The United States’ share of global semiconductor manufacturing capacity has dropped from 37 percent in 1990 down to 12 percent in 2021. Congress now seeks to secure chip supply chains to promote both economic competitiveness as well as U.S. national security.

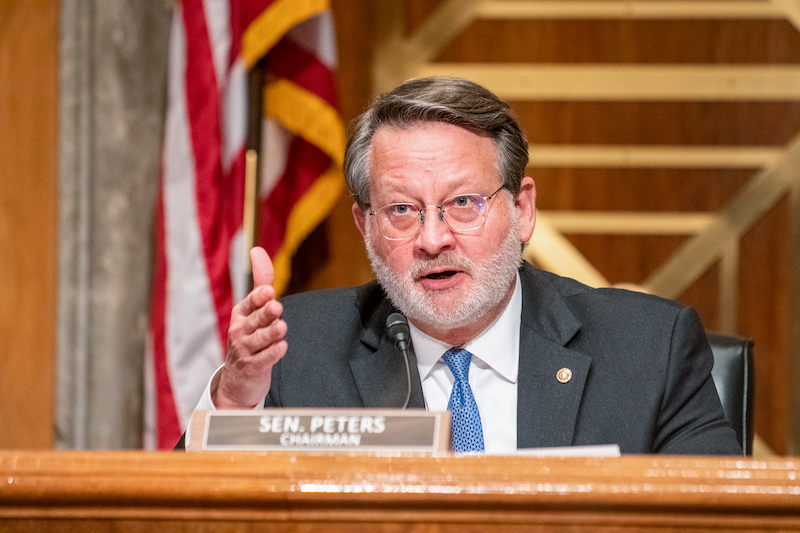

Senator Gary Peters (D-MI). Two of the pending bills have been introduced by Senator Peters. The semiconductor shortage has hit automakers particularly hard, making this an important issue for Senator Peters.

The global chip shortage slowing down production in the automotive and several other industries is causing lawmakers in D.C. to pursue efforts that would reshore semiconductor production and build up U.S. semiconductor fabrication within the United States. According to a 2021 report by the Semiconductor Industry Association on the state of the U.S. semiconductor industry, the United States’ share of global semiconductor manufacturing capacity has greatly decreased, dropping from 37 percent in 1990 down to 12 percent in 2021. This past September, the Biden Administration acknowledged that the global chip shortage could reduce U.S. gross domestic product (GDP) growth by nearly an entire percentage point. Many industry insiders see no quick end to the semiconductor supply chain woes; public remarks by Intel CEO Pat Gelsinger indicate that the global shortage could last through 2023.

Securing supply chain for critical technology areas has been a priority so far during the Biden Administration, whose 100-day review of critical supply chains issued this past June identified the importance of addressing the semiconductor shortage by supporting manufacturing and R&D programs. Currently, there are several bills that have been introduced into Congress that are meant to increase federal funding for semiconductor production and related activities, many of which have an eye towards the importance of securing chip supply chains to promote both economic competitiveness as well as U.S. national security.

What follows is a summary of the bills currently pending in Congress.

CHIPS for America Fund (U.S. Innovation and Competition Act)

After moving through the Senate this summer without much issue, the United States Innovation and Competition Act (USICA) has stalled in the House of Representatives for the past few months. Near the end of November, Commerce Secretary Gina Raimondo made public remarks urging passage of the USICA to address semiconductor supply chain issues that have been shutting down auto production facilities. While the USICA is a sprawling bill designed to support several critical areas of high tech, Secretary Raimondo’s remarks focused on the bill’s provisions to support chip production, specifically the Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Fund.

The CHIPS for America Fund, Section 1002 of the USICA, would set aside more than $50 billion in federal funding to create a trio of funds meant to support semiconductor production by funding various research initiatives that were enacted through Congressional passage of the William M. (Mac) Thornberry National Defense Authorization Act (NDAA) for Fiscal Year 2021 this past January. The bulk of the federal funding would be designated in a CHIPS for America Fund that would provide assistance to covered entities that are both investing in facilities and equipment for semiconductor fabrication, testing or research and development within the U.S. and working to develop workforce training programs. CHIPS for America Fund appropriations would also fund the Thornberry NDAA’s provisions on advanced microelectronics R&D, including the establishment of a National Semiconductor Technology Center.

Under the version of the USICA passed by the Senate, the CHIPS for America Fund would receive $24 billion in fiscal year 2022 to be administered by the Secretary of Commerce. $2 billion of these 2022 appropriations would be used to incentivize investment in semiconductor production at mature technology nodes, a term that the Secretary of Commerce is able to define under relevant provisions within the USICA. Under the USICA, the CHIPS for America Fund would also receive $7 billion in FY 2023, $6.3 billion in FY 2024, $6.1 billion in FY 2025 and $6.8 billion in FY 2026, a total of $50.2 billion in appropriations over the bill’s lifetime.

