Several weeks ago I wrote about CBM2015-00161, where the Patent Trial and Appeal Board (PTAB) at the United States Patent & Trademark Office (USPTO) instituted a Covered Business Method (CBM) review on a non-business method patent that has a clear and unambiguous technological aspect. See PTAB Gone Rogue.

Several weeks ago I wrote about CBM2015-00161, where the Patent Trial and Appeal Board (PTAB) at the United States Patent & Trademark Office (USPTO) instituted a Covered Business Method (CBM) review on a non-business method patent that has a clear and unambiguous technological aspect. See PTAB Gone Rogue.

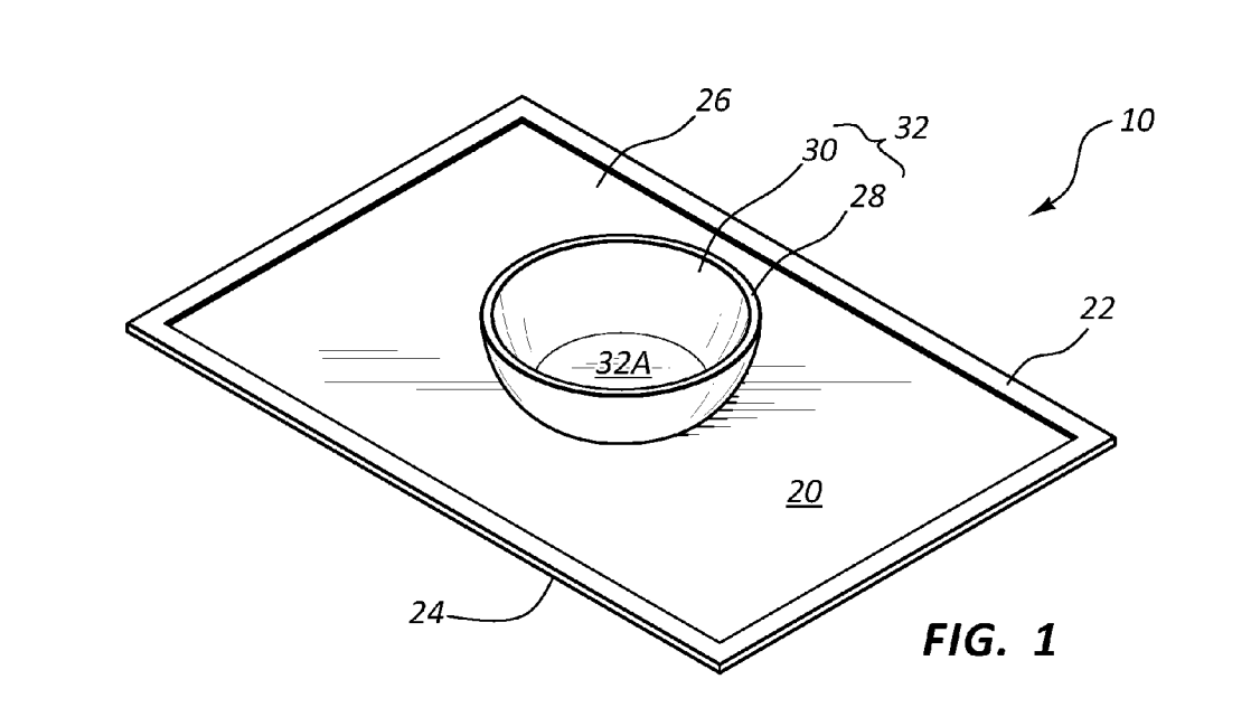

According to Section 18 of the America Invents Act (AIA), the USPTO may institute a CBM proceeding only for a patent that is a covered business method patent. A covered business method patent is defined as a patent that claims a method for performing data processing or other operations used in the practice, administration, or management of a financial product or service. The patent at question in CBM 2015-00161, U.S. Patent No. 6,766,304,claims the structure, makeup, and features of an improved graphical user interface (“GUI”) tool that can be used for electronic trading. The claims of the patent are in no way directed to a business method or to a method for data processing. The institution decision was clearly erroneous. The PTAB does not have jurisdiction to institute this CBM, period. Unfortunately, like other institution decisions made by the PTAB, institution decisions in CBM proceedings are not appealable.

The fact that CBM institution decisions are not appealable does not change the fact that the PTAB does not have subject matter jurisdiction to institute a CBM relative to the ‘304 patent. Notwithstanding the non-appealable nature of institution decisions, the Federal Circuit has recently shown a willingness to review the PTAB’s authority to in Ethicon Endo-Surgery, Inv. V. Covidien LP. In that case Ethicon challenged the final decision of the Board because it was made by the same panel that made the decision to institute inter partes review. The Federal Circuit ruled that Section 314(d) does not prevent the court from considering the question raised by Ethicon. Thus, while the substance of the decision to initiate on the merits cannot be appealed, the mechanics, or more broadly the subject matter jurisdiction, may be appealable.

Seeking to push this issue to a head sooner rather than later, Trading Technologies International, the owner of the ‘304 patent, has recently filed a Petition for Writ of Mandamus with the United States Court of Appeals for the Federal Circuit. As the mandamus petition explains, the ‘304 patent has been the subject of serial CBM petitions. Indeed, it is hard to look at the history of the challenges against the ‘304 patent and not on the surface suspect that there is a rather well coordinated scheme of harassment against the patent owner. Unfortunately, attempts by Trading Technologies to seek relief from Director Michelle Lee, who has the authority to stop harassing post grant challenges, have been unsuccessful to date.

Trading Technologies explains in its petition that the extraordinary remedy of mandamus is both necessary and required:

The extraordinary remedy of mandamus is needed to correct a recurring jurisdictional error by the Patent Trial and Appeal Board (“PTAB”): it improperly instituted a covered business method review (“CBMR”) under § 18 of the America Invents Act (“AIA”) against a patent that is clearly and indisputably not a CBM patent.

Trading Technologies is asking the Federal Circuit to order the PTAB to vacate its institution decision in CBM2015-00161 and terminate that proceeding.

The following amicus briefs have been filed in support of Trading Technologies’ mandamus petition:

BGC Partners and Cantor Fitzgerald have collectively filed a petition for an extension of time to file an amicus brief in support of Trading Technologies .

Stay tuned!

UPDATED Wednesday, March 16, 2016, at 2:30pm ET. An earlier version of this article inaccurately referred to Trading Technologies International as Technology Trading International.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/03/IP-Copilot-Apr-16-2024-sidebar-700x500-scaled-1.jpeg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

3 comments so far.

Eric Berend

March 18, 2016 05:30 pmThis giant racket is known in common society as a “shell game”.

WATCH the shells! SEE the inventors jumped from shell to shell trying to find the ‘pea’ of jurisprudence and legitimate interest! OBSERVE the software-centric and ‘bankster’ sycophants mocking the besmirched inventors’ slandered reputations! BRING your popcorn for the show!

Since the infringer empowered rubric of the ‘peanut gallery’ is running the show, the above characterization is entirely appropriate.

Edward Heller

March 17, 2016 06:19 pmIt would be nice if the likes of the AIPLA would conduct a survey of its entire membership on whether they would support repeal of both IPRs and CBMs.

Night Writer

March 16, 2016 01:40 pmGoing to the wolf for help with the fox. Good luck. CBM expansion is shocking. What is scary about it is that at least I thought that the PTO would want to avoid all the extra work expanding the subject matter beyond the statute would provide. I thought that would safe guard us. Those are about the only type of safe guards we have anymore.