patent families, 80,577 compared to IBM’s 38,541. IBM’s active patent family ownership has been reduced over the years by major deals such as the 2014 sale of the company’s chip business to GlobalFoundries.

IFI Claims’ data also looks at the number of U.S. granted patents based on the assignee’s country of origin. Unsurprisingly, the data shows that the United States has a large lead in this field, as the patent assignee’s home country for 164,379 U.S. patents issued during 2020. However, this was less than half of the total number of U.S. patents issued that year (47%) and represented a nearly 1% drop from 2019’s issued patent totals. By contrast, Chinese entities only received 18,792 U.S. patents during 2020, but that total represented an 11.3% increase over 2019’s issued patents. Taiwanese entities also saw a 5.1% increase to 11,286 total issued patents during 2020. A major gulf remains between the U.S. and fourth-place China, however, between which are Japan (52,421 issued patents) and South Korea (22,400 issued patents).

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.