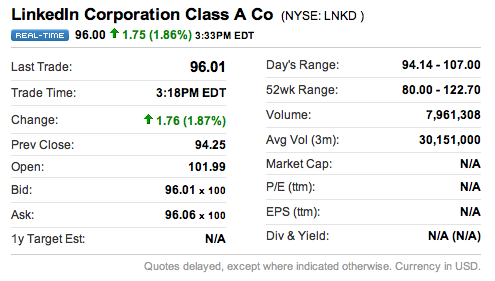

LinkedIn (NYSE: LNKD) announced this week that the professional social networking giant is now valued at $8.79 Billion, roughly 38 times sales figures reported in 2010, after it’s first day as a publicly traded company on May 18. This may be hard to believe by many because LinkedIn has never reported being profitable, nor have they ever made more than $250 million in any one year. However, within minutes of LinkedIn’s Initial Public Offering (IPO) of 7.84 million shares priced at $45, the shares doubled in price and at one point in the day LinkedIn stock peaked in excess of $122 per share. In fact when the stock market closed on day one, shares last traded at $96 per share and on day two shares last traded at $93.09 per share.

LinkedIn (NYSE: LNKD) announced this week that the professional social networking giant is now valued at $8.79 Billion, roughly 38 times sales figures reported in 2010, after it’s first day as a publicly traded company on May 18. This may be hard to believe by many because LinkedIn has never reported being profitable, nor have they ever made more than $250 million in any one year. However, within minutes of LinkedIn’s Initial Public Offering (IPO) of 7.84 million shares priced at $45, the shares doubled in price and at one point in the day LinkedIn stock peaked in excess of $122 per share. In fact when the stock market closed on day one, shares last traded at $96 per share and on day two shares last traded at $93.09 per share.

LinkedIn stock snapshot as of close day one.

How is it possible to have a valuation of nearly $9 billion? To start with, LinkedIn has a few different sources of revenue; they have advertising revenue, premium subscriptions allowing access to more data than with basic subscriptions and hiring solutions where both job seekers and employers can pay to access job listings. But LinkedIn credits their valuation to one main source; data, more specifically, job data.

Due to the fact that LinkedIn was originally launched in May of 2003, and is widely accepted as one of the few main stream social media sites used primarily by professionals, it understandably has more data in regard to job hunting than any other place on the Internet. But what differentiates LinkedIn most from the other social media and job-hunting sites is that LinkedIn contains an abundance of personally identifiable information uploaded by the users themselves. What is the popular saying, “Better to get it from the horse’s mouth?”

Given that LinkedIn has 100 million users that at one point or another have uploaded their own basic employment information to the site, the likelihood of that data being accurate is extremely high. Most have uploaded full resumes, teaming with data like phone numbers and addresses, employment and education history. Because of this data, LinkedIn’s primary revenue comes from its hiring solutions and premium accounts, both of which are steps to uncover more data on the service.

So why has LinkedIn become so popular and widely accepted by the business community with more than 2 million companies having a LinkedIn Company Page? How is it that LinkedIn has not fallen victim to the pitfalls of most other social media sites? The answer is rather simple. Being a mom, I will use parenting metaphors and say that it’s all in how the company was “raised.” Like a child, a business is a product of its environment and “upbringing.” When LinkedIn was launched in 2003, it was created specifically as one of the first business-oriented online social networks to be used primarily for business connections and job searching.

The founder of LinkedIn, Reid Hoffman is both an American entrepreneur and one of Silicon Valley’s most prolific and successful angel investors. Born in Stanford California, Hoffman acquired his BA in Symbolic Systems in 1990 and an MA in Philosophy from Oxford University in 1993. Hoffman is quoted as saying that he saw academia as an opportunity to make an “impact”, but later realized that an entrepreneurial career would provide him with a bigger platform.

When I graduated from Stanford my plan was to become a professor and public intellectual. That is not about quoting Kant. It’s about holding up a lens to society and asking ‘who are we?’ and ‘who should we be, as individuals and a society?’ But I realized academics write books that 50 or 60 people read and I wanted more impact.

For this reason Hoffman launched his first business in July of 1997, which was an online networking/dating site called SocialNet.com. While at SocialNet.com, Hoffman became one of the first members of the board of directors at PayPal, when PayPal was founded in March 2000. He later joined the company full time and eventually took the role of Executive Vice President of PayPal. When eBay acquired PayPal in 2002, Hoffman pulled together a team of people that he had worked with before and in May of 2003 LinkedIn was born. Hoffman stated that:

I realized that the world was transforming every individual into a small business. But how do you positively influence your brand on the Net? How do you assemble a team fast? Who has the expertise to guide you? The power of the Internet is to accelerate the way you do business. I was very interested in this whole notion of each of us as individual professionals who are on the Internet and how that changes the way we do business, our careers, our brand identity.

