Any well-working and finely tuned system is likely going to have a few participants who play a dishonest game in order to get ahead. Charges filed in the middle of May by the U.S. Securities and Exchange Commission (SEC) target a person whose name has already earned at least some notoriety for legal gamesmanship. The patent trolling activities of MPHJ Technology Investments and its owner, Texas lawyer Jay Mac Rust, have already been discussed in the online pages of IPWatchdog as well as elsewhere on the Internet and in the media at large. Now it appears that Rust is in the middle of an investment fraud scandal the SEC is taking to court.

An SEC press release from May 13th indicates that the financial regulation agency filed charges in Manhattan federal court alleging that Rust and an associate, Christopher K. Brenner, misrepresented the business activities of Atlantic Rim Funding, a commercial loan company upon whose behalf both Rust and Brenner acted as escrow agents. Small business owners seeking loans received assurances from Rust and Brenner that, upon deposit of 10 percent of the loan’s principal, Atlantic would use those deposits to purchase liquid, government-backed securities which Atlantic could then leverage to finance the larger loan.

The SEC’s complaint maintains that Atlantic had “no ability or intention to obtain these loans.” Rather, of the money the two collected, the SEC alleges that Rust took $662,000 from client funds for personal pay and risky securities investments; Brenner himself took $595,000, and both made investments claiming that the money was personally theirs and not from the client funds. Investigations at a brokerage firm where these trades were taking place led the SEC to discover the fraudulent activities.

This kind of dishonest activity strikes a familiar tune, at least for anyone who has heard of Rust’s dealings in the world of U.S. patents. We’ve written in the past on the difficulty of accurately defining the activities of a patent troll and how whatever patent trolling is it differentiates from the very legal business model of innovative non-practicing entities (NPEs) employed by major tech firms like Qualcomm Inc. (NASDAQ:QCOM) and IBM (NYSE:IBM), the largest earner of U.S. patents for each of the past 23 consecutive years. In Rust’s case, however, the patent troll label seems entirely accurate; if anyone is a patent troll it would have to be Rust.

Reports stemming back to April 2013 indicate that Rust began sending demand letters on behalf of a network of companies under the MPHJ parent company aegis to small businesses across America. The subsidiary companies were given gibberish six-letter names, increasing confusion as to the company’s actual identity. Demand letters reportedly sought about $1,000 per employee on a portfolio of five patents purchased in 2012 for $1 which were related to computer architecture. Transcripts of a phone call between Rust and an unnamed small business owner published in Ars Technica shows how Rust would repeatedly inform what he called “irate” business owners to seek advice from patent lawyers, despite the fact that there seem to be no reports of an MPHJ subsidiary demand letter resulting in a lawsuit against a single small business. Rust also stated that he believed 99 percent of Americans were infringing on MPHJ’s patents. Of course, ubiquity of an invention doesn’t make one a patent troll, but Rust’s actions seem to tell another tale.

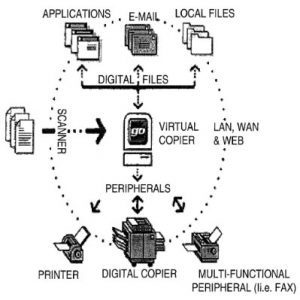

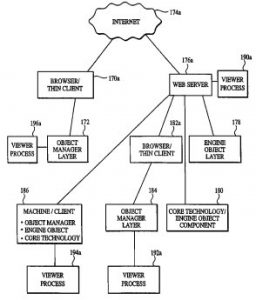

A quick stroll through the patents asserted by MPHJ gives a good idea of how the firm was able to target the business interests of others. U.S. Patent No. 7986246, titled Distributed Computer Architecture and Process for Document Management, protects a computer data management system that transmits electronic images, graphics and documents so that they can be “seamlessly replicated” on external devices and applications. It’s specifically noted that the system “enables a typical PC user to add electronic paper processing to their existing business process.” U.S. Patent No. 7477410,

A quick stroll through the patents asserted by MPHJ gives a good idea of how the firm was able to target the business interests of others. U.S. Patent No. 7986246, titled Distributed Computer Architecture and Process for Document Management, protects a computer data management system that transmits electronic images, graphics and documents so that they can be “seamlessly replicated” on external devices and applications. It’s specifically noted that the system “enables a typical PC user to add electronic paper processing to their existing business process.” U.S. Patent No. 7477410,  entitled Distributed Computer Architecture and Process for Virtual Copying, protects another computer data management system which also results in the seamless replication of images, graphics and documents to external destinations, this time specifically through the Internet. The patent, which was initially filed for in June of 2004, notes that companies were spending 15 percent of their total budget on managing paper despite the growing automation of business processes.

entitled Distributed Computer Architecture and Process for Virtual Copying, protects another computer data management system which also results in the seamless replication of images, graphics and documents to external destinations, this time specifically through the Internet. The patent, which was initially filed for in June of 2004, notes that companies were spending 15 percent of their total budget on managing paper despite the growing automation of business processes.

