“What’s missing in attempts to breathe new life into the flawed petition is that the real victim, if the petition were ever accepted, wouldn’t be multinational drug companies. It would be the entrepreneurial small companies which drive innovation—and our economy.”

As Knowledge Ecology International and its allies await the decision of the National Institutes of Health (NIH) on their latest attempt to misuse the Bayh-Dole Act for the government to set prices on any product based on a federally funded invention, they’re growing more uneasy. And that’s understandable. If you’d bet the house on an ivory tower theory that’s been summarily rejected for the past 18 years every time it’s been trotted out, you’d be uneasy too. They know that if the Biden Administration rejects the pending petition to march in on the prostate cancer drug Xtandi because of its cost, this leaky vessel can’t be credibly refloated again.

As Knowledge Ecology International and its allies await the decision of the National Institutes of Health (NIH) on their latest attempt to misuse the Bayh-Dole Act for the government to set prices on any product based on a federally funded invention, they’re growing more uneasy. And that’s understandable. If you’d bet the house on an ivory tower theory that’s been summarily rejected for the past 18 years every time it’s been trotted out, you’d be uneasy too. They know that if the Biden Administration rejects the pending petition to march in on the prostate cancer drug Xtandi because of its cost, this leaky vessel can’t be credibly refloated again.

Increasing their unease is the fact that their previous Xtandi petition was twice summarily dismissed in the Obama-Biden Administration as not sanctioned under the statute. The fact checker of The Washington Post reviewed their price control theory a few months ago, stating:

In the two decades since march-in was identified as a way to control drug prices, advocates of this approach have struck out every time they have sought to advance it. No administration or court has ever accepted this reasoning. For now, it remains just a theory, not a tool that has ever been used in this way by the federal government.

Ouch!

What’s missing in attempts to breathe new life into the flawed petition is that the real victim, if the petition were ever accepted, wouldn’t be multinational drug companies. It would be the entrepreneurial small companies which drive innovation—and our economy.

We’ve discussed before that the Bayh-Dole Act only allows the government to march in to force an academic institution to issue additional licenses in three specific circumstances: if good faith efforts aren’t being made for commercialization, if the needs of a national emergency or requirements of federal regulations can’t be satisfied by the licensee, or if the licensee violated their pledge to manufacture the resulting product substantially in the United States. That’s it. The government doesn’t have the power to impose “reasonable pricing” on resulting products.

So, what does this have to do with small businesses if the target is expensive drugs? The answer is that if this genie were ever released from the bottle, any product based on a Bayh-Dole invention could be accused of being sold at an “unreasonable price” and the government petitioned to force licensing to competitors. Because this has no basis in the statute, there is no definition of a “reasonable price” in the law. Thus, the agency funding the research would make one up. Of course, this could only be done after the company had invested its time and treasure turning an early-stage academic discovery into a useful product.

Under Bayh-Dole, approximately 70% of academic patent licenses go to small companies. These companies must secure venture funding to operate. What would happen if the Mad Hatter world the critics envision came into being? The Bayh-Dole Coalition (which I lead) held a webinar last week to find out.

Karen Kerrigan, President and CEO of the Small Business and Entrepreneurship Council, summarized the impact very succinctly:

The unraveling of Bayh-Dole, and what that would do from an IP perspective, would just be devastating I think for many of these startup small businesses. The money would definitely go elsewhere.

Entrepreneurs are in competition with other sectors and other entrepreneurs. And so, capital is mobile. It’s cowardly and it’s mobile. It will go to its best use. And for the future of U.S. innovation, particularly where we have a density of brain power and great ideas and great collaboration at the university level, I just think about all the innovations that just would not come to be. And obviously that would impact the U.S. economy, our innovative capacity, our competitiveness.

