“Weakening patent protection for drugs will do little to remediate our nation’s healthcare spending woes [but] will certainly have devastating effects on U.S. innovation and the long-term availability of curative and life-saving drugs for Americans.”

Healthcare costs in the United States continue to rise, placing an ever-increasing burden on patients and government payer programs. Popular discourse blames patented drugs as the culprit for these rising costs. In a move that previously would have been unthinkable, policymakers have even called upon the Department of Health and Human Services to exercise a mechanism known as Bayh-Dole “march-in” rights, to break the patents on drugs that the private sector has spent billions developing, in order to lower their prices.

Healthcare costs in the United States continue to rise, placing an ever-increasing burden on patients and government payer programs. Popular discourse blames patented drugs as the culprit for these rising costs. In a move that previously would have been unthinkable, policymakers have even called upon the Department of Health and Human Services to exercise a mechanism known as Bayh-Dole “march-in” rights, to break the patents on drugs that the private sector has spent billions developing, in order to lower their prices.

But this fixation on patents as a major driver of America’s medical spend is misplaced. Recently released government data show that patented drug spending makes up a small percentage of healthcare costs. Weakening patent protection for drugs will do little to remediate our nation’s healthcare spending woes. However, doing so will certainly have devastating effects on U.S. innovation and the long-term availability of curative and life-saving drugs for Americans.

