On October 11th, legal analytics firm Lex Machina released an intellectual property litigation report covering the third quarter of 2016. The report indicates that IP litigation in U.S. district courts is declining across the board, although the potential for volatility still exists in certain sectors thanks to some important players.

On October 11th, legal analytics firm Lex Machina released an intellectual property litigation report covering the third quarter of 2016. The report indicates that IP litigation in U.S. district courts is declining across the board, although the potential for volatility still exists in certain sectors thanks to some important players.

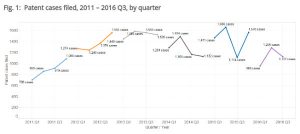

During 2016’s third quarter, U.S. district courts received a total of 1,127 new patent infringement suits. This was greater than the 960 patent infringement cases filed in the first quarter of this year but it was also the third smallest docket in a single quarter going back to the fourth quarter of 2011, before the terms of the America Invents Act (AIA) of 2011 went into effect. The third quarter of 2015 saw 1,114 patent litigation filed in U.S. courts, so three of the lowest quarters in terms of patent infringement filings since the AIA have come over the past 15 months.

During 2016’s third quarter, U.S. district courts received a total of 1,127 new patent infringement suits. This was greater than the 960 patent infringement cases filed in the first quarter of this year but it was also the third smallest docket in a single quarter going back to the fourth quarter of 2011, before the terms of the America Invents Act (AIA) of 2011 went into effect. The third quarter of 2015 saw 1,114 patent litigation filed in U.S. courts, so three of the lowest quarters in terms of patent infringement filings since the AIA have come over the past 15 months.

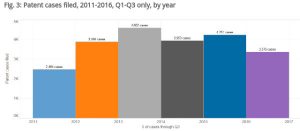

Given these facts, it’s fair to say that the most recent quarter continues a pattern of recent decline in patent infringement litigation according to Brian Howard, legal data scientist for Lex Machina. “It’s on the lower side, it’s a lot closer to 2014 than anything else,” Howard said. Looking at the first three quarters of each year going back to 2011, the patent infringement totals thus far through 2016 is less than 500 cases fewer than the 3,953 patent lawsuits filed in 2014. By contrast, 2015 saw 4,251 patent infringement cases through the first three quarters of that year and 2013 saw 4,602 such cases.

Given these facts, it’s fair to say that the most recent quarter continues a pattern of recent decline in patent infringement litigation according to Brian Howard, legal data scientist for Lex Machina. “It’s on the lower side, it’s a lot closer to 2014 than anything else,” Howard said. Looking at the first three quarters of each year going back to 2011, the patent infringement totals thus far through 2016 is less than 500 cases fewer than the 3,953 patent lawsuits filed in 2014. By contrast, 2015 saw 4,251 patent infringement cases through the first three quarters of that year and 2013 saw 4,602 such cases.

The 3,376 patent infringement cases filed through the first three quarters of 2016 is almost 1,000 cases more than the 2,484 infringement suits seen through the first three quarters of 2011. However, considering some of the provisions of the AIA, including a new plaintiff requirement that defendants be targeted by individual suits rather than one patent infringement suit listing multiple defendants, there’s some argument to make that we might be seeing a return to pre-AIA litigation levels. Howard noted that there were presumably some cases filed in 2011 that listed multiple defendants which would have to be filed individually post-AIA. “The data is consistent with the theory that we may be returning to pre-AIA levels but it doesn’t necessitate that you would come to that conclusion,” Howard said.

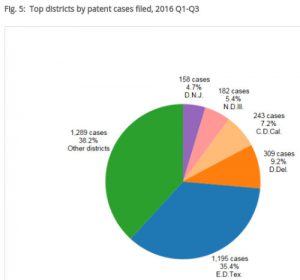

Lower levels of patent litigation mean smaller dockets across the board for district courts, including the U.S. District Court for the Eastern District of Texas (E.D. Tex.). However, the high concentration of patent infringement actions filed in E.D. Tex. still holds true through 2016’s third quarter. The recent Lex Machina IP litigation report shows that 35.4 percent of all patent infringement cases filed in the third quarter were filed in E.D. Tex. for a total of 1,195 patent suits. The venue with the next largest docket is the U.S. District Court for the District of Delaware (D. Del.), which accounted for 9.2 percent of the patent infringement suits filed during the quarter, a total of only 302 cases. Outside of the top five venues, all other U.S. district courts combined for a total of 1,289 cases, 38.2 percent of all patent infringement suits filed in the quarter.

