Perhaps the most concrete example most Americans refer to when they think of business monopoly is the classic case of Standard Oil, the American oil company established by John D. Rockefeller in 1870. Standard Oil grew to become one of the world’s largest multinational corporations by the early 1900s, and controlled almost unthinkable wealth.

Perhaps the most concrete example most Americans refer to when they think of business monopoly is the classic case of Standard Oil, the American oil company established by John D. Rockefeller in 1870. Standard Oil grew to become one of the world’s largest multinational corporations by the early 1900s, and controlled almost unthinkable wealth.

A series of acquisitions in the oil refining sector gave Standard Oil a great enough degree of control over that aspect of the oil industry that the company was able to secure large discounts on transportation and other business expenses. This process of controlling one aspect of an entire industry’s supply chain through horizontal integration angered Standard Oil’s competitors, who produced oil on a much smaller scale and could not secure such discounts for bulk transportation themselves. Standard Oil continued to grow through vertical integration, forming a business trust, which operated across dozens of states and was able to maintain market dominance through streamlined production and lowered costs.

Standard Oil’s dominance of the oil industry continued until May 15th, 1911, when the U.S. Supreme Court decided in Standard Oil v. United States, 221 U.S. 1 (1911) that the business trust operated in violation of the Sherman Antitrust Act. The Supreme Court affirmed the dissolution of the trust, which split Standard Oil into 34 business entities, some of which continue to exist today as ExxonMobil and ConocoPhillips.

It’s certainly true that Standard Oil had a massive grip on America’s oil industry. By 1890, the company controlled 88 percent of the U.S. market for refined oil products and this market share increased to 91 percent of all American oil production by 1904. Between 1882 and 1906, this market dominance reportedly brought Standard Oil a total of $838,783,800 in net income. On an annual basis, that would mean that Standard Oil earned nearly $35 million in net income each year. Using an inflation calculator, which calculates inflation based on consumer price index data going back to the early 19th century, $35 million in 1906 equals approximately $969 million in 2017.

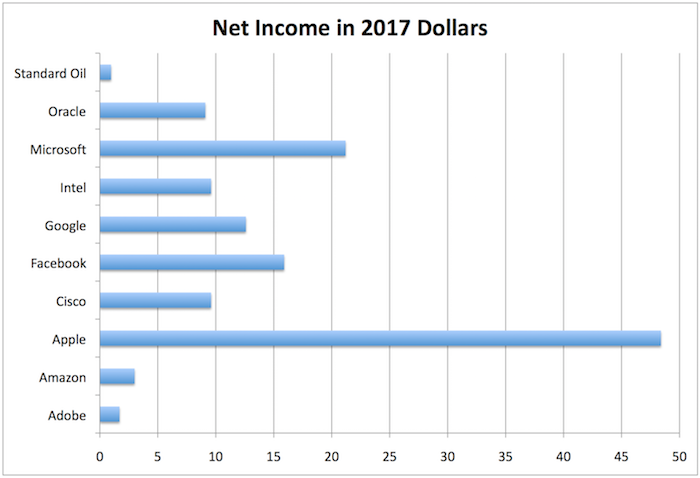

Figure 1: Net income for Standard Oil is the yearly average from 1882 to 1906, adjusted for inflation. Chart shows actual 2017 net income for other companies. Data Sources: NASDAQ and Wall Street Journal.

As shown in Fig. 1 (above), Apple, Google, Facebook and Microsoft all easily have more than 10 times the net income as did Standard Oil when it was broken apart. Apple coming in at close to 50 times the net income! Cisco and Intel come in just under 10 times the net income as compared to Standard Oil, both at 9.9 times greater net income than Standard Oil when it was broken apart.

If 91 percent control of the oil refining industry and net income of $35 million per year was enough to break apart Standard Oil under the terms of the Sherman Antitrust Act, there are a few tech super giants that would face a similar fate if the trust-busting philosophies that held sway during the administration of President Theodore Roosevelt were en vogue today.

In January, The Wall Street Journal published an article titled The Antitrust Case Against Facebook, Google and Amazon. The article reports that these major tech firms each have greater control over certain high tech industry sectors than Standard Oil had over oil production during its heyday. For example, 95 percent of young adults using the Internet subscribe to a Facebook product, whether it’s the company’s flagship social network or other services like Instagram or WhatsApp. Google controls 89 percent of Internet searches.

