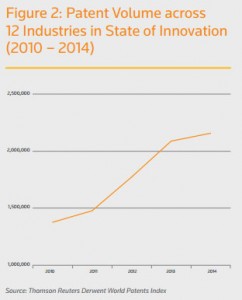

In the recently released 2015 State of Innovation report it is noted that more unique inventions were filed in patent grants and patent applications during 2014 than any other year in history. However, a slowing pace of patenting activity in several critical industrial sectors may signal some developments affecting innovators around the globe.

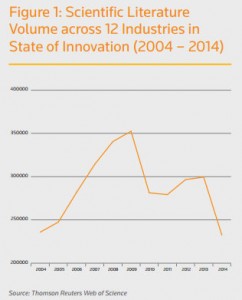

Global innovation continued to climb during 2014 but at the slowest pace seen since the global economic recession hit in 2009. The Thomson Reuters report didn’t draw any specific conclusions as to why the innovation slowdown had occurred but did draw a correlation between published scientific literature and patenting activities, noting that the former typically precedes the latter by three to five years. As graphs published in the Reuters study clearly show, scientific literature publications in 12 industries increased between 2008 and 2009 at a slower rate than prior years, mirroring the

Global innovation continued to climb during 2014 but at the slowest pace seen since the global economic recession hit in 2009. The Thomson Reuters report didn’t draw any specific conclusions as to why the innovation slowdown had occurred but did draw a correlation between published scientific literature and patenting activities, noting that the former typically precedes the latter by three to five years. As graphs published in the Reuters study clearly show, scientific literature publications in 12 industries increased between 2008 and 2009 at a slower rate than prior years, mirroring the  patenting slowdown experienced this year. Troublingly, a steep drop in published scientific literature was experienced in 2010, so if this model holds we may see a reduction in global patenting activity when the annual Reuters innovation study comes out next year.

patenting slowdown experienced this year. Troublingly, a steep drop in published scientific literature was experienced in 2010, so if this model holds we may see a reduction in global patenting activity when the annual Reuters innovation study comes out next year.

Losses in patenting activities were felt in a couple of fields where we would otherwise have expected to see an increase in research and development. Given the incredibly expansive Internet of Things sector, which involves the application of computing technologies and is expected to grow to 50 billion Internet-connected devices by 2050, it’s strange to see semiconductor inventions, which account for nearly 10 percent of innovation worldwide, contract by about 5 percent from 2013’s totals. Smart home appliances are highly touted by IoT proponents and yet there were only 160 more patents filed in this field between 2013 and 2014, an increase of less than one percent.

There was also a significant reduction in the number of patents filed to protect medical devices, representing a loss of 6 percent from 2013 to 2014. Every subsector of the medical device field saw a drop in the number of patents filed, most notably the area of sterilising, syringes and electrotherapy which saw 3,224 fewer inventions in 2014 than in 2013. Japanese companies Toshiba, Olympus Optical and Toshiba Medical were the top three medical device innovators worldwide but American research in this field is strong; each of the top 10 most prolific scientific research institutions in medical devices between 2004 and 2014 were American.

Another area where we were surprised to note a slowdown in innovation was the automotive sector. We’ve been documenting the rise of self-driving, or autonomous, vehicles this year on IPWatchdog ever since a conspicuous showing at the 2015 Consumer Electronics Show. Another Thomson Reuters study from earlier this year focusing on auto innovation showed a significant increase in patenting activities in automotive fields such as autonomous driving and telematics systems. However, the overall automotive sector only saw a 1 percent increase in worldwide patenting activities, from 152,221 inventions in 2013 to 153,872 inventions last year.

A major reason behind the slowdown in automotive patents proposed by the Reuters study is one that we’ve been covering here in recent months on IPWatchdog. Open source innovation in the auto sector, which was kicked off by Tesla Motors CEO Elon Musk about one year ago, has led to reductions in alternative powered vehicle R&D; related patent volumes fell by 5 percent between 2013 and 2014. The much bigger culprit noted by the Reuters study, however, is Toyota, which trumped Tesla by offering cost-free licensing of thousands of fuel cell vehicle technologies through 2020. Only four subsectors of automotive tech saw increased patent volumes: safety (6 percent), suspension systems (3 percent), seats, seatbelts & airbags (2 percent) and navigation systems (1 percent). Three of the top five innovators in the automotive field are Japanese: Toyota (4,338 inventions in 2014), Denso (2,383) and Honda (2,120).

When looking at percentages for an entire field, the greatest patenting activity gains were seen in the food, tobacco & beverage fermentation industry. This sector makes up about 2 percent of global innovation but it expanded by 21 percent between 2013 and 2014. The subsector with the greatest patent volume and percentage growth was meat, which grew by 31 percent between 2013 and 2014 up to 9,033 inventions The top five innovators in this field are Chinese and they include China Tobacco (865 inventions in 2014), Harbin Shanbao Wine (127) and Shenzhen Heyuan (101). In the U.S., the two largest innovators in this field were Philip Morris and Reynolds Tobacco. Despite the preponderance of innovations coming from tobacco companies in 2014, the Reuters analysis indicates that health and wellness will be guiding factors for future innovation in this sector.

