“Unless competitors can design around Square’s patents, Square could monopolize banking of cryptocurrency in the United States.”

Cryptocurrencies are virtual currencies based on blockchain technology that uses a network of computers to keep a public ledger of past transactions. The most popular cryptocurrency is Bitcoin, which some believe could replace bonds and serve as a reserve currency in the future. The value of Bitcoin has skyrocketed over recent years, as major companies are buying into it. In February 2021, Tesla Inc. bought $1.5 billion worth of Bitcoin and announced plans to start accepting the currency as payment for its electric vehicles. Since Bitcoin has the potential to be used directly in commercial transactions, fintech companies are developing and patenting related technologies.

Cryptocurrencies are virtual currencies based on blockchain technology that uses a network of computers to keep a public ledger of past transactions. The most popular cryptocurrency is Bitcoin, which some believe could replace bonds and serve as a reserve currency in the future. The value of Bitcoin has skyrocketed over recent years, as major companies are buying into it. In February 2021, Tesla Inc. bought $1.5 billion worth of Bitcoin and announced plans to start accepting the currency as payment for its electric vehicles. Since Bitcoin has the potential to be used directly in commercial transactions, fintech companies are developing and patenting related technologies.

The Eligibility Trap

One of the challenges of patenting transactions using cryptocurrency is that the subject matter is likely directed to one of the judicial exceptions (i.e., abstract ideas) that are not patent eligible. Moreover, the subject matter likely falls within one of USPTO’s enumerated groupings of abstract ideas, i.e., “certain methods of organizing human activity” (e.g., commercial interactions). To be patent eligible, the claims would need to include additional limitations that either integrate the abstract idea into a practical application or add significantly more to the judicial exception.

Square Inc. and PayPal Holdings, Inc. are the two U.S. fintech leaders that are currently offering Bitcoin buying and selling services. Their U.S. patent portfolios include patents related to commercial transactions using cryptocurrency that have successfully overcome patent subject matter eligibility hurdles at the USPTO. A review of these patents could offer insight on future developments in the fintech industry and on patenting blockchain related technology in the cryptocurrency space.

1. Square Inc.

Square is known for its mobile reader device that can turn a smart phone into a credit card reader. Square’s Cash App is the second largest peer-to-peer payment application and digital wallet in the U.S. and began supporting buying and selling Bitcoin as early as 2017. Square bought $50 million worth of Bitcoin in October 2020, and another $170 million in February 2021 as part of its ongoing commitment to Bitcoin. In March 2021, Square begins banking operations through its subsidiary Square Financial Services, including offering business loans and deposit products. Square could one day become a “bank of cryptocurrency” enabling commercial transactions in cryptocurrency, as described in its patents on “Cryptocurrency Payment Network.”

Square’s “Cryptocurrency Payment Network” patent family aims to eliminate at least two major barriers to using cryptocurrencies in commercial transactions. Currently, cryptocurrencies are not accepted by most retail or online merchants, partially because cryptocurrency exchange rates with fiat currencies fluctuate widely, posing financial risk to business owners. In Square’s patents, this problem is solved by allowing customers to pay in cryptocurrency and merchants to receive fiat currency (e.g., U.S. dollars). Another issue associated with using cryptocurrency is the long transaction time. For example, Bitcoin transactions take 10 minutes on average, which makes its use impractical for many commercial transactions (e.g., buying a cup of coffee). In Square’s patents, the speed of transaction can be increased to real time.

In Square’s patents, a payment service is used to bypass a cryptocurrency’s public ledger at least temporarily. The payment service is essentially a “bank of cryptocurrency”, i.e., a middleman between the merchant, buyer, and cryptocurrency network. The payment service has its own cryptocurrency account and fiat currency account. Like a bank, the payment service also maintains accounts for buyers and merchants, including both cryptocurrency accounts and fiat currency accounts. The transactions between accounts owned or managed by the payment service can be performed in real time, including between cryptocurrency accounts. Time-consuming updates to the cryptocurrency’s public ledger can be performed at a later time.