Where monopolies don’t exist, duopolies certainly do; Google and Apple, for example, collectively hold 99 percent of the mobile operating software market.

If the percentage of market share for important tech sectors held by these titans wasn’t enough, the massive fortunes these companies continue to generate would seem likely to trigger at least some antitrust scrutiny. Remember, Standard Oil’s annual net earnings through 1906 earned what today would be $969 million each year in 2017 dollars, adjusted for inflation. To some of the tech super giants of today, $1 billion in profits is nothing more than pocket change.

Apple’s earnings report for the first quarter of its 2018 fiscal year, for example, showed that the consumer tech giant took in just over $20 billion for the three months ending December 30th, 2017. That’s more than 20 times the average annual net earnings of the Standard Oil trust when adjusted into today’s dollars, and Apple took that amount in over only three months, not the full year that it took Standard Oil to accumulate slightly less than $1 billion in 2017 equivalent dollars.

During its fourth quarter of fiscal year 2017, also ending in late December, Facebook took in $4.26 billion in net income. Alphabet’s earnings report for 2017’s fourth quarter reflects similar numbers for Google, which generated $8.76 billion in operating income that quarter alone.

Moving beyond Standard Oil, there is further precedent that suggests a breakup of at least several big-tech companies would be warranted. One such case is United States v. Alcoa, decided by the Court of Appeals for the Second Circuit in 1945 with an opinion penned by Judge Learned Hand, perhaps the most influential jurist never to be appointed to the Supreme Court. In that opinion, Judge Learned Hand explained that a 60 to 64 percent market share was “doubtful” in terms of establishing a monopoly, but theorized that a 90 percent market share was certainly enough to constitute a monopoly.

The Hand rule wouldn’t trigger regulatory action for today’s tech duopolies, but would certainly support regulatory action to review Google’s hold over the online search market, as well as Facebook’s control of social media. And even if the tech super giants that form duopolies and oligopolies might not in and of themselves warrant individual regulatory attention, they have collectively cooperated very closely to suppress individuals and smaller entities by aggressively (and successfully) lobbying for weakened patent rights. But of course, it isn’t just the individual and small enterprises that have suffered. Facebook has engaged in widespread copying of SnapChat features, seemingly without consequence.

Contemplating the breakup of these tech giants as a way to promote competition is no panacea for the American economy. Critics of historic antitrust activity, especially in the Alcoa case, have noted that companies may obtain such a dominant market position not through illicit business activities but by increased investment or improved cost efficiencies. After all, while competitors may have had problems competing against Standard Oil, consumers enjoyed the cheaper oil. In a similar way, today’s tech consumers do benefit from free access to platforms developed by tech giants like Google and Facebook.

But at what cost do American’s receive these “free” platforms? Free is an interesting word, which rarely applies. Increasingly American consumers are giving up private data in order to access “free” platforms, products and services. Moreover, the real cost is impossible to know when you factor in the fact that big-tech giants routinely crowd out independents and small enterprises. Increasingly, as patent rights have weakened and antitrust enforcement has been non-existent, tech giants like Apple, Google, Facebook and others have routinely trampled on the proprietary property of others in an effort to support their largeness. What innovations have been suppressed as the result of monopolistic super-giants that make Standard Oil look like nothing more than a modestly sized enterprise?

We are watching a new era unfold before our eyes. Antitrust enforcement is nearly non-existent and patent rights are extraordinarily weak. What hope does an individual or small enterprise have against super-giants? Without a functioning patent system that provides real and enforceable rights to patent owners it becomes all the more necessary for Antitrust regulators to level the playing field.

If Standard Oil remains the benchmark for what it means to be a monopoly, which many believe it does, it is difficult to understand why U.S. Antitrust regulators are not at least asking very serious questions about the market dominance of the tech super giants and the associated suppression of smaller, truly innovative enterprises.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

20 comments so far.

angry dude

March 5, 2018 10:19 amPoesito@19

I wish I had 2 electric power lines to my house too – that’s where true monopoly (PSEG) gets me:

the delivery charge is like 60% of supply so even with all so-called “deregulation” switching to another electricity supplier doesn’t save me anything cause the power lines are still owned by PSEG’s de-facto monopoly

Monopolies or duopolies rule in USA

Poesito

March 4, 2018 10:50 pmangry dude: @ 18: You’re fortunate in that respect then. It’s probably very rare to have two “wired” broadband services in the neighborhood. They usually avoid direct competition. Municipalities don’t like redundant utilities anyway but then fail to regulate the cable co’s as natural monopolies.

angry dude

March 3, 2018 08:54 pmPoesito@17

I said 2 cables not 2 tv cable companies

I have triple service from either verizon or comcast and swich every once in a while

Physical cables stay all the time

and dont get removed

They beg me to switch or to stay

P.s. i do not watch tv anymore

Poesito

March 2, 2018 10:34 pmangry dude @ 8: Why in the world would you want two TV cable companies in your life when most people hate having to have one?