Lower levels of patent litigation mean smaller dockets across the board for district courts, including the U.S. District Court for the Eastern District of Texas (E.D. Tex.). However, the high concentration of patent infringement actions filed in E.D. Tex. still holds true through 2016’s third quarter. The recent Lex Machina IP litigation report shows that 35.4 percent of all patent infringement cases filed in the third quarter were filed in E.D. Tex. for a total of 1,195 patent suits. The venue with the next largest docket is the U.S. District Court for the District of Delaware (D. Del.), which accounted for 9.2 percent of the patent infringement suits filed during the quarter, a total of only 302 cases. Outside of the top five venues, all other U.S. district courts combined for a total of 1,289 cases, 38.2 percent of all patent infringement suits filed in the quarter.

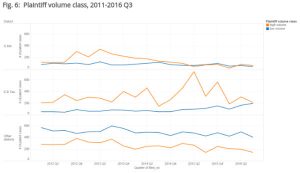

The reduced caseload at E.D. Tex. is likely related to an interesting phenomenon seen more often at that venue than other district courts, according to Howard. The IP litigation report notes that the third quarter saw fewer cases from what are known as “high-volume plaintiffs,” or plaintiffs filing at least 10 cases within the past 365 days, the span of a typical calendar year. The average number of cases from high-volume plaintiffs is well below the number of cases from low-volume plaintiffs, which file less than 10 cases in a year, for most U.S. district courts. In E.D. Tex., however, cases filed by high-volume plaintiffs have outnumbered cases coming from low-volume plaintiffs going back to before 2012. However, the number of E.D. Tex. high-volume plaintiff cases in the third quarter fell close to 200 cases, a reduction that nearly meets the number of cases filed by low-volume plaintiffs in that venue during the quarter.

The reduced caseload at E.D. Tex. is likely related to an interesting phenomenon seen more often at that venue than other district courts, according to Howard. The IP litigation report notes that the third quarter saw fewer cases from what are known as “high-volume plaintiffs,” or plaintiffs filing at least 10 cases within the past 365 days, the span of a typical calendar year. The average number of cases from high-volume plaintiffs is well below the number of cases from low-volume plaintiffs, which file less than 10 cases in a year, for most U.S. district courts. In E.D. Tex., however, cases filed by high-volume plaintiffs have outnumbered cases coming from low-volume plaintiffs going back to before 2012. However, the number of E.D. Tex. high-volume plaintiff cases in the third quarter fell close to 200 cases, a reduction that nearly meets the number of cases filed by low-volume plaintiffs in that venue during the quarter.

The highpoint of patent infringement case filings from high-volume plaintiffs in E.D. Tex. came in the second quarter of 2015, when such case filings spiked to more than 600 filings. “What this is saying is that the volatility of case filings between districts and within districts is largely driven by high-volume plaintiffs,” Howard said. There’s also a spike to nearly 600 cases from high-volume plaintiffs during the fourth quarter of 2015, which is when Form 18 ceased to be used as a mechanism for pleading patent infringement in U.S. district courts. “If you are a high-volume plaintiff, you file cases all at once, maybe 20 to 50 cases are filed within the same few days,” Howard said. “It lends to them being spiky.”

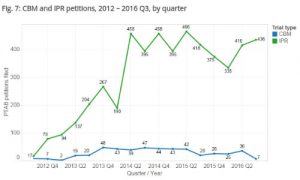

Over at the Patent Trial and Appeal Board (PTAB), it was business as usual during the third quarter in terms of inter partes review (IPR) filings. The 436 IPRs filed during the most recent quarter falls directly in the middle of the range of 395 IPR filings to 460 filings seen every quarter going back to the second quarter of 2014, notwithstanding two outliers in 2015’s fourth quarter and 2016’s first quarter. Covered business method (CBM) reviews, however, took a tumble down to only seven such cases filed during 2016’s third quarter. That was down from only 36 CBM filings in this year’s second quarter, however, and the number of CBM filings seen each quarter have not gone above 50 filings going back to 2012’s third quarter. “I don’t think that it’s the end of CBM until we see a couple of quarters like that,” Howard said. He added that PTAB was experiencing website issues during the recent quarter and wondered whether practitioners experienced disruption of online services which may have caused them to hold off on filing CBMs.