Peter Falzon is the CEO of Ripple Science, founded on a University of Michigan technology. This is the eighth company he’s founded on Bayh-Dole inventions– seven of them are alive and well, employing thousands of people. Here’s his reaction to the misuse of Bayh-Dole for price control:

It’s just such a very easy answer, as I wouldn’t be able to raise capital, because I wouldn’t be competitive. If I’m encumbered in a way that none of the other companies that are out there vying for the same funding dollars that I’m vying for are, then it’s not a level playing field. So as an entrepreneur, fine, I can continue to be an entrepreneur. I would just choose assets that don’t involve university licenses because they’d be toxic.

John Stanford is the Executive Director of the Incubate Coalition comprised of venture funds for early-stage life science companies. They wrote to Health and Human Services Secretary Becerra urging him to deny the Xtandi petition. Here’s why they felt so strongly about it:

We wanted to send a really clear signal about what this does to the capital market. Karen put it eloquently, we are cowards and that’s because we’re stewards of other people’s money. And we are prepared to shoulder great risk and great burden in terms of entrepreneurial training, but we can’t shoulder price controls…

But a lot of us asked ourselves, “What problem are we trying to solve here?” And it seems what march-in is being used for today is an end run around another debate about our healthcare system, and quite frankly, our broken healthcare payer system. But because no one wants to tackle those critical issues, they’re pushing the easy button and saying, “Well, what if we just march in and take the product?” Because where does it end?

And eventually it means—and the reason we feel so strongly about this is—it means our ruin. That third leg that I described earlier, is no longer certain if you add more risk. We brought seven leading VCs to Washington last September, and this is their phrasing—that investment would fall off a cliff. And that is because we simply cannot stomach price controls in our system. And we feel like we’ve been really clear about that. And instead of having the debates in the light of day, what we hope the Secretary would hear is these march-in petitions based on price have nothing to do with the Bayh-Dole Act, have nothing to do with the true authority for march-in provisions as you laid out, but are an end run around a debate about a broken healthcare system and rising out of pocket costs. And so, it was really frustrating to see this tool being used so inappropriately. And that’s why our community felt very compelled to stand up.

Joy Goswami is the Assistant Director of the Office of Economic Innovation and Partnerships at the University of Delaware. He talked about the potential impact on startup companies:

They’re trying to perfect the product itself. They’re trying to stay focused on critical goals. They’re trying to balance their jobs, university positions and venture funding, finding the right partners, looking for early-stage venture capital. So, they have a lot of moving parts.

And if you then throw in the uncertainty of their prices being micromanaged by somebody like a federal entity, you are again, throwing in another big variable that only would be, in my opinion, of detrimental impact to the commercialization of the technology.

