This January, patent analytics firms IFI CLAIMS released its latest annual analysis of the U.S. patent landscape, including the top recipients of U.S. utility patents, which was led once again by American tech giant IBM (NYSE:IBM) for the 25th year in a row. IFI’s research found that the U.S. Patent and Trademark Office issued 320,003 utility grants in 2017, a 5.2 percent increase over 2016’s patent grants and more than double the number of patents issued a decade earlier in 2007. Following behind IBM were Asian tech giants Samsung (KRX:005930) and Canon (NYSE:KAJ) in second- and third-place, respectively.

This January, patent analytics firms IFI CLAIMS released its latest annual analysis of the U.S. patent landscape, including the top recipients of U.S. utility patents, which was led once again by American tech giant IBM (NYSE:IBM) for the 25th year in a row. IFI’s research found that the U.S. Patent and Trademark Office issued 320,003 utility grants in 2017, a 5.2 percent increase over 2016’s patent grants and more than double the number of patents issued a decade earlier in 2007. Following behind IBM were Asian tech giants Samsung (KRX:005930) and Canon (NYSE:KAJ) in second- and third-place, respectively.

One interesting aspect of IFI CLAIMS’ most recent annual patent analysis is a list of eight areas of technology that have seen the fastest growing increases in patent applications between 2013 and 2017. To do this, IFI computed the compound annual growth rate (CAGR) of patent applications for all Cooperative Patent Classification (CPC) codes over the course of the study period to see which CPC codes were receiving the greatest number of patent applications.

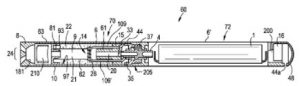

According to IFI’s analysis, the greatest growth in patent applications were for E-cigarettes and other technologies under the CPC code A24F for smokers’ requisites. Between 2013 and 2017, such applications grew by a CAGR of 45 percent with a great deal of the increase being filed under code A24F/47 for simulated smoking devices. The top companies in this sector were Altria Client Services (90 published patent applications in 2017); Philip Morris Products (80 publications in 2017); Lunatech (46 publications in 2017); and Shenzhen First Union Tech (42 publications in 2017). IFI provides a representative patent application in this field, filed by Altria, which covers a cartridge of an electronic vaping device having a roll of material which may be impregnated with additives such as flavorants, tobacco and nicotine.

According to IFI’s analysis, the greatest growth in patent applications were for E-cigarettes and other technologies under the CPC code A24F for smokers’ requisites. Between 2013 and 2017, such applications grew by a CAGR of 45 percent with a great deal of the increase being filed under code A24F/47 for simulated smoking devices. The top companies in this sector were Altria Client Services (90 published patent applications in 2017); Philip Morris Products (80 publications in 2017); Lunatech (46 publications in 2017); and Shenzhen First Union Tech (42 publications in 2017). IFI provides a representative patent application in this field, filed by Altria, which covers a cartridge of an electronic vaping device having a roll of material which may be impregnated with additives such as flavorants, tobacco and nicotine.

Although patents for e-cigarette technologies had been filed through the latter stages of the 20th century, the first commercially successful e-cigarette wouldn’t be released until 2003 in China, reaching European markets a few years after that. In 2016, the U.S. Food & Drug Administration passed a final rule which gives the agency regulatory authority over all tobacco products, including electronic nicotine delivery systems such as e-cigarettes. According to a report released last October by Research and Markets, the global market for e-cigs and vaporizers is expected to grow by a CAGR of 20.8 percent to reach about $61.4 billion by the year 2025. Research published last November by the University of North Carolina’s Lineberger Comprehensive Cancer Center found that the number of online e-cigarette vendors more than tripled in one year, from 980 vendors in 2013 up to 3,096 vendors in 2014.

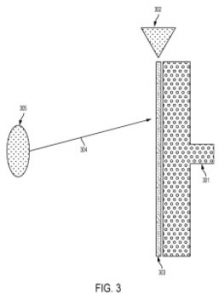

Patent applications in CPC code B33Y for additive manufacturing, or 3-D printing, grew at a CAGR of 35 percent between 2013 and 2017. The top companies having patent applications publish during 2017 include large industrial firms like General Electric (89 published patent applications in 2017); Xerox (78 publications in 2017); and Boeing (50 publications in 2017). IFI identified a patent application filed by GE representing the current field of development. That patent application discloses a method for manufacturing a three dimensional structure by scanning an energy beam on a substantially continuous curtain of powder to sinter or melt the powder to an adjacent vertical-oriented build plate, and then moving the vertical curtain and/or build plate by a set distance and repeating until the structure is built.

