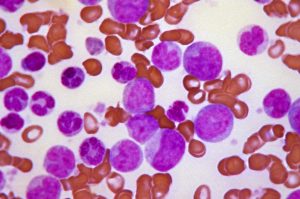

“Microscopic View of Blast Crisis of Chronic Myelogenous Leukemia” by CDC/Stacy Howard. Public domain.

In late May, news outlets were reporting that Dublin, Ireland-based Jazz Pharmaceuticals (NASDAQ:JAZZ) had reached an agreement to purchase Celator Pharmaceuticals (NASDAQ:CPXX) of Princeton, NJ. The deal values Celator at about $1.5 billion dollars with Jazz Pharmaceuticals paying $30.25 per share of Celator. Shares of Celator were up as much as 70 percent in the day following news of the corporate acquisition.

Of particular interest in this deal is a drug in Celator’s pipeline is Vyxeos (cytarabine:daunorubicin), an injectable liposomal treatment for blood cancers, especially acute myeloid leukemia (AML). The treatment, which has received a Breakthrough Therapy designation from the U.S. Food and Drug Administration (FDA) for fast-tracked approval, recently achieved positive results in a Phase 3 trial. Patients with high-risk, or secondary, AML who received Vyxeos injections saw a significant increase in overall survival rates, 41.5 percent for Vyxeos-treated patients versus 27.6 percent for other patients in a year’s time.

The use of nanoscale liposomes in the Vyxeos treatment allows for the treatment of AML patients with a 5:1 ratio of cytarabine, which interferes with cancer cell DNA synthesis, to daunorubicin, which slows cancer cell growth. Compared to 3:1 or “7+3” applications of the combination drug therapy, Vyxeos accomplishes better optimal rates of molar ratio within a patient’s body more than 24 hours after an application. This prolonged exposure to the medication maintains a high level of cytotoxicity to kill tumor cells.

An American is diagnosed with a blood cancer once every three minutes according to statistics published by the Leukemia & Lymphoma Society. During 2016, it’s expected that 19,950 new cases of AML will be diagnosed, just over one percent of all new cancer cases diagnosed this year. Of those diagnosed, a little over 25 percent survive after five years and 10,430 estimated deaths related to AML are expected throughout 2016. Diagnoses of AML are rare before an adult reaches the age of 45 and the average age of a patient suffering from AML is 67. AML is a leukemia, or blood cancer, most often affecting those cells which would normally turn into white blood cells. It is acute, meaning that the cancer progresses quickly, and it affects the myeloid tissues of bone marrow.

Although Jazz Pharmaceuticals sees greater value stemming from its portfolio of sleep and narcolepsy drugs, Vyxeos isn’t the company’s first foray into the oncology sector. The company also sees sales of about $200 million per year for Erwinaze, an injectable treatment which is prescribed to patients suffering from acute lymphoblastic leukemia, another form of blood cancer. Elsewhere in hematology, Jazz has been developing treatments based on defibrotide, an anticoagulant which has shown some ability in preventing the formation of blood clots. This March, the FDA approved a form of defibrotide sodium being marketed by Jazz as Defitelio. The drug is prescribed to patients hepatic veno-occlusive disease, a condition where veins in the liver can become blocked after chemotherapy or hematopoietic stem cell transplantation (HSCT), increasing the risk of liver damage. HSCT involves a transplant of stem cells from blood or bone marrow.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.