Tesia Thomas

March 2, 2018 03:29 pm@PTO-Indentured,

Yep. Net neutrality was an oxymoron or whatever it’s called when you say one thing and mean another.

But, most people listened to the tech company shills- the media and thought their beloved internet was being threatened.

The best evidence that destroying that bill was good: it failed and the net is just the same.

PTO-Indentured

March 2, 2018 02:57 pmTesia@13 — Yes, once one or more politicians of a first sort hitch up to a six-figure ‘funding source’ (so handy to getting elected) — politicians of a second sort (fearing being left behind) quickly adapt to hitch up to a same or similar ‘funding source’. You might say: ‘Join the PAC’.

Since six-figure (or higher) ‘contributions’ are so much more satisfying than the meager limits of former times, who would not want to milk/bilk such cash cows.

Result: ‘The best anti-trust, governance and patent systems money can buy’. Which, unfortunately yielded, systems run amok.

For a quick, recent of example of PAC-funding ‘influence’ of all 535 members in Congress on the issue of Net ‘Neutrality’ see here:

http://www.theverge.com/2017/12/11/16746230/net-neutrality-fcc-isp-congress-campaign-contribution

Angry Dude@14 — Yes, a 99% marketshare duopoly, glaring example, controlling an order of magnitude more power and exclusivities — than Standard Oil could ever have dreamed of — is invisible to, and/or kept out of reach of, a sane anti-trust governance, relegated to those wooed into timidity, or at least utter silence.

At incalcuable loss to U.S. patent competitiveness, IP-value and innovation.

angry dude

March 2, 2018 01:09 pmPTO-Indentured@12

Does duopoly allow them to escape anti-trust ?

Lemmings are happy to have just 2 choices and no more:

Comcast or Verizon (in my area), Home Depot or Lowes, Dish Network or DirectV, IOS or Android, NVidia or AMD etc etc etc

Tesia Thomas

March 2, 2018 12:20 pm@PTO-Indentured,

You mean the same lobbyists who pay the same politicians and fund their re-election campaigns are going to trust bust them?

WOAH.

Why would a politician actually hurt their money supply?

You mean to tell me they have that level of integrity?

It’ll have to be the next generation of politicians that do this…if and only if they can do it before they get bought off.

PTO-Indentured

March 2, 2018 11:58 amSee, Hear, Speak ‘No Evil’…

Can be good for humans, not so great for governance, justice. But here,we’re talking about a mega-averting of eyes, ears and voice.

Might we otherwise (more-aptly?) title this article:

Tech Super Giants Control Standard Oil-On Steroids Monopolies

Considering the analogy of the Standard Oil monopoly is helpful, but with where we are in Tech today, we need to add to that a whole lot of exclusive-power and exclusive revenue-generation. A more complete analog would be Standard Oil also owning/controlling the most geographically-widespread and most daily-used communication, news-reporting and advertising channel in the world. The channel deliberately built by design, to track and report the personal whereabouts and behavior of all (billions) of its users, and sell that (your) personal data to advertisers (which alone yields billions of dollars). No app (of millions) is welcomed into this (exclusive duopoly) eco-system unless and until it is equipped upon being downloaded, to ‘robotically spy’ on and report on its user.

Standard Oil in its day, would likely have needed to also control and monitor via, the likes of Bell Telephone, the Trans-Atlantic Cable, monopolized rail travel, and a Hearst-like empire of newspapers… I think you get the idea, Standard Oil on steroids.

Ironic — that Giant Tech Co’s even approaching the size of a Standard Oil monopoly alone, could not suffice to raise a red flag, an eyebrow. The anti-trust checks and balance ‘switch’ has so long been decomissioned, that an unfettered growth of monopolies (or duopolies) — orders of magnitudes bigger than Standard Oil — fell on those turning a blind eye, a deaf ear, a muted voice.