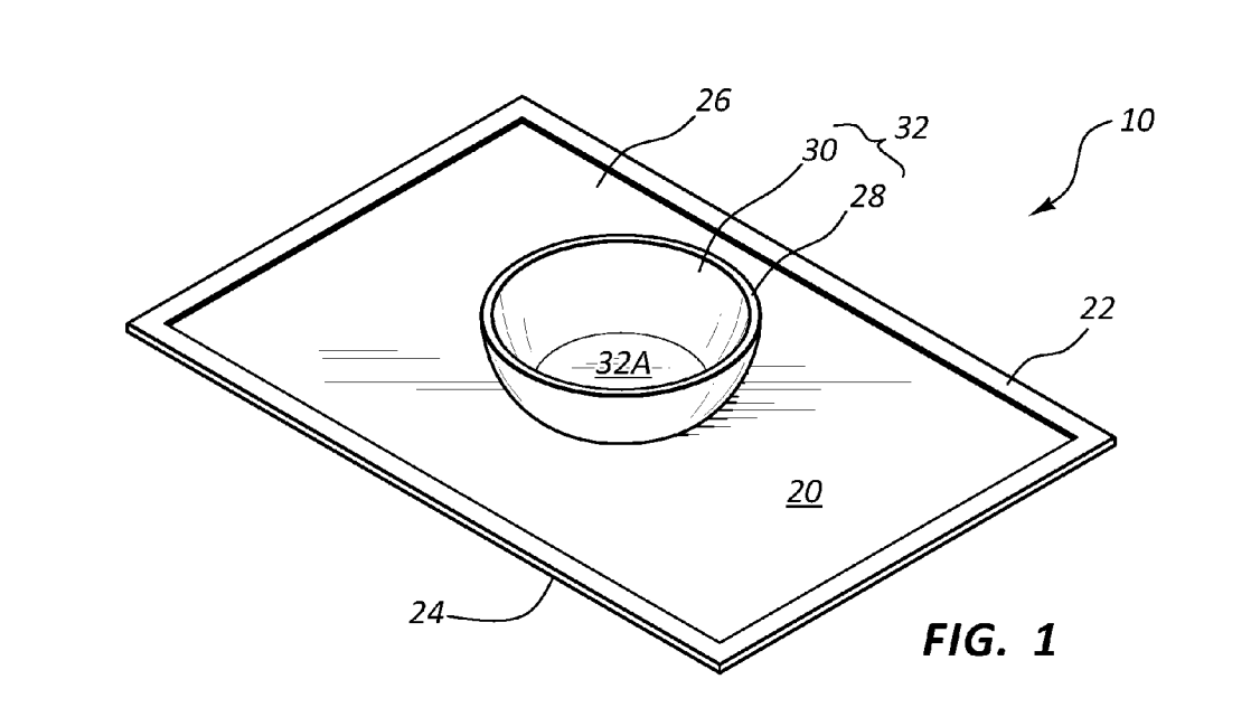

Square currently holds four patents in this patent family (10,055,715; 10,163,079; 10,108,938; and 10,540,639) and has a continuation application pending (16/686,053). Patent No.10,055,715 claims a payment service that enables a customer to pay a merchant using cryptocurrency (e.g., Bitcoin), while the merchant receives fiat currency (e.g., U.S. dollars). The merchant can always receive the amount of fiat currency specified by the merchant, without worrying about cryptocurrency’s fluctuation in value. The payment value in cryptocurrency can be calculated based on the exchange rate between the cryptocurrency and the fiat currency at the time of transaction.

The examiner in Patent No.10,055,715 initially believed that the claims were not patent eligible because they are directed to an abstract idea of settling a financial transaction using generic computer functions. However, in the Notice of Allowance, the examiner pointed to the specification that discloses that “the payment service described herein can facilitate real-time (or substantially real-time) transactions, allowing a customer to pay in any currency of their choice, while the merchant can receive payment in a currency of their choice. In some embodiments, the payment service can eliminate barriers to transactions common when using non-fiat currencies, while maintaining the benefits of transacting in those non-fiat currencies….” Although no specific reason was provided by the examiner, the underlying reason for allowance appears to be that the disclosed technology improves computer/blockchain technology (e.g., making transactions faster).

Other patents in the patent family are not patentably distinct from Patent No. 10,055,715. Patent No. 10,108,938 adds that the customer is first presented with two payment options, a fiat currency payment option and cryptocurrency payment option, and then selects the cryptocurrency payment option. Patent No. 10,163,079 more broadly claims a cryptocurrency transaction system having a payment service that can transfer cryptocurrency owned by a user to another entity via the cryptocurrency transaction system instead of interfacing with the cryptocurrency source system. Patent No. 10,540,639 claims a method of settling a transaction where a payment service receives a payment request in a fiat currency from a merchant, identifies an indication that a buyer intends to satisfy the payment request using cryptocurrency, transfers cryptocurrency from the buyer’s account to the payment service’s account, and transfers fiat currency from the payment service’s account to the merchant’s account.

In addition, Square has several patents related to payment technology, including “Mobile Reader Device” (9,256,769 and 9,460,322), “Payment Via A Messaging Application” (9,595,031 and 10,552,808), “Payment Without Account Creation” (9,773,232), “Invitation Management Based on Existing Contacts” (9,892,400), and “Contacts for Misdirected Payments and User Authentication” (10,810,569). Although these patents do not recite cryptocurrency, they contemplate that the payments and transactions can be in cryptocurrency, such as Bitcoin. Square also holds two patents (10,594,487 and 10,666,442) on “Password Management and Verification with A Blockchain.”

2. PayPal Holdings, Inc.

PayPal’s Venmo is the largest peer-to-peer payment application and digital wallet in the United States. PayPal enabled its customers to buy, hold and sell Bitcoin from their PayPal account in October 2020. PayPal announced on March 30, 2021, that it has started allowing U.S. users to check out using cryptocurrency online. PayPal filed about two dozen patent applications related to blockchain technology between 2017 and 2020. It holds at least two patents directly related to improving cryptocurrency transactions, including providing dispute resolution and risk assessment.