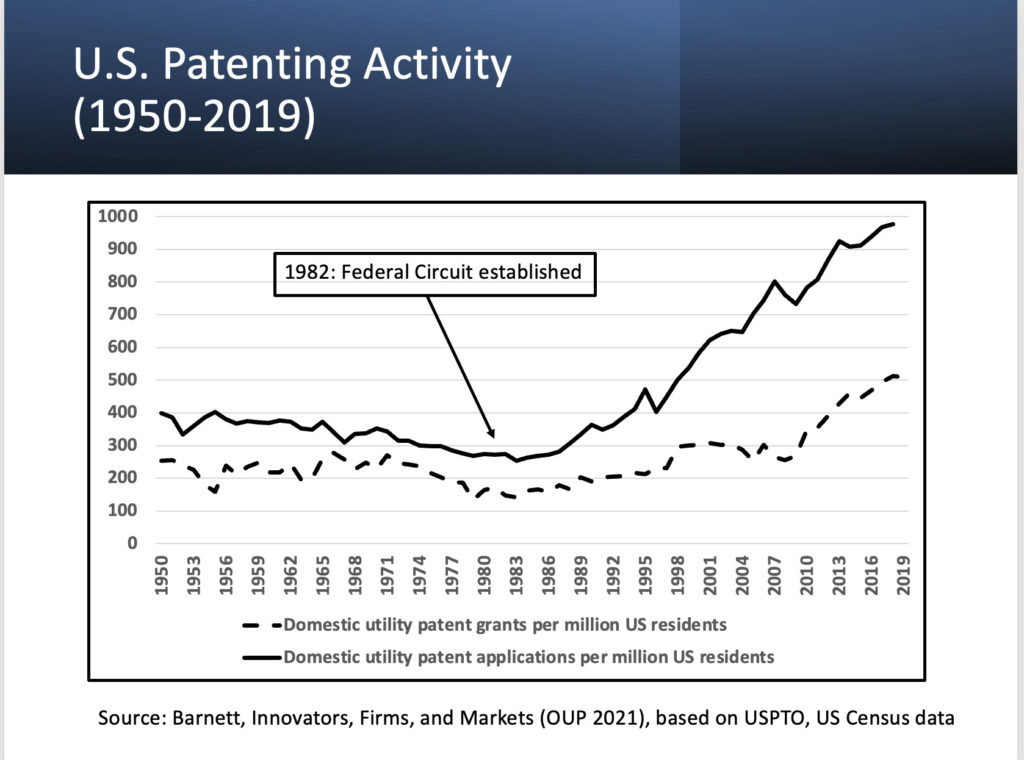

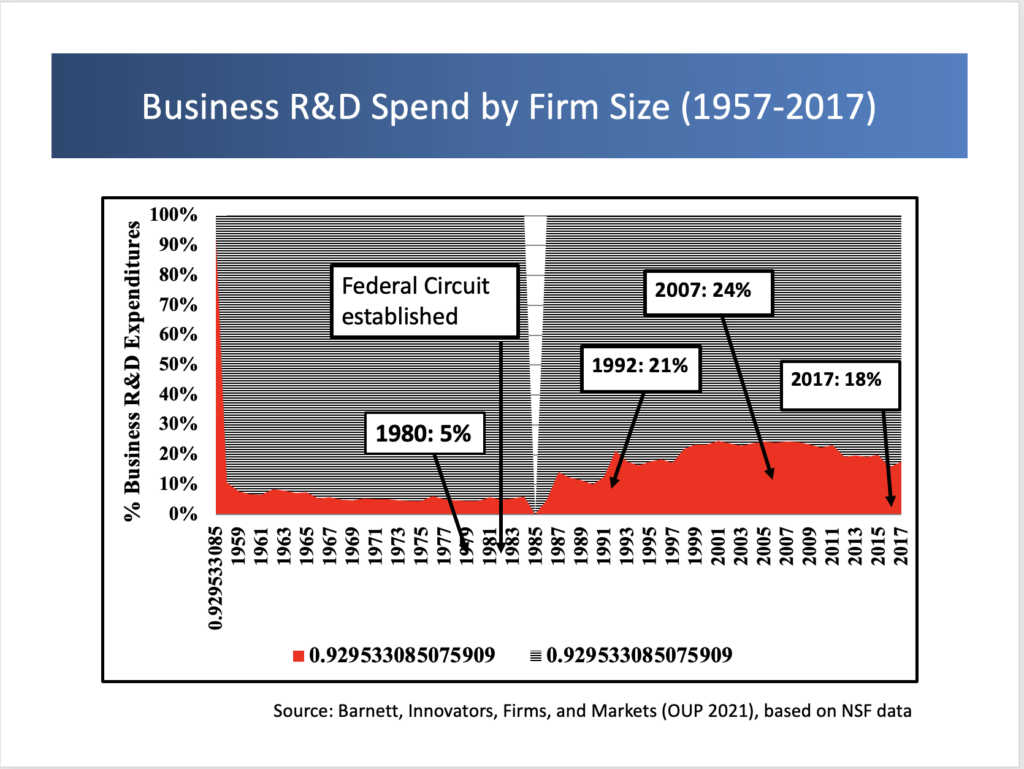

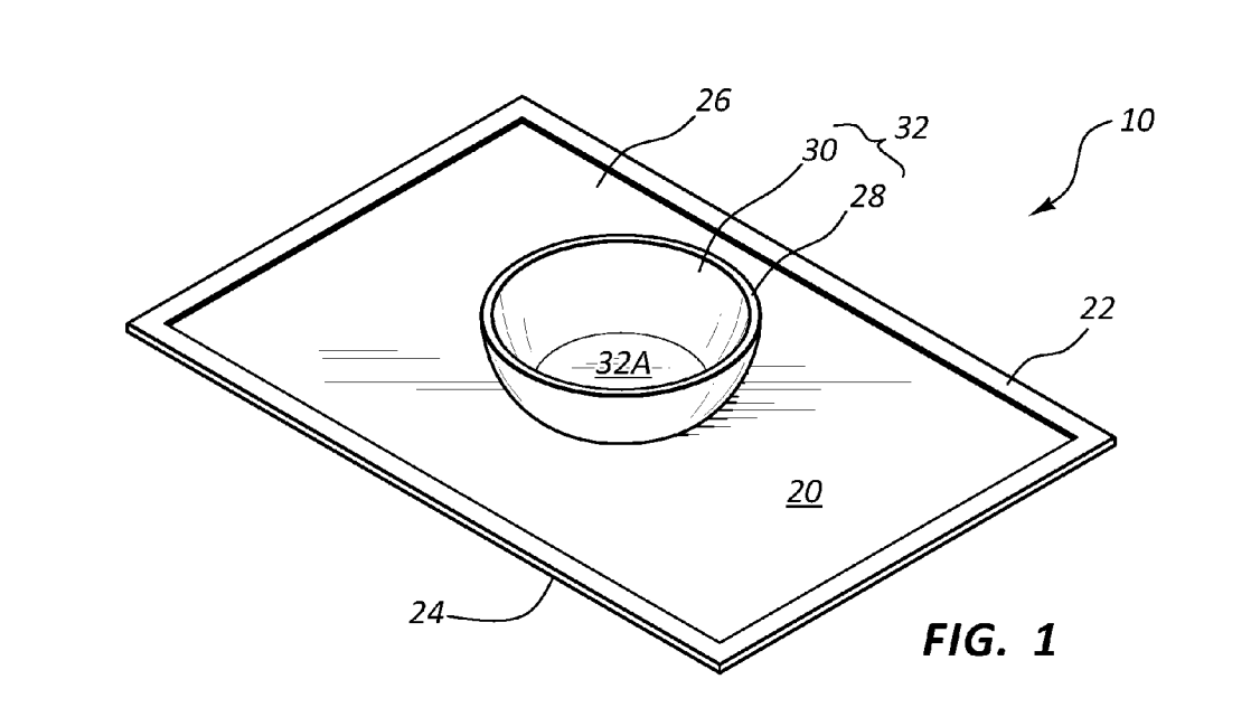

To get an idea of the impact undermining entrepreneurial small businesses would have on a U.S. economy that’s one quarter away from falling into recession while staggering under raging inflation, consider two charts produced by Professor Jonathan Barnett in his insightful book, Big Tech, Patents and the Innovation Economy. It describes how and why our patent system is under attack.

Here’s his chart showing the stagnant state of U.S. patent activity until unleashed by the passage of Bayh-Dole and the creation of the U.S. Court of Appeals for the Federal Circuit (which restored confidence in our patent system):

And this chart shows that small companies increased their share of private sector R&D almost 400% since the enactment of Bayh-Dole in 1980.

Amazingly, even in these tough times, three new spinout companies are formed around academic inventions every day of the year. No other country comes close to that accomplishment.

The bottom line is that misusing march-in rights for price control won’t lower drug costs. But it will cripple American innovation just when we need it most. Let’s hope that message gets through to the Biden Administration.

Image Source: Desposit Photos

Author: zentro

Image ID: 433185826

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/03/IP-Copilot-Apr-16-2024-sidebar-700x500-scaled-1.jpeg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

Anon

May 3, 2022 05:55 pmEquity demands the dagger be used.

Or some such…