“In terms of relative changes, the augmented/virtual reality area saw the biggest relative change, with a 22-fold increase from 2007 to 2018.”

This is the tenth in a 13-part series of articles authored by Kilpatrick Townsend that IPWatchdog will be publishing over the coming weeks. The series will examine industry-specific patent trends across 12 key patent-intensive industries.

In part nine of our patent trends study, we discussed the emerging blockchain industry. Today, we turn to artificial intelligence (AI).

To quickly summarize this series:

- The goal of the research was to characterize recent patenting trends and statistics for each of twelve industries (and technology clusters within those industries) to inform applicants’ filing decisions of tomorrow.

- The study was conducted at an industry level (not at an art-unit or class level). This was achieved by designing and implementing various queries and iteratively manually reviewing a large number of search results to refine the queries.

- The study is further unique in that we used proprietary data from recent years and data-science techniques to estimate statistics for recent time periods (which would otherwise have poor data as a result of the non-publication time window).

Artificial intelligence (AI) has become a hot topic in both the tech and political spheres. This technology holds huge widespread potential, and strategic use of AI may well be a source of commercial and/or political power. For example, potential uses of AI may range from facilitating targeted and efficient drug development to controlling traffic lights (and thus reducing pollution and commute times), to developing life-like online personas. With all of the media attention that AI is receiving and with its widespread potential uses, how is a company to decide how fervently to pursue patents in this area and to weight their patent portfolios across different types of AI innovations?

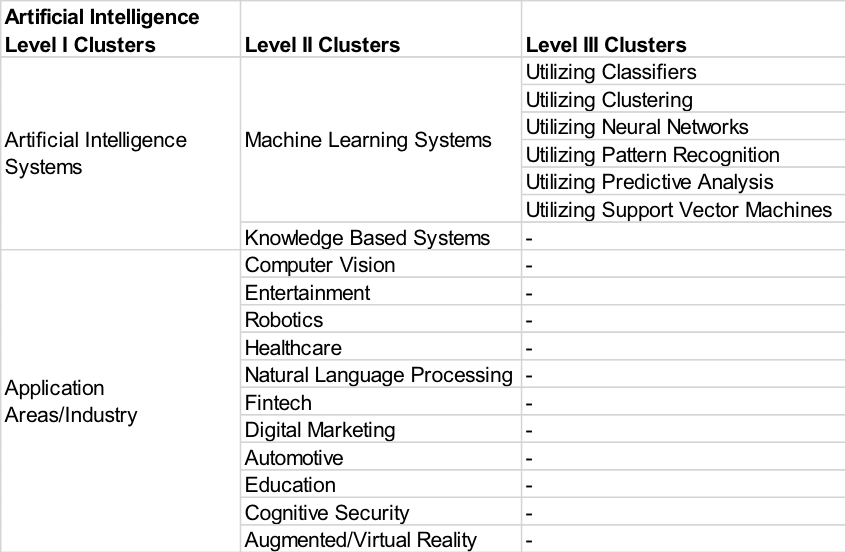

Our study not only identified a set of applications that pertained to this industry, but also—for each application in this set—we determined whether the application pertained to one or more of the categories shown in the topology below. If so, the application was appropriately tagged, such that it could be included in one or more category-specific data subsets for subsequent analysis.

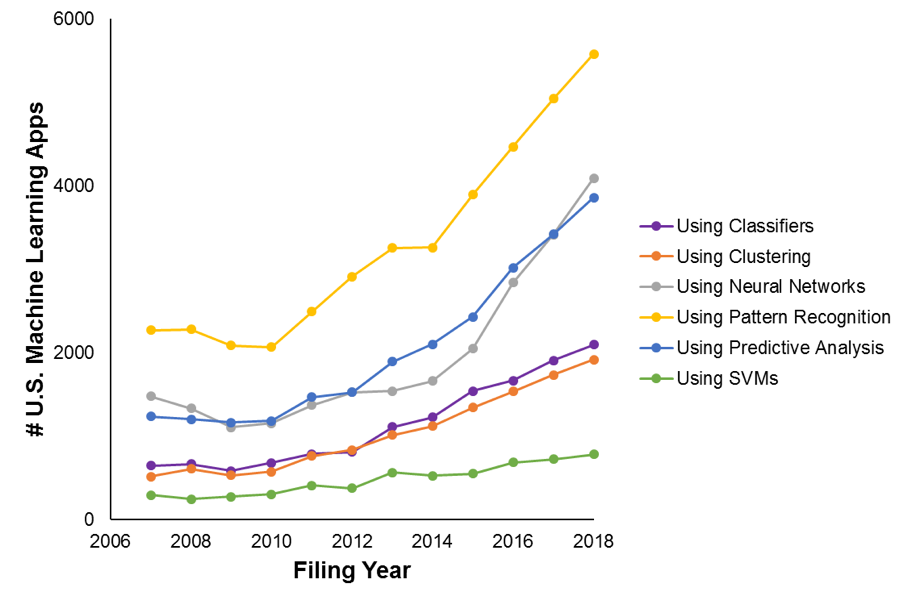

As reported in our initial patent trends article, filings for the industry overall have dramatically increased over the studied time period: from approximately 5,200 filings in 2007 to approximately 12,400 filings in 2018. Figures 1A and 1B show the filing trends broken down by specific types of machine-learning systems (Figures 1A) and by specific use areas (Figure 1B).