Unlike credit card transactions that can be disputed through the credit card issuer, there is no way to reverse a transfer of cryptocurrency on a blockchain through dispute resolution. Patent No. 10,789,589 “Dispute Resolution Cryptocurrency Sidechain System” provides a dispute resolution system that utilizes a sidechain (e.g., a secondary blockchain) for performing dispute resolution for transactions in cryptocurrency occurring on a primary blockchain. Specifically, a buyer can dispute a transaction by sending the transaction amount to a designated primary blockchain public address, which suspends the transaction on the primary blockchain and allocates a sidechain public address on the sidechain. If the dispute is resolved, the buyer may sign a transaction involving the sidechain public address with a private key, which causes the transaction amount of the cryptocurrency to be sent from the designated primary blockchain public address to a primary blockchain public address controlled by the merchant, completing the transaction. The sidechain public address can also be used to receive dispute communications or have a system provider determine a dispute resolution.

The claims were initially rejected on subject matter eligibility grounds because dispute resolution is an abstract idea. Implementing the abstract idea on a computer does not integrate the abstract idea into a practical application because it requires no more than a computer performing functions that correspond to acts required to carry out the abstract idea. However, the allowed claims recite additional elements, including generating a smart contract, generating a sidechain address on a dispute resolution sidechain ledger based on a public key of a public/private key pair, and using the smart contract to carry out most of the functions (e.g., monitoring the sidechain address, detecting a communication having the payer’s digital signature, and broadcasting the dispute transaction to a network). These additional elements appear to integrate the abstract idea into a practical application and/or add significantly more such that the claims are allowable.

Another issue related to cryptocurrency transaction is the lack of mechanism to gauge the risks involved in transacting with the other party. Without a conventional payment service provider (e.g., a bank or credit card issuer) serving as an intermediary, a party to a cryptocurrency transaction is often forced to transact “blindly” with parties that may be unknown or have unknown histories. In Patent No. 10,853,811 “Risk Determination Enabled Crypto Currency Transaction System,” a buyer may choose to enable risk determinations in a cryptocurrency transaction by using a wallet application that includes a request for a risk determination before the transaction can proceed. In response to the risk determination request, computing devices on a distributed network that maintain a cryptocurrency public ledger can identify risk information about the seller by accessing an external risk information database. If the risk information satisfies the risk criteria specified by the buyer, the cryptocurrency transaction is added to a block in the cryptocurrency public ledger so that the transaction can be completed.

The prosecution history of this patent has a similar pattern to that of Patent No. 10,789,589. To overcome subject matter eligibility rejections, the allowed claims recite additional elements, including generating a block using two cryptocurrency transactions, writing the block to a cryptocurrency public ledger, and broadcasting the block to a network.

Potential for Monopoly

Square’s “Cryptocurrency Payment Network” patents appear to have solved critical issues related to transactions using cryptocurrency (e.g., slow transaction speed and value fluctuation). PayPal’s patents directly related to cryptocurrency translations tend to focus on more nuanced issues (e.g., dispute resolution and risk assessment). Unless competitors can design around Square’s patents, Square could monopolize banking of cryptocurrency in the United States. Since PayPal will likely be the first to launch crypto checkout service, it will be interesting to see whether PayPal’s checkout service infringes Square’s patents.

Avoid the Traps

To overcome subject matter eligibility rejections, patent applications on crypto transactions should focus on improvements to computer/blockchain technology (e.g., making transactions faster, more secure, etc.). Sufficient details should be included in the specification explaining how the improvement is achieved. Specific components or steps that correspond to the improvement should be incorporated into the claims. Reciting novel instructional steps on how to perform a blockchain transaction (e.g., generating a sidechain address on a dispute resolution sidechain ledger, generating a block using two cryptocurrency transactions, etc.) appear to be especially helpful.

Image Source: Deposit Photos

Photography ID:136583164

Copyright:spaxiax

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[[Advertisement]]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-banner-early-bird-ends-Apr-21-last-chance-938x313-1.jpeg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/03/IP-Copilot-Apr-16-2024-sidebar-700x500-scaled-1.jpeg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

4 comments so far.

Raj Paul

June 15, 2021 03:31 pmVery helpful breakdown of the technology and patent eligibility issues. As I see it, Jack Dorsey and Square have assumed a leadership role in trying to prevent monopolies that would otherwise hamper innovation in this burgeoning space, with its Crypto Open Patent Alliance (COPA) initiative. Remains to be seen whether PayPal will join, as far as I can tell.

Shuo Liu

May 25, 2021 02:45 amThank you Jeff for your kind words. While I believe a strong patent portfolio is indicative of a good company, investment decisions should not be made solely based on patents. Also, investment decisions are inherently personal, depending on one’s time horizon, understanding of the market, and risk tolerance and mitigation strategies. I wish you best of luck with your investment decisions.

Jeff Cox

April 17, 2021 01:44 pmSo Dr. Liu, after providing an excellent overview of the difficulty that digital finance systems face in obtaining unassailable patents regarding cryptocurrency banking and exchange (while clearing the murkiness of this subject) would you venture to say which entity you might throw money into?

Regina DeAngelo

April 3, 2021 05:02 pmThis tidily clarifies not only blockchain but the attendant snags patent practitioners face in the murky realm of software patents. Interesting reading.