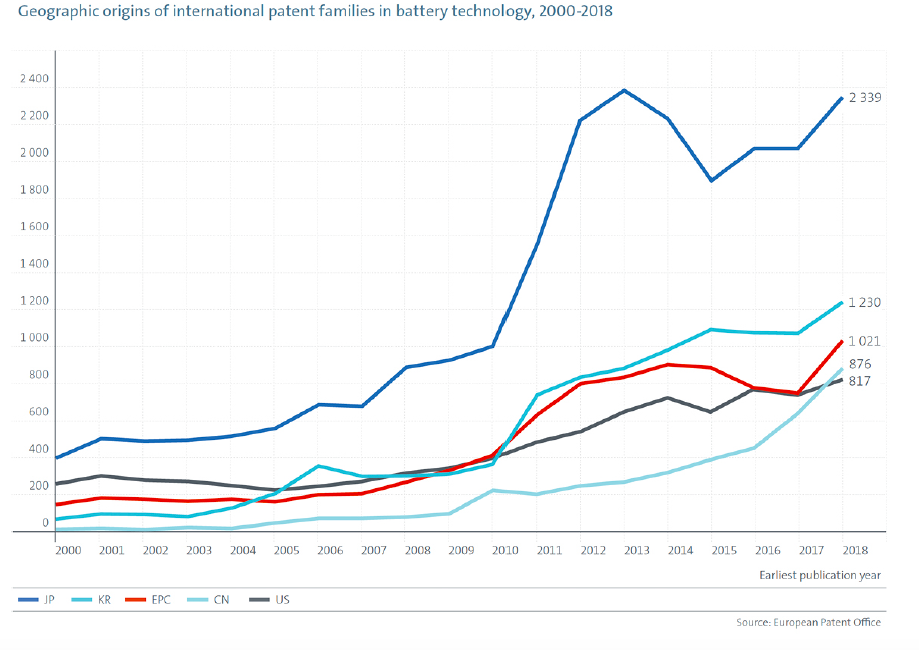

“The United States is lagging behind Japan, South Korea, Europe and China in its overall number of international patents in battery technology but is strong in emerging and next-generation batteries.”

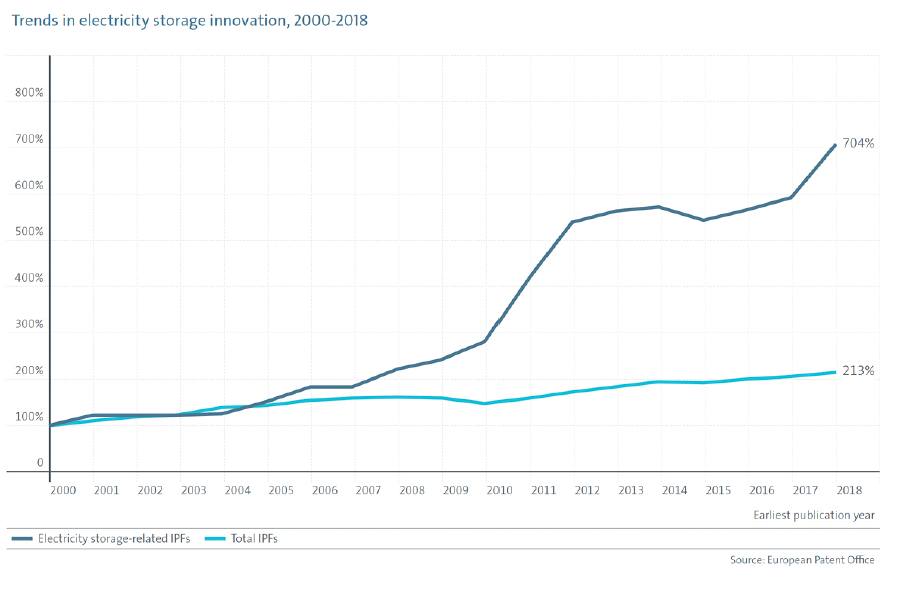

On Tuesday, the European Patent Office (EPO) and the International Energy Agency (IEA) released a joint study titled “Innovation in batteries and electricity storage – a global analysis based on patent data.” The study revealed that patenting activity in batteries and other electricity storage technologies grew four times faster than the average for all technology fields over the past decade, but that “energy storage… is currently not on track to achieve the levels called for in the [IEA’s] Sustainable Development Scenario, both in terms of its deployment and its performance.”