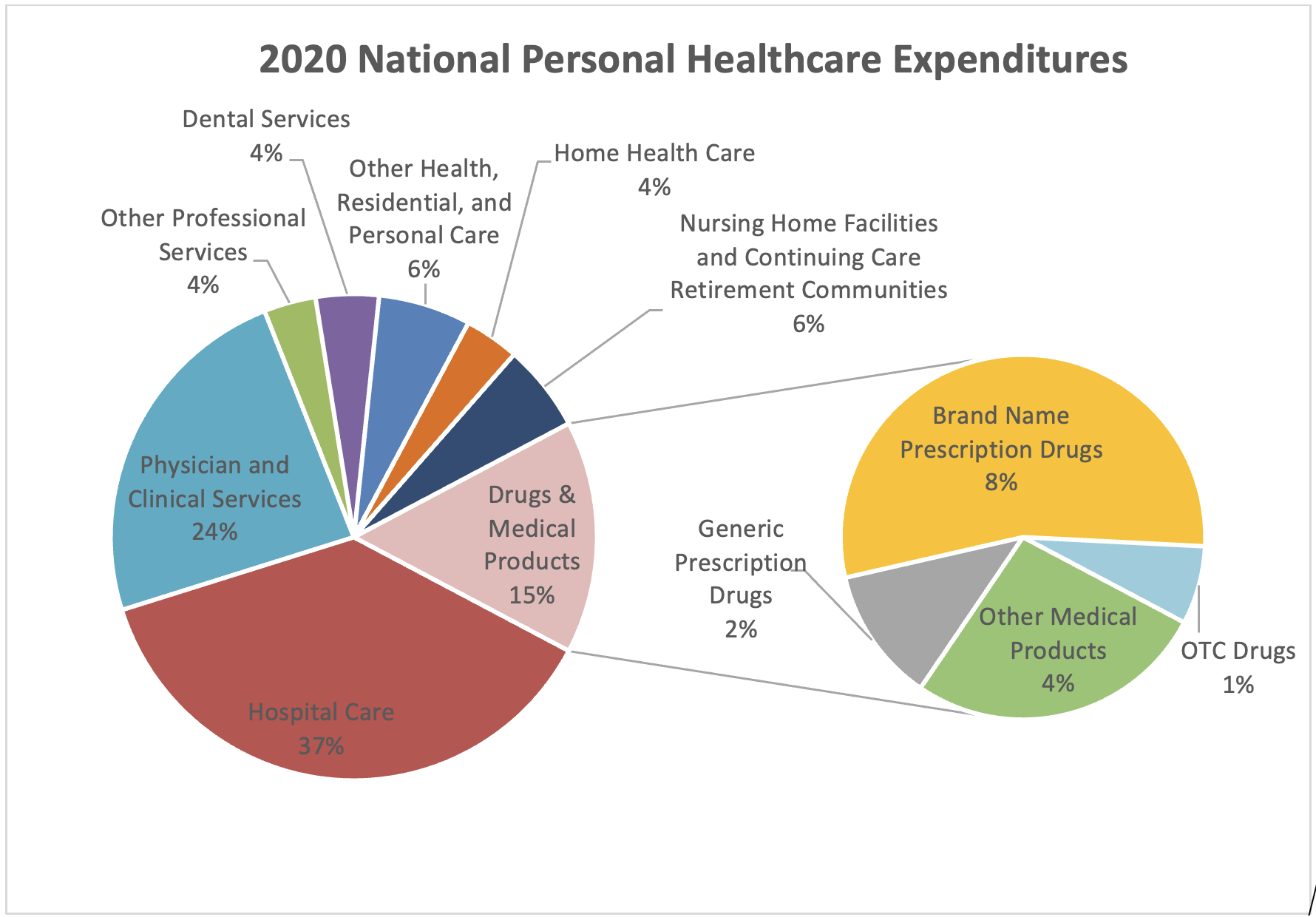

Figure 1: 2020 National Healthcare Expenditures.*

In 2020, annual national health expenditures on personal healthcare exceeded $3.35 trillion. The highest spending area within personal healthcare was hospital care, at nearly $1.27 trillion, followed by physician and clinical services, at $809 billion. (Centers for Medicare and Medicaid Services (2020)). By comparison, expenditures on all prescription drugs (patented and generic) and other medical products accounted for only about 15%of spending. U.S. spending on prescription drugs and medical goods as a percentage of total healthcare spending is less than that of Organisation for Economic Co-operation and Development (OECD) countries that are similarly large and wealthy. Of the 15%attributable to prescription drugs and medical products, patent-protected prescription drugs make up an even smaller slice. Generics (drugs created after brand-name patent rights expire), together with over-the-counter drugs and other medical products, account for nearly half of this 15% slice (Trish (May 2022), Consumer Healthcare Products Association (2020)). That leaves just 8% of healthcare costs attributable to brand-name drugs protected by patents. 8% is a fraction comparable to the other single-digit slices of our nation’s overall healthcare spend that receive far less attention from policymakers; and it does just about as little to move the affordability needle.