Patent applications in CPC code B33Y for additive manufacturing, or 3-D printing, grew at a CAGR of 35 percent between 2013 and 2017. The top companies having patent applications publish during 2017 include large industrial firms like General Electric (89 published patent applications in 2017); Xerox (78 publications in 2017); and Boeing (50 publications in 2017). IFI identified a patent application filed by GE representing the current field of development. That patent application discloses a method for manufacturing a three dimensional structure by scanning an energy beam on a substantially continuous curtain of powder to sinter or melt the powder to an adjacent vertical-oriented build plate, and then moving the vertical curtain and/or build plate by a set distance and repeating until the structure is built.

This January, UK-based industry intelligence firm ReportBuyer forecast that the global 3-D printer market would grow by a CAGR of 12.8 percent between 2017 and 2022, when the global market was expected to reach $4.2 billion. Recent trends in the use of additive manufacturing processes include the on-demand custom manufacturing of shoes as well as the streamlining of order fulfillment for 3-D printed items sold via e-commerce platforms. Recent reports also indicate that luxury automakers like Bugatti and Porsche have been using 3-D printing technologies to either recreate out-of-stock parts or develop high-performance auto parts like titanium brake calipers. This January, a ZDNet interview with the CEO of 3D Systems indicated that the industry needed more research and development in the field of materials that can be used in additive manufacturing processes.

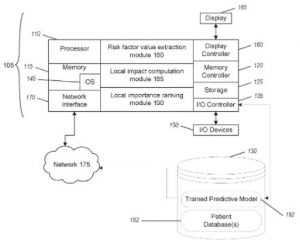

In third place was CPC code G06N for computer systems based on specific computational models, which includes patent applications related to machine learning and artificial neural networks. Such patent application filings increased by a CAGR of 34 percent between 2013 and 2017. IBM is far and away the leader in this field with a total of 654 patent applications that published in 2017. This total was multiples higher than totals posted by second-place Microsoft (139 publications in 2017) and third-place Google (127 publications in 2017). IFI highlights one IBM patent application which discloses a computer-implemented method designed to identify patient-specific risk factors and to rank risk factors for specific patients in a database using trained predictive models.

In third place was CPC code G06N for computer systems based on specific computational models, which includes patent applications related to machine learning and artificial neural networks. Such patent application filings increased by a CAGR of 34 percent between 2013 and 2017. IBM is far and away the leader in this field with a total of 654 patent applications that published in 2017. This total was multiples higher than totals posted by second-place Microsoft (139 publications in 2017) and third-place Google (127 publications in 2017). IFI highlights one IBM patent application which discloses a computer-implemented method designed to identify patient-specific risk factors and to rank risk factors for specific patients in a database using trained predictive models.

Recent industry research from Markets and Markets forecasts growth in the global machine learning market at a CAGR of 44.1 percent, increasing from $1.41 billion in 2017 up to $8.81 billion in 2022. Growing trends related to machine learning innovation include improvements to neural network design, visual processing and high-level probabilistic programming languages. In February, Alphabet subsidiary Verily announced advancements in the use of artificial intelligence and machine learning to determine a patient’s risk of heart disease through the scanning of retinal images.

The fourth-fastest area of growth identified by IFI CLAIMS was autonomous vehicles, including both air and land vehicles, which grew by a CAGR of 27 percent. The 2017 leader was IBM with 80 patent applications published that year, followed by Ford (79 publications), Chinese drone maker SZ DJI (63 publications), Toyota (60 publications) and Honda (59 publications). The fifth-fastest growth area was moulding materials, including materials for additive manufacturing, which also grew at a 27 percent CAGR during the study period. Leading companies in this field include Boeing (110 patent publications in 2017), Honda (83 publications), 3M (48 publications) and Saudi diversified chemicals firm SABIC Global (40 publications). In sixth-place was hybrid vehicles and vehicle control technology, growing at a CAGR of 26 percent. Toyota (200 publications), Ford (134 publications), Hyundai (117 publications) and Honda (83 publications) were the leaders in this field. Aeroplanes and helicopters, especially aerial drones, were seventh-place with a five-year CAGR of 26 percent, largely driven by companies like Boeing (261 publications), Sikorsky Aircraft (160 publications) and SZ DJI (108 publications). In eighth-place was food innovations, increasing by a CAGR of 24 percent between 2013 and 2017. Companies leading in this space include Nestlê subsidiary Nestec (83 publications), Abbott Laboratories (24 publications) and Dutch baby formula firm Nutricia (22 publications).

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

Night Writer

March 23, 2018 09:05 pmThanks.