On Tuesday, the European Patent Office (EPO) and the International Energy Agency (IEA) released a joint study titled “Innovation in batteries and electricity storage – a global analysis based on patent data.” The study revealed that patenting activity in batteries and other electricity storage technologies grew four times faster than the average for all technology fields over the past decade, but that “energy storage… is currently not on track to achieve the levels called for in the [IEA’s] Sustainable Development Scenario, both in terms of its deployment and its performance.”

The study also noted that the United States is lagging behind Japan, South Korea, Europe and China in its overall number of international patents in battery technology but is strong in emerging and next-generation batteries. For example, the United States is the clear leader with 36% of related international patent families in NCA (lithium nickel cobalt aluminum oxide) chemistry, which is used for Li-ion batteries.

In explaining the purpose of the study, the EPO and IEA noted that “[b]etter batteries and other energy storage technologies can open up opportunities to replace unabated fossil fuels in a variety of end-use applications and integrate more renewable energy into the energy system.”

Overview of International Patent Families in Electricity Storage

More than 7,000 international patent families (IPFs) related to electricity storage were published in 2018 and there has been an annual growth rate of 14% from 2005 until 2018, compared to 3.5% on average for all technology areas. In order to be considered an IPF for the study, a patent application must have been filed at two or more patent offices. The study noted that the increase “reflects in small part the use of batteries in an ever-expanding array of personal devices and tools, but the findings of this report point to a much larger driver in recent years: clean energy technologies, in particular electric mobility.” Electrochemical inventions such as batteries account for 88% of all patenting activity in the area of electricity storage. Patenting in the area of battery technology has increased in most key technology variants, including lead acid, redox flow, nickel and Li-ion technology. The study noted that Li-ion is the dominant technology for portable electronics and electric vehicles and, in 2018, innovation in Li-ion cells accounted for 45% of patenting activity related to battery cells.

While the automotive application area has dominated the inventive activity for electric storage over the last decade, other application areas, such as battery packs for all-electric and plug-in hybrid cars, also benefit from technical developments, said the study. Li-ion is the dominant battery for these other technology areas as well.