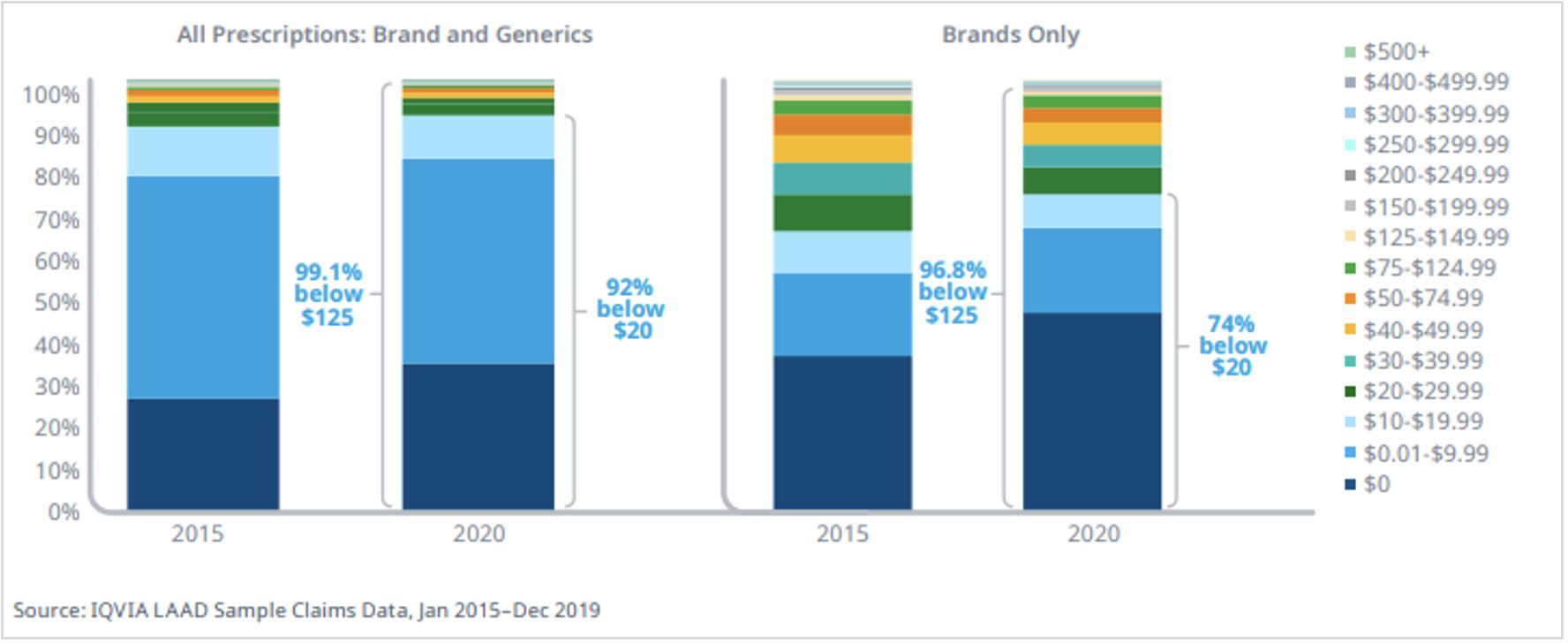

Concerns over patent-protected drugs driving healthcare spend also reflect a misconception that prescription drug use is predominantly driven by patented drugs. The opposite is much closer to the truth. Generic drugs are used extensively and represent 90% of all prescriptions. In many therapy areas, nearly all dispensed drugs are generics. And over 92% of prescriptions—including those for patented drugs—have a final out-of-pocket cost below $20 per month; only 0.9% cost above $120 per month out-of-pocket. In total dollars, the United States spends about $1,127 per capita on prescription drugs annually, and only about $164 of that is out-of-pocket. Clearly, the affordability of medicines for the large majority of patients is not significantly driven by patent rights.

Figure 2: Distribution of Prescriptions by Out-of-Pocket Cost in 2020, All Channels, published by the IQVIA Institute.

Figure 2: Distribution of Prescriptions by Out-of-Pocket Cost in 2020, All Channels, published by the IQVIA Institute.

Even as to those few patented drugs having what some view to be “high prices,” there are legitimate mitigating factors that must be taken into account. First there is the rising number of specialty and rare disease drugs whose development costs must be spread across a small number of patients. Newer drugs are also more likely to be biologics, which are more complex and harder to manufacture than previous generations of treatments. Of the 20 drugs generating the highest revenue by dollar in 2020 (cited as reasons to exercise march-in rights in the recent bicameral policy push), nearly two-thirds (13) are prescription biologics (of the 20 drugs listed here, Humira, Ocrevus, Enbrel, Trulicity, Revlimid, Stelara, Rituxan, Eylea, Remicade, Keytruda, Opdivo, Prevnar 13 and Avastin are all prescription biologics). Competition in the biologics space from manufacturers of biosimilar drugs, even after patents for these new drugs expire, comes at higher prices due to the cost and risk in producing biosimilars. For these biologics-based drugs, weakened patent protection would do little to decrease prices. The prices reflect the immense private investments required to develop and manufacture the drugs, as well as to run the clinical trials mandated for Food and Drug Administration (FDA) approval.

From a long-term systemic perspective, innovative drugs actually reduce overall healthcare spending. For example, new curative drugs for Hepatitis C represent a modest upfront cost when compared to the $577,000 average cost of a liver transplant, not to mention that curative drugs are much less prone to complications than surgery. New COVID-19 drug treatments can cut hospitalization rates for high-risk patients by up to 88%. With our aging population, unless cures or more effective treatments are found for indications such as heart disease, diabetes and Alzheimer’s disease, our costs for physician and clinical services, hospital care and long-term care relating to these conditions will continue to escalate. Of course, today’s innovative treatments also become tomorrow’s generics. This is another important way the patent system helps to reduce costs over the long term, since generics could not exist without the innovative reference products paving their way.