It’s simple to see how Rust and his associates were able to manipulate small businesses. These patents are related to business processes. Technically, yes, patents exist to keep competitors from a market but demand letters from MPHJ were sent spuriously and without any intention of taking a business to court. MPHJ seemed to be entirely interested in extracting payment which, if actually litigated in a district court, almost certainly wouldn’t have been anywhere near $1,000 per employee.

As a result of their focus on truly small, mom and pop businesses, MPHJ quickly became a focal point in the patent troll debate, which was still growing at that time. By January 2014, the firm had sent demand letters to about 16,465 American small businesses, for which it received 17 licenses. In May 2013, MPHJ was the target of a lawsuit filed by the state of Vermont accusing MPHJ of violating the Vermont Consumer Protection Act (VCPA). Vermont officials said that MPHJ broke the VCPA by engaging in “unfair trade practices,” threatening litigation against businesses even though MPHJ was unlikely to file suit. As of this February, MPHJ was petitioning the U.S. Supreme Court to reject an appeal filed by Vermont in the case. Vermont’s next-door neighbor New York State reached a settlement with MPHJ in January 2014. A press release from the office of state attorney general Eric T. Schneiderman at that time announced that, as per the terms of the settlement, any MPHJ licensees in the state could void their license and receive a full refund; MPHJ was also barred from contacting small businesses to which it had sent demand letters.

At the federal level, MPHJ’s patent trolling activities have also caused dust-ups at the Federal Trade Commission (FTC). In January 2014, MPHJ filed suit against the FTC and five FTC commissioners alleging that the defendants unlawfully interfered and threatened MPHJ’s business activities by considering it an “unfair trade practice” under the terms of Section 5 of the FTC Act. The suit, filed in the U.S. District Court for the Western District of Texas (W.D. Tex.), was dismissed in September of that year because the judge in that case did not consider the FTC’s ongoing investigation to be an official office action, an action which MPHJ was hoping to preempt. In November 2014, the FTC announced it had reached a settlement with MPHJ, Rust and Farney Daniels, the law firm assisting Rust with his demand letter activities. Finding that MPHJ and its representatives hadn’t filed any lawsuits, which it had threatened, the FTC barred them from conducting misleading patent assertion communications for a period of at least 20 years.

With the latest SEC allegations regarding Rust’s activities in promoting the bilking of small business dollars through Atlantic Rim Funding, it looks like our country could do no better to promote the Main Street economy than by making sure that Jay Mac Rust never touches it again. The SEC’s case against Rust will be an important one to follow for anyone with an interest in seeing justice served on behalf of American small businesses. Many who felt terrorized by his trolling activities will no doubt watch with a certain amount of satisfaction as this next chapter unfolds.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[[Advertisement]]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-2024-banner-938x313-1.jpeg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

2 comments so far.

Anon

May 28, 2016 09:37 amYou mean that patent law does not have to be mashed beyond recognition to achieve certain “Ends” and that other laws already exist to achieve those “ends”….?

Who would have thought that? I mean, besides those that have previously stated that (and those that have read what was previously stated and perhaps have chosen to disregard what they have read)…?

But that would mean that the avenues of employing a “Ends justify the means” approach is even weaker….

Maybe those that continue to want to use this approach should be held more accountable for their choice in tactics….

Valuationguy

May 27, 2016 01:03 pmWow….good thing that the main poster child and nominal public excuse for passing the AIA (which has destroyed 50-70% of patent values to date) is shown to be a petty thief and prosecuted for a crime not even related to their patent assertion shakedown operation.

Yeah….16K assertion letters…16 licenses…and no lawsuits filed (which mean no measurable direct costs for any of them)….ohh yeah….that is certainly worth Congress devaluing U.S. patents by $1 trillion.

Ohh…..the patent troll under the bed is going to get you.

<>