Pharmaceuticals, which made up about one-tenth of all worldwide innovation in 2014, also enjoyed a significant increase of 12 percent between 2013 and 2014. The top innovator in pharmaceuticals for 2014 was the Chinese Academy of Sciences, which developed 481 inventions in that year. Four of the five most influential scientific research institutions for drugmakers over the past decade are situated in Germany: Goethe University Frankfurt Hospital, Ernst Moritz Arndt Universitat Greifswald, University of Duisburg Essen and University of Bonn.

Cosmetics & well being is the smallest of the 12 industrial sectors analyzed for the Reuters report but it experienced positive gains in innovation of 8 percent over the past year. By a 2-to-1 margin over second place, the top innovator of cosmetics products was France-based L’Oreal, which developed 482 inventions through 2014. About one-fifth of this industry’s 2014 innovations were focused on shampoos but cosmeceuticals, cosmetic applications with medicinal properties, factored into second place.

The greatest increase in patent volume numbers for a single industrial sector was experienced by the technological field that makes up nearly one-third of all global innovation: information technologies. Between 2013 and 2014, IT innovation increased by nearly 13,300 inventions up to 380,325 unique developments, representing a growth rate of 4 percent. The top innovators in this space represent some of the biggest Companies We Follow here on IPWatchdog and they include South Korea’s Samsung (5,948 inventions in 2014), American-based IBM (5,894) and Japan’s Canon (5,281). The computing subsector, which makes up the vast majority of IT innovation, is the only one that saw an increase in innovation whereas all other sectors, including printers, smart media and other peripherals, experienced a decline in patenting activities between 2013 and 2014. The U.S. has maintained a strong research presence in information technologies as the home of six of the top ten research facilities over the past decade, including Stanford University, the University of California and the Massachusetts Institute of Technology.

There are some sectors of global innovation where the United States is dominant. One of those is aerospace & defense, where the top three innovative companies in 2014 are all American: United Technologies Corp. (1,024 inventions in 2014), General Electric (619) and Boeing (560). American research organizations also make up eight of the top ten R&D operations for this sector, the leading research organization being the University of Michigan System. Subsectors seeing the greatest increasing in innovation are instrumentation, structures & systems as well as propulsion plants, while production techniques declined by 6 percent.

Biotechnology was another strong sector for American companies and research institutions. The top company in this field was DuPont which held its own with 456 biotech inventions in 2014 despite a 3 percent drop in revenues. Again, the U.S. was home to eight of the top ten research institutions in this field including the top three: Broad Institute, MIT and the Howard Hughes Medical Institute. Much of the global innovation focus for this sector is on general biotech but the greatest gains by percentage were seen in the cancer treatment sector, which rose by 11 percent to a 2014 patent volume of 4,855 inventions.

American research institutions also dominated in the field of telecommunications. Once again, eight of the top ten research organizations in this field were American and they were led by Rice University, the University of California Berkeley and the State University of New York. In terms of the top innovative companies, however, only San Diego-based Qualcomm managed to crack the top five with 2,208 inventions in 2014. South Korean companies are dominant in this field, which is led by Samsung (4,261 inventions in 2014); Korean-based LG placed third with 2,538 inventions last year.

The other major industrial sector which reflects the current strength of American innovation is the oil & gas industry. Despite growing worldwide calls for action on climate change which weans global consumers away from fossil fuels, two-thirds of all innovation in the energy sector was focused on petroleum & gas exploration, drilling, production and processing. American companies Halliburton (783 inventions in 2014) and Schlumberger (448) are third and fourth overall among global innovators in this area. The United States is home to six of the top ten research institutions for oil & gas but the top spot in this regard is the domain of the United Kingdom’s Imperial College London.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[[Advertisement]]](https://ipwatchdog.com/wp-content/uploads/2023/01/2021-Patent-Practice-on-Demand-1.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

2 comments so far.

Anon

June 11, 2015 07:31 amBenny,

You are generally correct, but it is hardly a distinction that makes a difference. Instead of a nice crisp picture, the “real” picture is generally the same, albeit a bit more “fuzzy” (think error bars instead of a sharp thin line, but the shape of the graph remains the same).

It is more complicated than that. The 18 month publication rule is from earliest claimed priority. Many applications are not stand-alone applications to which a straight 18 month calculation applies.

Benny

June 11, 2015 05:28 amSteve,

In using patent grant and application data as a parameter for measuring innovation progress, shouldn’t you be paying more attention to the date of filing rather than the date of grant? And given the 18 month delay before publication, doesn’t that mean that relevant data will always be a year and half behind the game?