By comparing the cost of patented prescriptions against the costs of other personal healthcare segments, we can appreciate what a tiny fraction of expenditures are attributable to patent rights. Patented prescription costs make up just a sliver of the pie. Generic drugs already make up the lion’s share of prescriptions, and every patented drug eventually goes generic. Incentives for drug innovation produce much larger savings in other healthcare segments. Diminishing patent rights works to decrease investment and decrease the feeder stock for future low-cost generics. In the end, the greatest tragedy is the treatment that doesn’t reach the marketplace—the price of that treatment is effectively infinite.

Lucille Dai-He also contributed to this article.

Image Source: Deposit Photos

Image ID: 95689176

Author: TpaBMa2

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

7 comments so far.

Model 101

November 23, 2022 11:03 amYour Honor.

Thank you for this insight.

Your dart is spot on target.

Senator Blumenthal needs to read and understand your article for a better understanding of the need for patent rights in all fields of technology.

Sadly, many others in the government need this education as well.

Anon

November 23, 2022 08:20 amLab – another area in which we are in prime agreement.

Thank you for adding some sunlight as I reference below.

Other_anon

November 23, 2022 06:22 amExpiration of a drug patent does not seem to stop pharmaceutical price gouging anymore. Think of the rising cost of insulin and the actions of “pharma bro” Martin Shkreli.

Lab Jedor

November 22, 2022 10:17 pm“For example, new curative drugs for Hepatitis C represent a modest upfront cost when compared to the $577,000 average cost of a liver transplant,…” Modest here is $ 87,000 for a course of Gilead’s Sovaldi.

That is the pharma talking point on this controversial pricing issue.

It would be like comparing the price of a programmable pocket calculator with the original price of ENIAC. If we had maintained that price we would perhaps have 6 smart phones in the whole world.

The history of Gilead’s pricing of Sovaldi, the Hep-C medication for which Gilead charged $84,000, is well documented and described in for instance a Washington Post article, that states:

“The report suggests that the factors Gilead used to set its price were not based on the research and development needed to bring the drug to market, or on the $11.2 billion it paid for Pharmasset, the company that developed Sovaldi. Instead, Gilead executives looked at what previous treatments had cost and the effect of future waves of competition on the revenue it could bring in.”

The plan was to get an outrageous price in a “see-if-it-sticks” strategy with absolutely no relation to actual research/development or even acquisition cost.

The plan was to suck the community out of as much money as possible, before any competition would destroy this fairy-tale opportunity.

Patent protection clearly has helped to secure Gilead’s insane profits. There have been enough willing helpers to prolong this scheme, which has absolutely nothing to do with ploughing back money into innovation or to recoup R&D money (for which Gilead apparently did little R).

I would expect former Director Kappos to be a bit more nuanced in his comments on pricing of pharmaceuticals as it relates to patents.

If we need to defend our patent system based on the insane pricing of Sovaldi we are really defending a lost cause.

Anon

November 22, 2022 06:29 pmLOL – B, I will take that as a compliment, even as I would distance myself from that last administration.

To be clear, I would distance myself even more so from the current administration, which is objectively far worse, in most nearly any category.

B

November 22, 2022 04:05 pm@ Anon “ Put ALL of it into the public light.”

That is soooo last administration thinking!

Anon

November 21, 2022 06:32 pmOne difficulty in coming up with an answer is the level of details hiding in the shadows.

By this I mean that between Big Pharma and the distribution system therein (including both pharmacy and insurance entities), there is FAR TOO MANY unknowns — and this leads to profiteering that – if seen in full sunlight – would have most people deeming such to be usury.

Put ALL of it into the public light.

Mind you, I am not against profiteering (per se), but when the shadows rule, the result is a run-away train running over Joe USA.