Over at the Patent Trial and Appeal Board (PTAB), it was business as usual during the third quarter in terms of inter partes review (IPR) filings. The 436 IPRs filed during the most recent quarter falls directly in the middle of the range of 395 IPR filings to 460 filings seen every quarter going back to the second quarter of 2014, notwithstanding two outliers in 2015’s fourth quarter and 2016’s first quarter. Covered business method (CBM) reviews, however, took a tumble down to only seven such cases filed during 2016’s third quarter. That was down from only 36 CBM filings in this year’s second quarter, however, and the number of CBM filings seen each quarter have not gone above 50 filings going back to 2012’s third quarter. “I don’t think that it’s the end of CBM until we see a couple of quarters like that,” Howard said. He added that PTAB was experiencing website issues during the recent quarter and wondered whether practitioners experienced disruption of online services which may have caused them to hold off on filing CBMs.

For all of the volatility seen in patent infringement, trademark litigation has followed a very steady and slight decline going back to the third quarter of 2010. U.S. district courts saw 831 trademark infringement cases in the third quarter, a drop from the 904 trademark actions filed in the second quarter. 2016’s third quarter and first quarter (825 trademark infringement cases) were the two lowest quarters shown in the study in terms of trademark infringement cases. The timeline remains incredibly steady except for one spike to 1,422 trademark infringement cases filed in 2014’s third quarter, when a flood of 461 cases came from former National Football League players suing the league over the use of their likeness in NFL content. “Trademark infringement is interesting because it is so consistent,” Howard said, noting that unlike patent actions, trademark actions must be made when infringement is spotted or the mark holder risks losing the rights to the mark. “My suspicion is that consistency in trademark litigation is due to this nature of enforcing the mark which is absent in patent law,” Howard said.

The one area of IP litigation which did increase on the quarter was copyright, where infringement actions rose from 891 cases in 2016’s second quarter up to 937 cases filed in the third quarter. Much of this rise is attributable to an increase in file sharing cases which rose quarter-to-quarter from 249 cases up to 331 cases in the third quarter; other copyright litigation declined from 642 cases in the second quarter down to 606 cases in the third quarter.

The one area of IP litigation which did increase on the quarter was copyright, where infringement actions rose from 891 cases in 2016’s second quarter up to 937 cases filed in the third quarter. Much of this rise is attributable to an increase in file sharing cases which rose quarter-to-quarter from 249 cases up to 331 cases in the third quarter; other copyright litigation declined from 642 cases in the second quarter down to 606 cases in the third quarter.

File sharing cases are typically brought by firms against John Doe defendants who are accused of illegally downloading content through BitTorrent or related technologies. The single largest filing party for these cases is Malibu Media, which filed 166 file sharing cases during the recent quarter. As has been reported here and elsewhere, Malibu Media is a developer of adult erotic films. Howard notes that while not all file sharing cases involve such content, about 80 to 90 percent of the cases are related to adult films. Interestingly, although Malibu Media seems to be fueling file sharing cases, its activities in filing copyright suits have tailed off dramatically since the second quarter of 2015, when the company filed 589 copyright infringement suits.

Although it’s a bit outside of the IP world’s purview, Lex Machina’s most recent litigation report is the first to include statistics on securities litigation. The 327 new case filings in the third quarter is the highest total of new securities litigation actions going back to 2009. Not surprisingly, the top venues include top U.S. cities for the financial industry, including the U.S. District Court for the Southern District of New York (S.D.N.Y.) and the U.S. District Court for the Central District of California (C.D. Cal.). The new securities report presages a number of new legal analytics categories to be offered by Lex Machina in the coming months, including antitrust, bankruptcy, product liability, employment and general commercial litigation.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.