The USICA would set up another pair of funds related to domestic semiconductor production, including the CHIPS for America Defense Fund. This fund would provide financial assistance for various initiatives specific to the U.S. Department of Defense and the U.S. intelligence community, including Thornberry NDAA provisions directing the Secretary of Defense to establish a national network for microelectronics R&D. The CHIPS for America Defense Fund would receive $400 million annually from FY 2022 to FY 2026 for total appropriations of $2 billion, none of which can be used on facilities construction. Finally, the CHIPS for America International Technology Security and Innovation Fund would receive $100 million annually from FY 2022 to FY 2026, a total of $500 million in appropriations. This fund would be directed by the Secretary of State to secure semiconductor supply chains and support Thornberry NDAA provisions establishing trust funds financing a pair of common funding mechanisms in coordination with foreign partners, one supporting the development of secure semiconductors and supply chains, and another supporting the development of secure and trusted telecommunications technologies.

Investing in Domestic Semiconductor Manufacturing Act

On December 8, Senators Gary Peters (D-MI), Rob Portman (R-OH), Marsha Blackburn (R-TN) and Mark Kelly (D-AZ) introduced S. 3331, the Investing in Domestic Semiconductor Manufacturing Act, in the Senate. This short, proposed piece of legislation would amend the language of certain provisions within the Thornberry NDAA to expand eligibility for CHIPS for America Fund financial assistance beyond entities involved in semiconductor fabrication, assembly, testing or R&D to firms that are involved with materials used to manufacture semiconductors or semiconductor manufacturing equipment. “By incentivizing those who produce essential materials and equipment, we can create more opportunity for manufacturers in Michigan and across the country — as well as strengthen the supply chain that supports domestic semiconductor manufacturing,” said Sen. Peters in a press release announcing the introduction of the bill.

Securing Semiconductor Supply Chains Act

On December 2, Senator Peters and Blackburn, along with Sen. Rick Scott (R-FL), also introduced S. 3309, the Securing Semiconductor Supply Chains Act, into the Senate. If enacted, the bill would direct the SelectUSA initiative of the Department of Commerce’s International Trade Administration to coordinate with state-level economic development organizations to increase foreign direct investment into semiconductor-related manufacturing and production. Within 180 days of the bill’s enactment, SelectUSA’s Executive Director would be required to solicit comments from state-level organizations to review opportunities for attracting foreign direct investment, barriers to such investments, resource gaps and efforts the federal government can take in support of increasing foreign investment into semiconductor production. Based on those comments, SelectUSA would then develop recommendations for increasing foreign direct investment either on its own or by cooperating with foreign investing entities.

Within two years of the passage of this bill, the Executive Director of SelectUSA would also be required to produce a report in coordination with the Federal Interagency Investment Working Group to be submitted to Commerce Committees in both the House of Representatives and the Senate. The report would include a review of comments received by SelectUSA from state-level organizations, a description of activities undertaken to increase foreign direct investment, and strategies for increasing investment and securing semiconductor supply chains that can be implemented in cooperation with relevant federal and state-level agencies. On December 17, the bill was reported by Senator Maria Cantwell (D-WA), Chair of the Senate Commerce Committee, with an amendment that requires SelectUSA to ensure that governments defined as foreign adversaries under provisions of the Secure and Trusted Communications Act of 2019 do not benefit from U.S. efforts to increase foreign direct investment into semiconductors.

Microelectronics Research for Energy Innovation Act (Micro Act)

This bill, which would provide for a comprehensive and integrated program to accelerate microelectronics R&D at the Department of Energy, was introduced into the House of Representatives by Reps. Paul Tonko (D-NY) and Jake Ellzey (R-TX). The Microelectronics Research for Energy Innovation Act, also referred to as the Micro Act, would direct the Secretary of Energy to creating a research, development and demonstration (RD&D) program to improve the country’s global competitiveness in microelectronics. The Energy Secretary would be authorized to provide financial assistance to carry out research projects in: foundational science areas such as materials sciences, novel microelectronic devices and component integration; methods to leverage artificial intelligence for enhancing microelectronics design; fabrication and processing science associated with microelectronics manufacturing including lithography, surface deposition and etching; approaches for optimizing system-level computing energy efficiency in energy infrastructure; approaches for enhancing the durability of radiation-hardened electronics; and enhancement of microelectronics security for severe weather environments and national security.

Among the entities that would be eligible for microelectronics RD&D funding under this bill are institutions of higher education, nonprofit research agencies, state research agencies, national laboratories, private commercial entities, a consortium of such entities or any other entity the Energy Secretary deems appropriate. The Energy Secretary would also be directed to support tech transfer of microelectronics technologies developed through the research program, support educational outreach initiatives to promote public understanding of microelectronics, and provide a report to the Commerce Committees of the Senate and House on goals and priorities of the research program within 180 days of the bill’s enactment. The bill would provide the Energy Secretary with $75 million to carry out research activities during FY 2022 and an additional $100 million in each of the four following fiscal years for a total appropriation of $475 million.

The bill would also direct the Energy Secretary to establish up to four Microelectronics Science Research Centers to carry out RD&D activities in several areas such as: accelerating the development of new microelectronics science; advancing device sustainability and energy efficiency; advancing experimental capabilities in surface and materials science; and creating technology testbeds for prototyping platforms and sharing both ideas and intellectual property. Centers would be selected to receive funding for up to five years, and while the enumerated list of eligible applicants only includes national laboratories, higher education institutions and research centers, the Energy Secretary is able to deem appropriate any entity to receive funding as a Microelectronics Science Research Center. Centers selected under this portion of the bill would receive up to $25 million per fiscal year between FY 2022 and FY 2026.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[[Advertisement]]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-banner-early-bird-ends-Apr-21-last-chance-938x313-1.jpeg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.