PTO Policies Helped Foster Anti-Trust ERA

By disallowing, hampering or stonewalling patents that clearly would’ve helped level the playing field (e.g., see FOIA PTO secret ‘SAWS’ program), by, then unleashing a “Patent Death Squad” destroying of U.S. patent value, particularly in the ‘Tech’ field, the PTO helped foster an unprecedented Anti-Trust era.

mark @9 — a duopoly seizing a 99% marketshare out to have done the trick.

every app downloaded to an iOS or Android device (by design) is a ‘spy’

Anon

March 1, 2018 09:58 amMr. Martens,

I would qualify the “it’s irrelevant” comment as pertains perhaps “irrelevant to the merits.”

The (unhappy) fact of the matter is that cases are comprised of more than merely the merits, and the real world aspect of non-competitive (in the innovation sense) factors – such as net income – really are NOT irrelevant.

Night Writer

March 1, 2018 08:24 amGene: sounds like a good idea. (Also, as a side note corporate start-ups are notoriously bad at creating innovation.) That is overt attempts at innovation are terrible, although corporations have had success creating innovation when they are merely supporting research.

Mark H Martens

March 1, 2018 12:18 amNet income is NOT going to make the case. It’s irrelevant.

angry dude

February 28, 2018 09:19 pmI have both Verizon fiber and Comcast cable entering my house

Makes a world of difference when negotiating with them

Brian

February 28, 2018 05:03 pmGene,

Google has become a technology copy cat machine and that is the reason they don’t like patents. Look at the small sample list below

Google introduces Slack competitor today https://techcrunch.com/2018/02/28/hangout-chat-googles-slack-competitor-comes-out-of-beta/

Recently Google released GoPro competitor https://www.reuters.com/article/us-google-hardware-clips/google-takes-on-gopro-snap-with-compact-smart-camera-idUSKBN1C9347

Over the years Google have copied and entered markets when someone else has figured out the Product/market fit or business model.

Copy Apple – > Android

Copy Amazon -> Build and sell Google cloud services.

Copy Facebook -> Launch G+

Copy Instagram – > Google Photos

Copy Yelp -> https://www.theguardian.com/technology/2015/mar/20/google-illegally-took-content-from-amazon-yelp-tripadvisor-ftc-report

Copy Travelocity / Expedia – > Google flights

List goes on and on .. someone needs to research a little more and write this in a forceful article on why Google is anti-patent . Mainly because they are now in the business of copying other peoples technology and businesses

Tesia Thomas

February 28, 2018 04:55 pm@Gene,

Yup. Or just get a Fire TV stick from Amazon or digital cable TV (Xfinity or something like that.)

Gene Quinn

February 28, 2018 04:53 pmTesia-

That is exactly what I have in mind, but I don’t think it will be limited to government monopolies. What is interesting, or at least I think so, is how Cable TV companies have had to become more consumer friendly. They used to be the worst when they had an absolute monopoly on whatever location they served. But now even if only one company services your area you can select Direct TV or Dish. What a difference competition makes!

Tesia Thomas

February 28, 2018 03:59 pm@Gene,

Use the government-monopoly utilities companies.

James Milk

February 28, 2018 03:58 pm“Patent Pirates” need to be stopped. Large companies like Google, Apple, Amazon and FB need to be stopped from taking advantage of patent holders that do not have the money to fight them in court from stealing their IPs. They need to scrap the AIA Act and the PTAB that was created by Google to curb any legal rights a patent holder had in getting fair compensation for their property right. I hope the new administration gets it right and puts a stop to patent pirates that have been feeding off of small patent holder for free for too long.

Gene Quinn

February 28, 2018 01:40 pmNight Writer-

I agree. It is hard to argue that a monopoly can execute best. I’m not an expert on monopolies, but that notion flies in the face of everything I do know about monopolies (and have experienced throughout my life). When there is real competition nimble companies typically execute best. Will see if I can follow this lead with an article. If I can find someone knowledgeable about historic monopolies could be quite interesting.

-Gene

Night Writer

February 28, 2018 08:45 amIt occurred to me that these are the same people that are saying that we don’t need patents but that the company that can best execute should get to do whatever they want–and yet they are near monopolies. By definition they have market power.