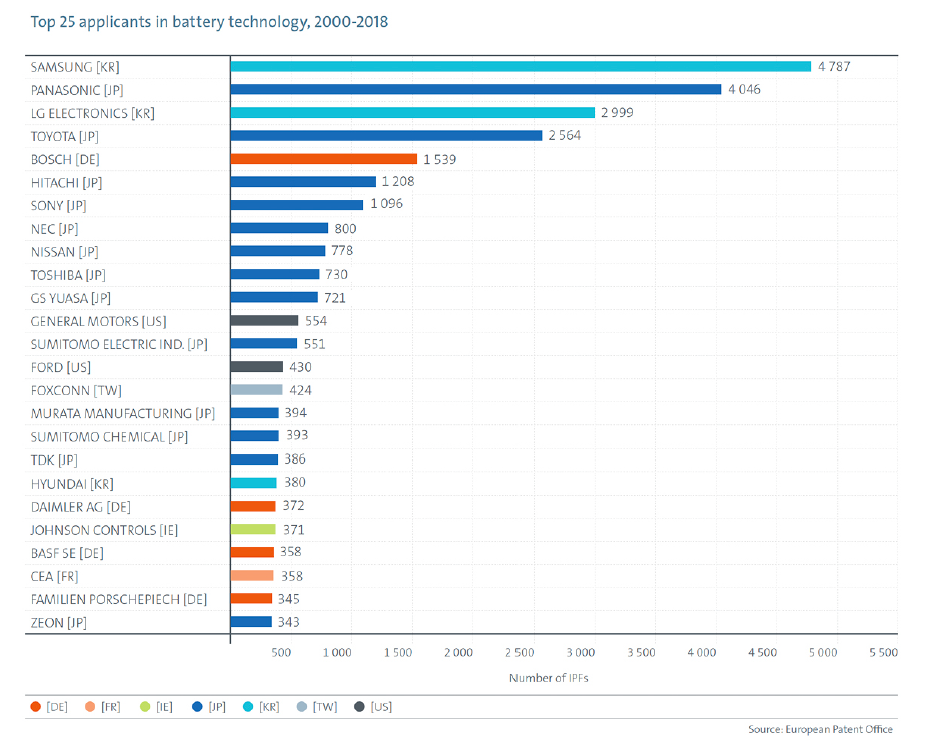

Top Applicants in Battery Technology

The study noted that the top applicants are primarily Asian companies, with Japanese companies at the forefront. The top 25 applicants include 13 Japanese companies (including Panasonic and Toyota), three Korean companies (Samsung, LG and Hyundai), Foxconn from Chinese Taipei, four German companies (Bosch, Daimler AG, BASF and Volkswagen), two U.S. companies (Ford and General Motors), the French Alternative Energies and Atomic Energy Commission (CEA) and Ireland-based Johnson Controls. The study noted that the top 25 applicants combined have accounted for 47% of all IPFs related to batteries since 2000, but “innovation in battery technology is still mainly concentrated within a limited group of very large companies.”

Developments in Li-ion Batteries

The increase in innovative activity in Li-ion technology was responsible for 40% of all IPFs in battery technologies between 2000 and 2018. Since “smartphones, power tools, electric cars and utility-scale stationary batteries have different requirements and tolerances for energy and power density, durability, material costs, sensitivity and stability… their theoretical limits are defined by the core components – the battery electrodes and electrolyte – through which electricity is stored and conducted.”

Noting that the increase in patent rates for Li-ion technology coincides with falling prices, the report explained that Li-ion prices for electric vehicles have decreased by almost 90% since 2010, and have dropped by about two-thirds for stationary applications, such as electricity grid management. According to the report, the cost reductions are at least partially due to new chemistries and economies of scale in manufacturing. The patent statistics noted in the study also demonstrated that innovative manufacturing practices have played a key role in lowering prices. For example, the patenting activity related to the manufacturing of battery cells and cell-related engineering developments has grown threefold over the last decade.

The study analyzed the geographic origins of IPFs in established electrode materials and revealed that Japan is dominant in the areas of the cathode materials NMC (47%), LMO (51%) and LTO (50%), but the United States is the leader for NCA (36%). Further, in solid-state Li-ion battery IPFs U.S. companies rank 2nd behind Japan, holding an 18% share. With respect to Redox flow batteries, the study revealed that the United States is the leading innovation center and accounts for about one-third of all IPFs in that field.

An EPO press release emphasized the critical role of battery technology in tackling the climate crisis.

“Electricity storage technology is critical when it comes to meeting the demand for electric mobility and achieving the shift towards renewable energy that is needed if we are to mitigate climate change,” said EPO President António Campinos. “The patent data reveals that while Asia has a strong lead in this strategic industry, the U.S. and Europe can count on a rich innovation ecosystem, including a large number of SMEs and research institutions, to help them stay in the race for the next generation of batteries.”

IEA Executive Director Fatih Birol added that “IEA projections make it clear that energy storage will need to grow exponentially in the coming decades to enable the world to meet international climate and sustainable energy goals” and that “accelerated innovation will be essential for achieving that growth.”

Editor’s note: An earlier version of this article incorrectly listed Porsche as one of the top 25 applicants in battery technology, rather than Volkswagen.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

3 comments so far.

pump and dump COUV

December 30, 2020 12:11 amThey (almost) did it already at least once, with NKLA

Donald Walter, Ph.D.

September 24, 2020 12:49 pmWhere can I get more information about the methodology that they used?

Thanks!

MaxDrei

September 23, 2020 08:43 amNo mention of Tesla. I read today that Elon Musk will be going into production in the coming three years with revolutionary battery technology. His “giga-factory” outside Berlin is already half-built, in record time. How many patents has he got then? Could it be that “quality” of each Tesla patent in battery technology counts more than the “quantity” of patents in the portfolio?

In which case, it might not be quite so serious for the USA, that only two out of the Top 25 List are American companies.