Hoffman was LinkedIn’s founding CEO for the first four years before moving to his role as Chairman and President of Products in February 2007. In 2009, while maintaining his roles as Co-Founder and Executive Chairman of LinkedIn, Hoffman became a partner in the oldest venture capital firm; Greylock Partners which was originally founded in 1965 where he runs their multi-million dollar Discovery Fund.

In addition, Hoffman is a board of director on a variety of Silicon Valley businesses, most of which are in the social network industry including, Mozilla Corp, Burger King, Vendio, Six Apart, Kiva.org, Tagged and Zynga. He is an advisor to Groupon and an angel investor in numerous influential Internet companies, including Digg, Facebook, Flickr, Grockit, IronPort, Last.fm, Ning, Six Apart and Zynga.

LinkedIn, which is headquartered in Mountain View CA and has offices in San Francisco, Chicago, New York, Omaha, Amsterdam, Dublin, London, Paris Sydney, Toronto and India is currently available in six languages including English, French, German, Italian, Portuguese and Spanish. LinkedIn is currently the world’s largest professional network on the Internet with nearly 150 million professionals using the site. In 2010 alone, there were nearly two billion people searches conducted on LinkedIn.

LinkedIn is also a large source of jobs in the US and abroad. In fact, LinkedIn reports that in January of 2011 it had about 1,000 full-time employees across the globe and as of mid-March 2011, 73 of the Fortune 100 Companies have used LinkedIn’s hiring solutions.

Of all of the social media sites that are available to businesses today, LinkedIn is by far the best site for professionals. In 8 years it has continued to maintain it’s integrity as a professional network and continues to grow at a rate of one professional joining LinkedIn every second. Whether you are looking for new employment opportunities, to hire new employees, to increase your client base, to expand your existing product reach, establish and build your brand and/or increase your profitability and bottom line, there are so many ways that professionals can use LinkedIn to accomplish these goals.

Check out my series of articles on LinkedIn to learn more about how to use LinkedIn and feel free to onnect to me on my LinkedIn page as well.

- The Importance of Social Networking for Business Part III: LinkedIn Chapter 1

- The Importance of Social Networking for Business Part III: LinkedIn Chapter 2

- The Importance of Social Networking for Business Part III: LinkedIn Chapter 3

- Using Social Media to Show Expertise and Build Credibility

- LinkedIn Continues to Add New Ways to Customize Profiles

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

8 comments so far.

step back

May 24, 2011 09:54 pm… and therefore I put my ear next to my clock to see if talks to me too

… so far no luck

I guess time talks to only a select few 😉

step back

May 24, 2011 09:52 pm“Time will tell whether the speculators and investors were incorrect”

Gene,

That sounds like sound advice.

Gene Quinn

May 24, 2011 06:11 pmStep-

I think you are looking at the glass as half empty. Linkedin was obviously OK with $45 a share, so they got what they asked for. What difference does it make to Linkedin if others pay more? Of course it would appear that Linkedin left money on the table, but that is hardly a market failure. The market worked properly. A price was set and demand caused the stock to rise. That is the way the market is supposed to work. The failure, if any, was by those setting the price.

Time will tell whether the speculators and investors were incorrect to run up the price like they did.

-Gene

step back

May 24, 2011 04:13 pmHi Renee,

With due respect, when a stock doubles on IPO day that is not a huge success but rather a giant market failure. The money from the IPO is supposed to go to LinkedIn so they can fund future development and expansion. However, the money instead goes to the speculators who bought the shares on the hunch that the IPO might be undervalued. 😉

Renee C. Quinn

May 23, 2011 01:02 pmJake,

Thank you for reading IPWatchdog. I agree it seems to me that of all of the social networks, LinkedIn really does have “it.” What I did not put in the article and probably should have is given that Hoffman is an angel investor himself, he has a higher stake and a higher vested interest in seeing his company succeed than perhaps the Mark Zuckerbergs of the world. Not only does he have “it.” He gets it!

Thanks again for reading.

Renee

Renee C. Quinn

May 23, 2011 01:00 pmCara,

Thank you for reading IPWatchdog and for taking the time to post a comment. As of 12:55 PM EST the stock was still trading at $85.37. Quite impressive still. The Wall Street Journal seems to think the spike is a result of the huge demand for LinkedIn to go public. Now that it finally has, it is clear that people were waiting anxiously for the trading to begin.

Thanks again for reading.

Renee

Jake

May 23, 2011 09:35 amWhen you have “it”, you have it all! Wonderful news for Linkedin.

carajnelson

May 23, 2011 02:53 amI’m pretty sure I saw it mentioned that for Linkedin they may start trading as soon as next week. I honestly don’t know all of the requirements regarding the start of options trading for a new stock but I believe it’s mostly related to trading volume and the need for there to be enough liquidity in the options market for a particular stock http://bit.ly/mkxfme