Figure 1A

Filing increases are observed across all types of machine learning assessed in this study. Though the absolute counts vary depending on the type of machine learning, the relative increase is strong across all types (ranging from a 2.5-fold increase for pattern recognition to a 3.7-fold increase for clustering).

Figure 1B

Trends across various application areas are less consistent. For most application areas, filings steadily increased over the studied time period. In terms of relative changes, the augmented/virtual reality area saw the biggest relative change, with a 22-fold increase from 2007 to 2018. A sizable 4.4-fold increase was also observed for the natural-language-processing cluster, and the largest absolute difference (2217 filings) is associated with the computer-vision area.

Meanwhile, steady filing increases are not observed across all application areas. For example, filing counts fell around 2015 for the entertainment, education and digital-marketing clusters within the AI industry. This fall-off may be a result of the Alice v. CLS Bank decision having been issued in mid-2014 that caused allowance rates of business-method patent applications to subsequently fall.

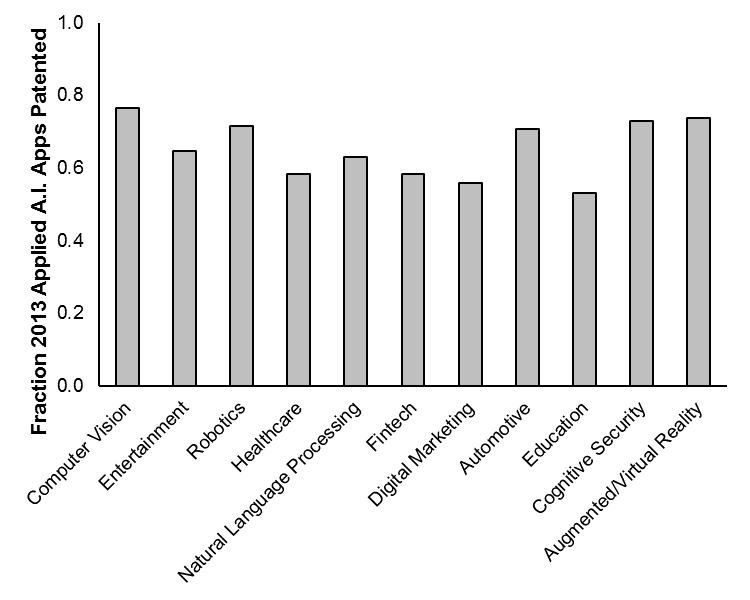

Figure 2 shows, for each of the applied-AI areas, the fraction of the applications that were filed in 2013 and are now patented. Lower issuance percentages are seen for areas traditionally associated with the business-method class (e.g., digital marketing, education, FinTech). These percentages are not as low as they would be if only looking at these areas as an industry, without the combined requirement that the applications be related to AI Nonetheless, this data (while not perfectly correlated with filing changes) does seem to be consistent with the idea that at least some of the filing decreases is due to reduced allowance prospects.

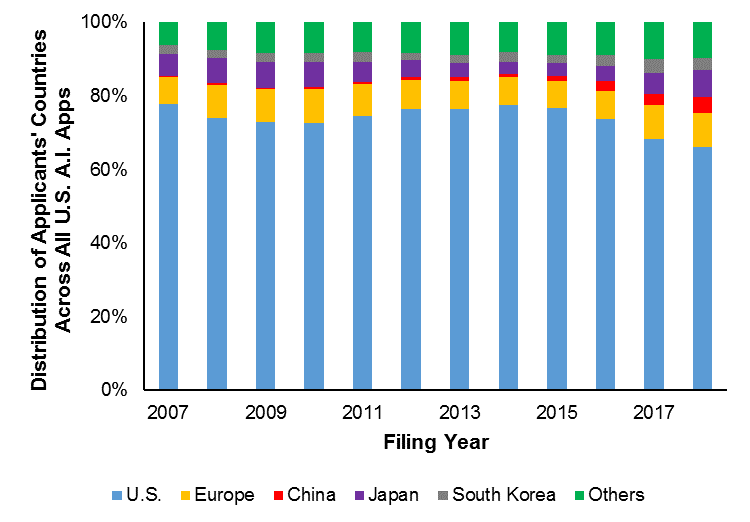

Figure 3 shows a time-series breakdown of applicants’ countries. Even though the absolute of AI filings by U.S. applicants has approximately doubled over this time range, the contribution of U.S. applicants to the total filing of AI applications has fallen. This is because the AI filings from applicants in other countries has risen at even a faster rate. For example, AI filings from Chinese applicants increased by more than a factor of 10 in this time period. The U.S. is losing its early advantage in AI innovation domestically.

Thus, trends in the A.I. industry are interesting. The industry as a whole is strong with a steadily increasing emphasis on patenting. However, it appears as though recent challenges in protecting business-method innovations is affecting decisions as to whether to file at least some A.I. applications. The recent Updated Eligibility Guidance may potentially reverse both of the allowance-decrease and filing-decrease trends, but the readers will have to wait for next year’s study to know for sure. Finally, even though the quantity of U.S. A.I. applications has been increasing, the overall representation of the U.S. in the patenting space of A.I. is decreasing. We hope that A.I.-focused companies can use this data to size up this emerging patent space and to help shape their patenting strategies.

A copy of the full published study is available with additional detail here.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.